Forecasting Revenue Expenses Direct Costs Personnel

Entering recurring charges (subscription) revenue streams

Jump to

Recurring charges revenue streams are very useful for forecasting products or services that involve signups, recurring billings, cancellation rates, and the like. Some good examples are magazine subscriptions, gym memberships, or software-as-a-service products. If your business is building a subscription service, creating a reliable sales forecast is a critical step to understanding how your business will grow, and what the key drivers of revenue growth will be.

Note: When you create a recurring charges revenue stream, the revenue will be calculated into your financials according to how your forecast is set for multi-month charges. Read Changing the setting for multi-month charges.

To learn more about how to forecast and track your recurring revenue business, read these related posts:

Adding a recurring charges revenue stream

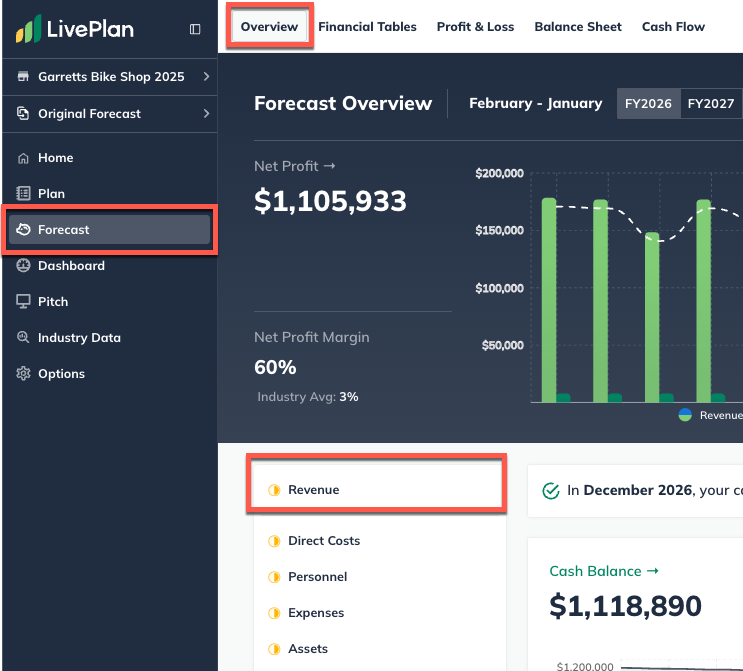

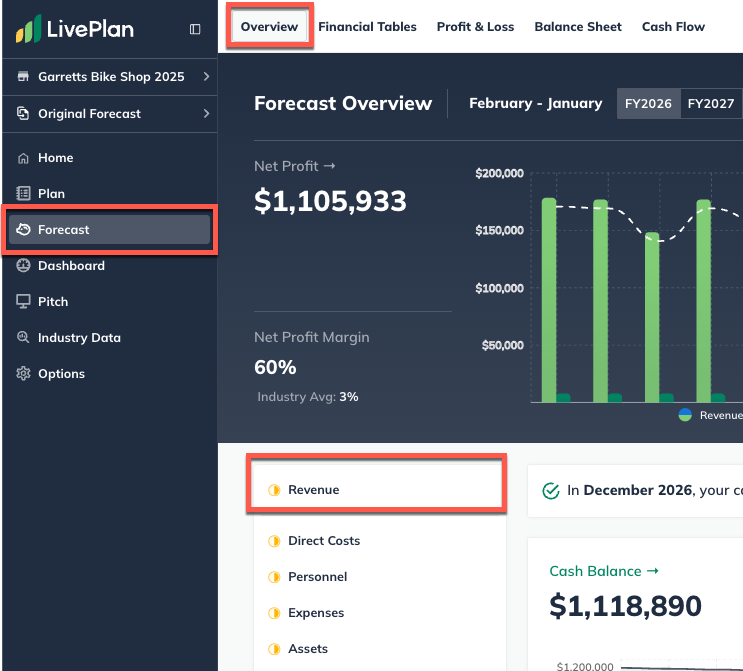

In the Forecast Overview, select Revenue:

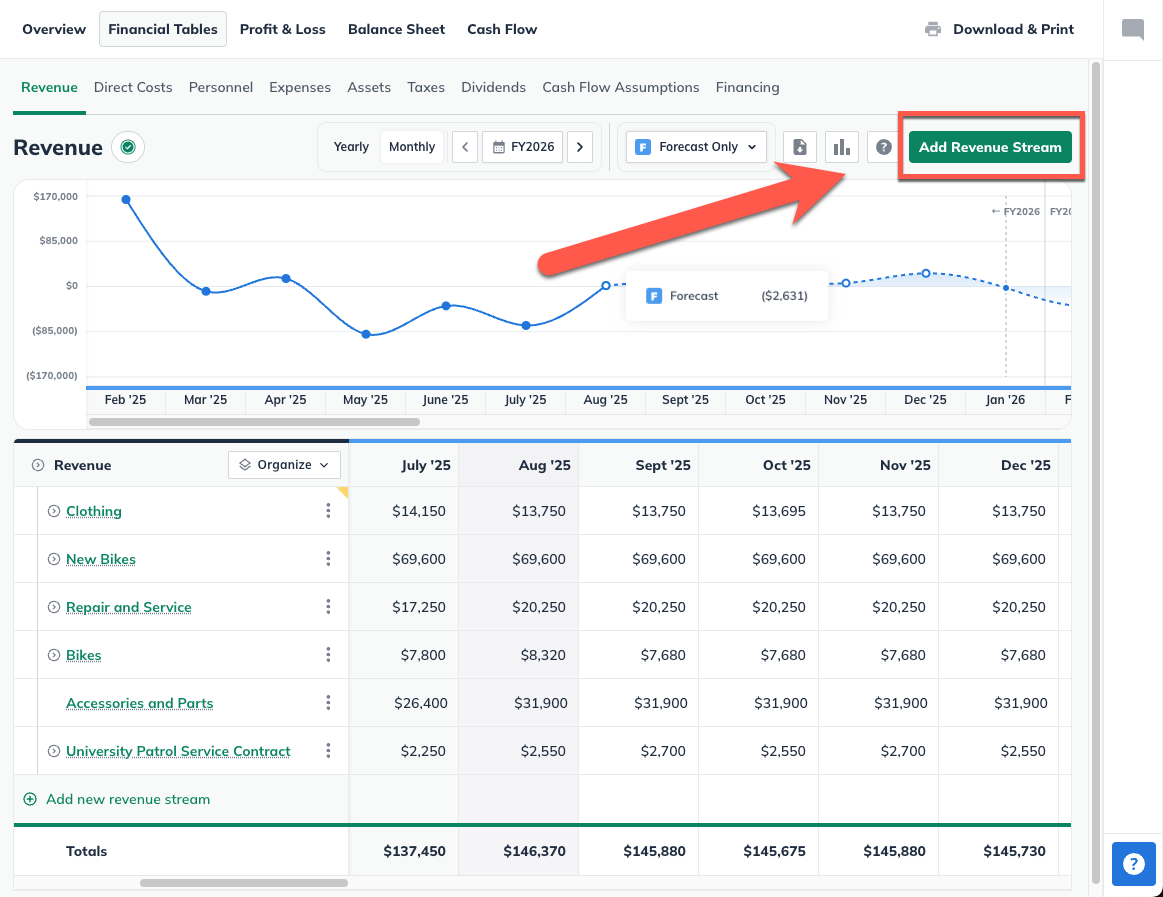

Click the Add revenue stream button near the top-right of your LivePlan window to enter a single revenue stream, or click Add new revenue stream at the bottom of the revenue table to add multiple streams:

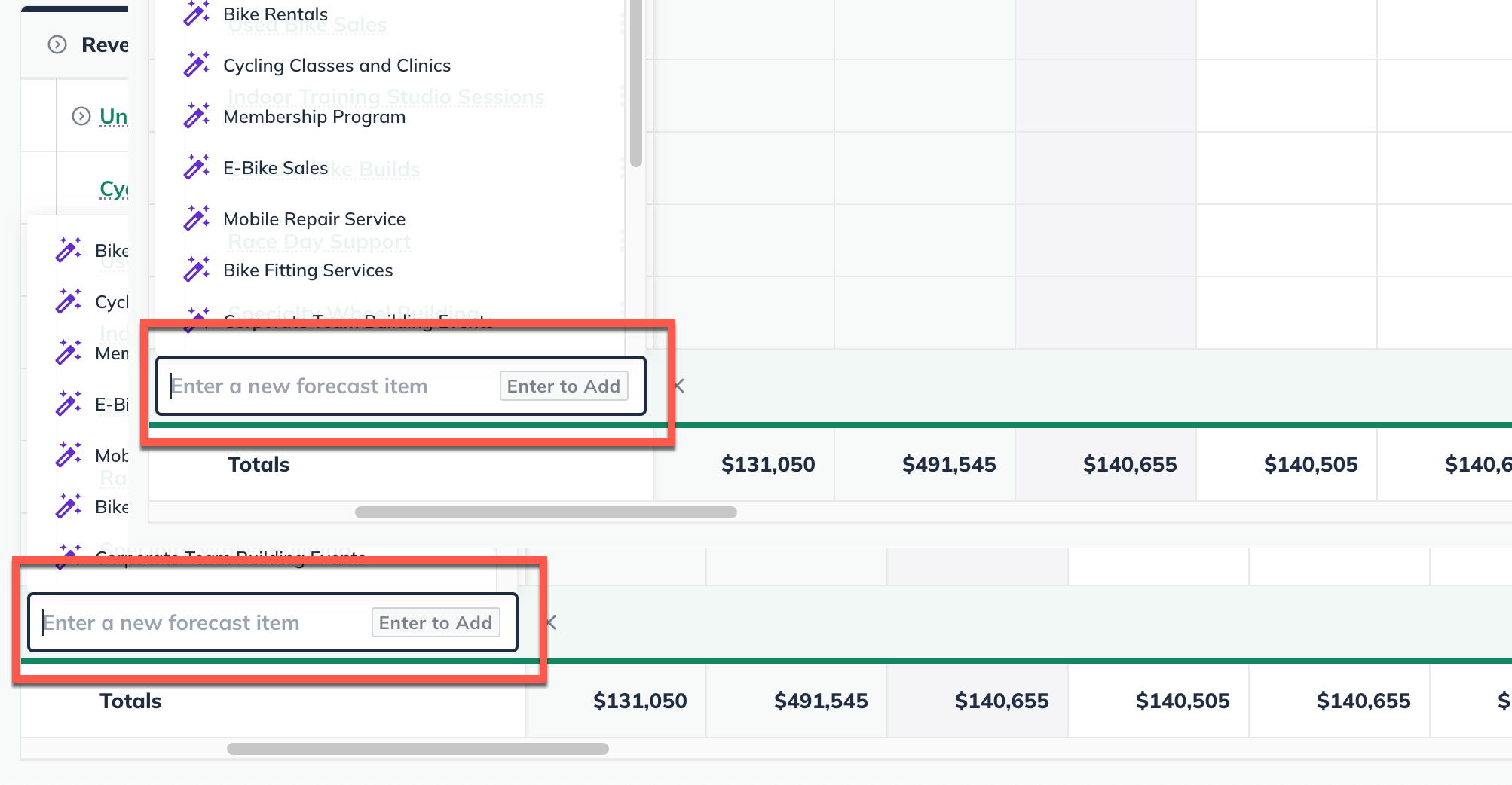

If you are entering multiple revenue streams, enter a name for each, then click Enter to Add:

Note: You can name multiple revenue streams and then return to complete their details later. If you're click a suggested revenue line item from the AI Assistant, then it will automatically be added to the table.

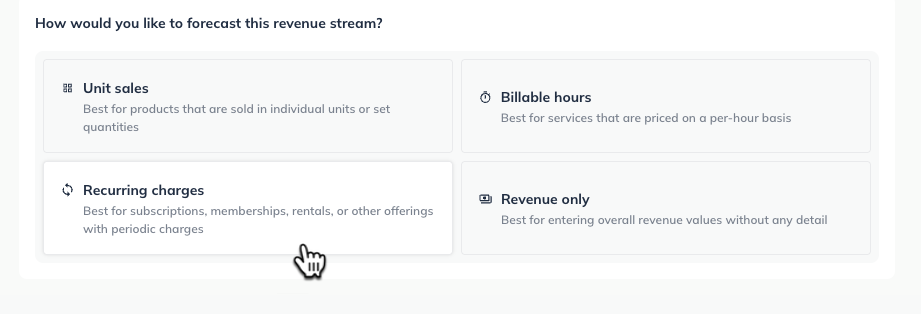

Under Revenue Stream Type select Recurring Charges:

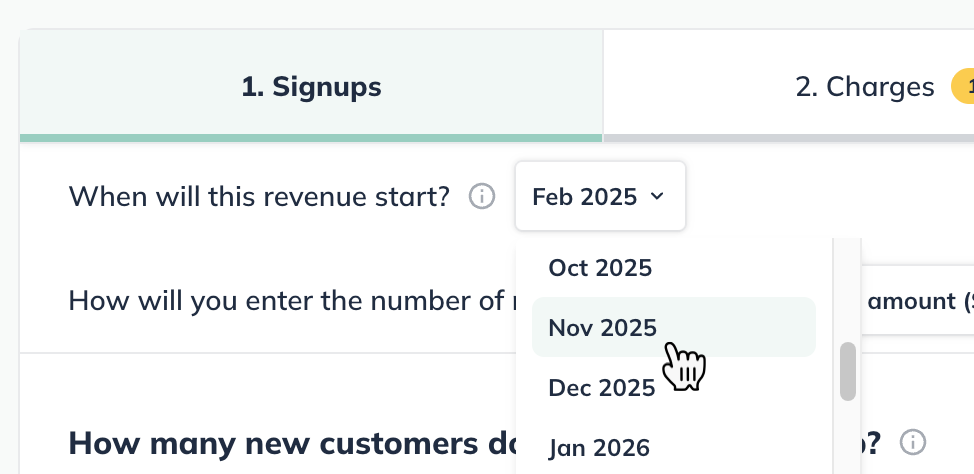

Choose the month and year that you plan to begin signing people up for your subscription product or service:

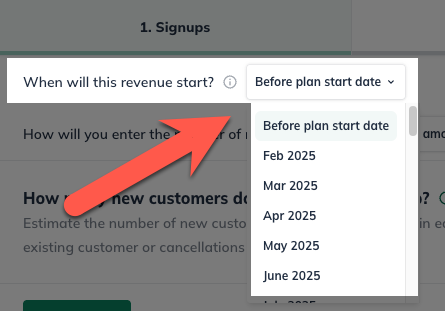

Note: if your subscription starts before your forecast start date, choose Before plan start date. You'll find additional instructions about this option below after these steps.

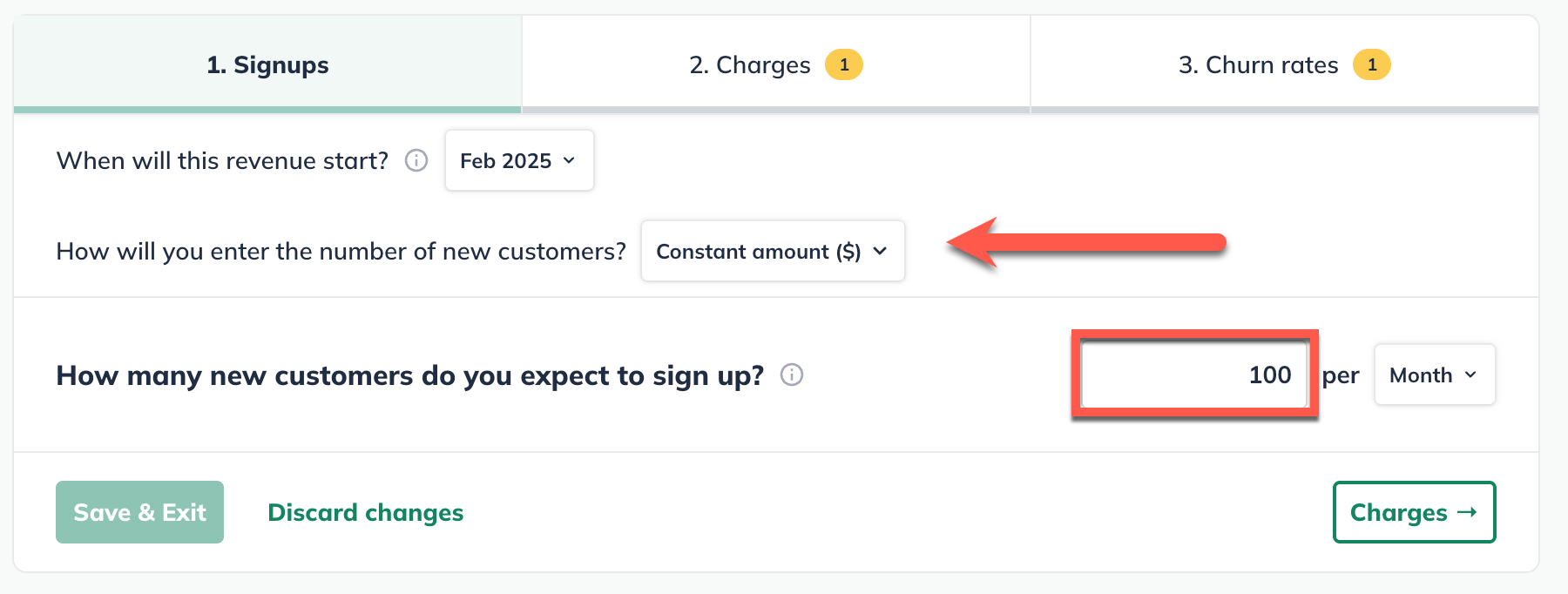

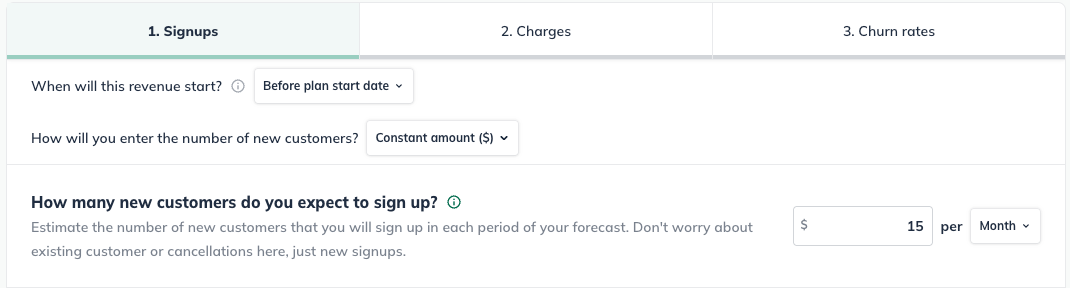

If you think you will have the same number of signups per month, choose Constant amount and enter the number of new customers per month:

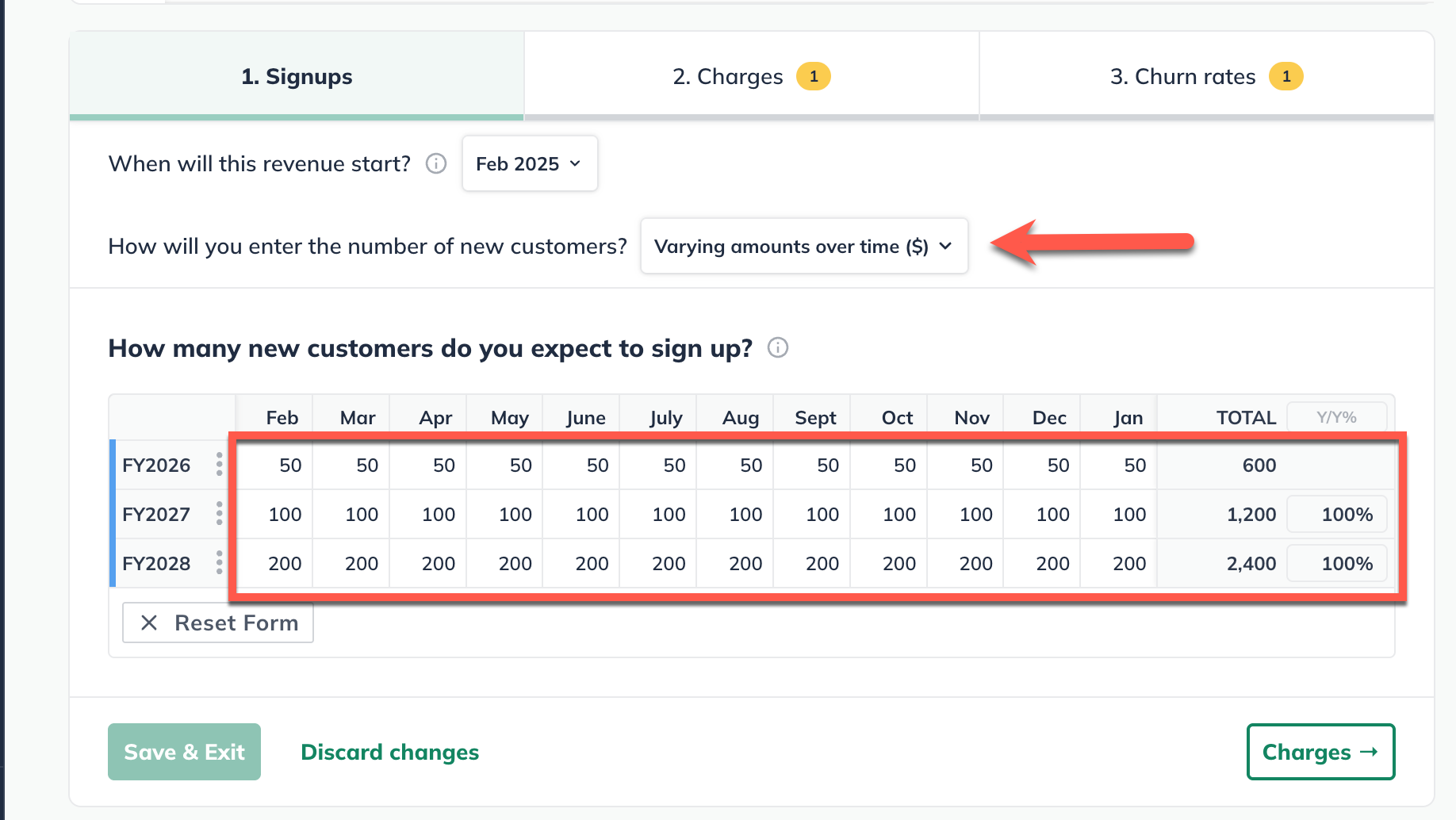

If you expect different numbers of customers to sign up depending on the month (for example, if your business has seasonal highs and lows), choose Varying amounts over time. This will give you a grid so you can enter varying amounts:

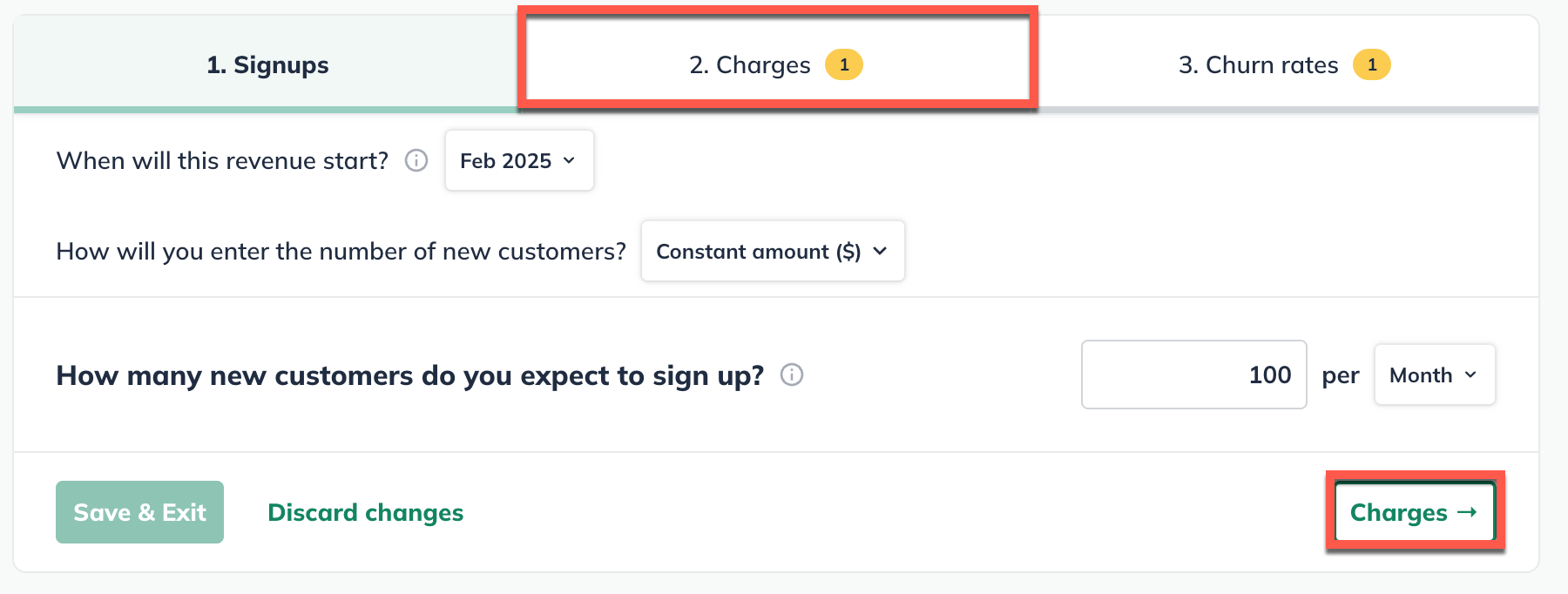

Click on the Charges step at the top or the Charges button at the bottom to set the recurring charges:

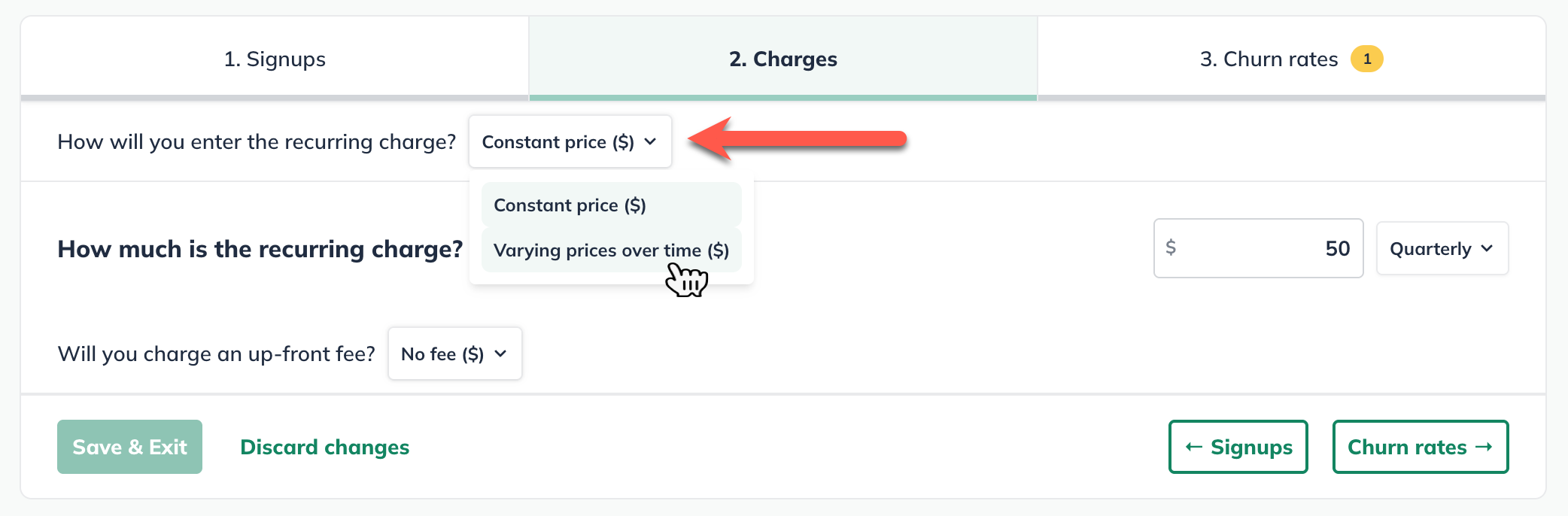

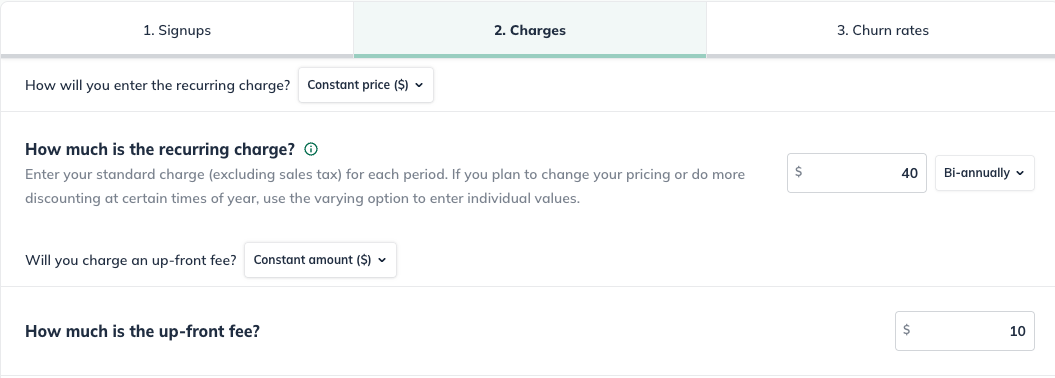

Next, choose whether you will charge a constant price or varying prices over time for the subscription:

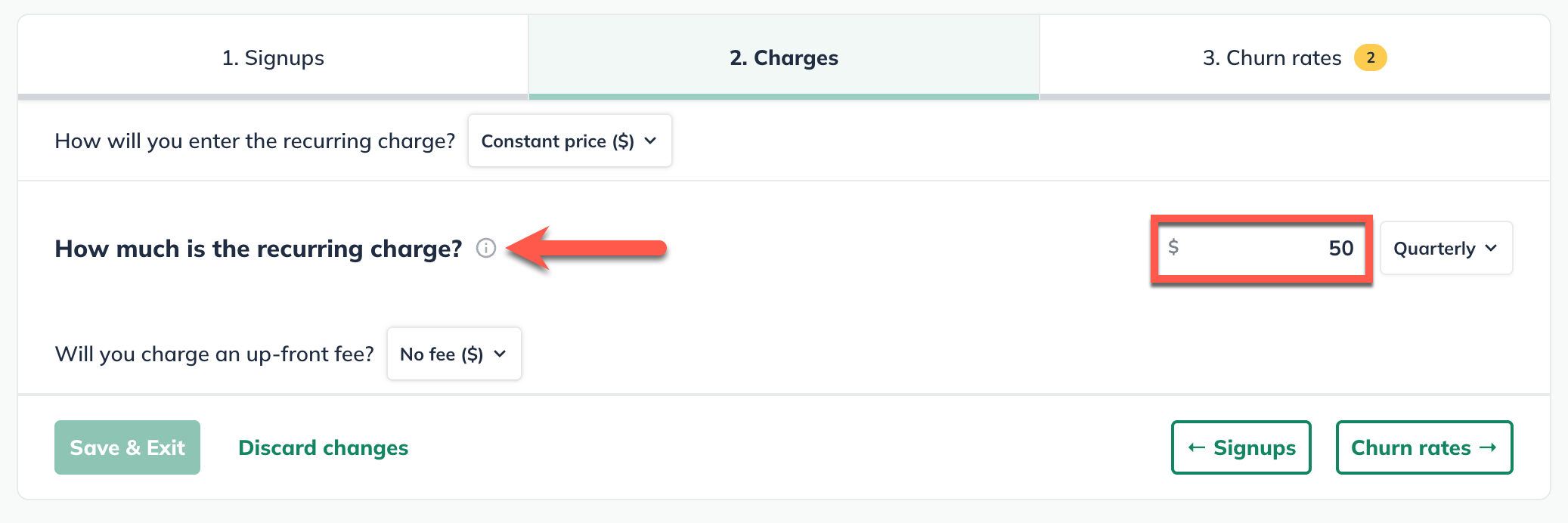

Enter the amount that you will charge for each period of the subscription - this is your renewal charge:

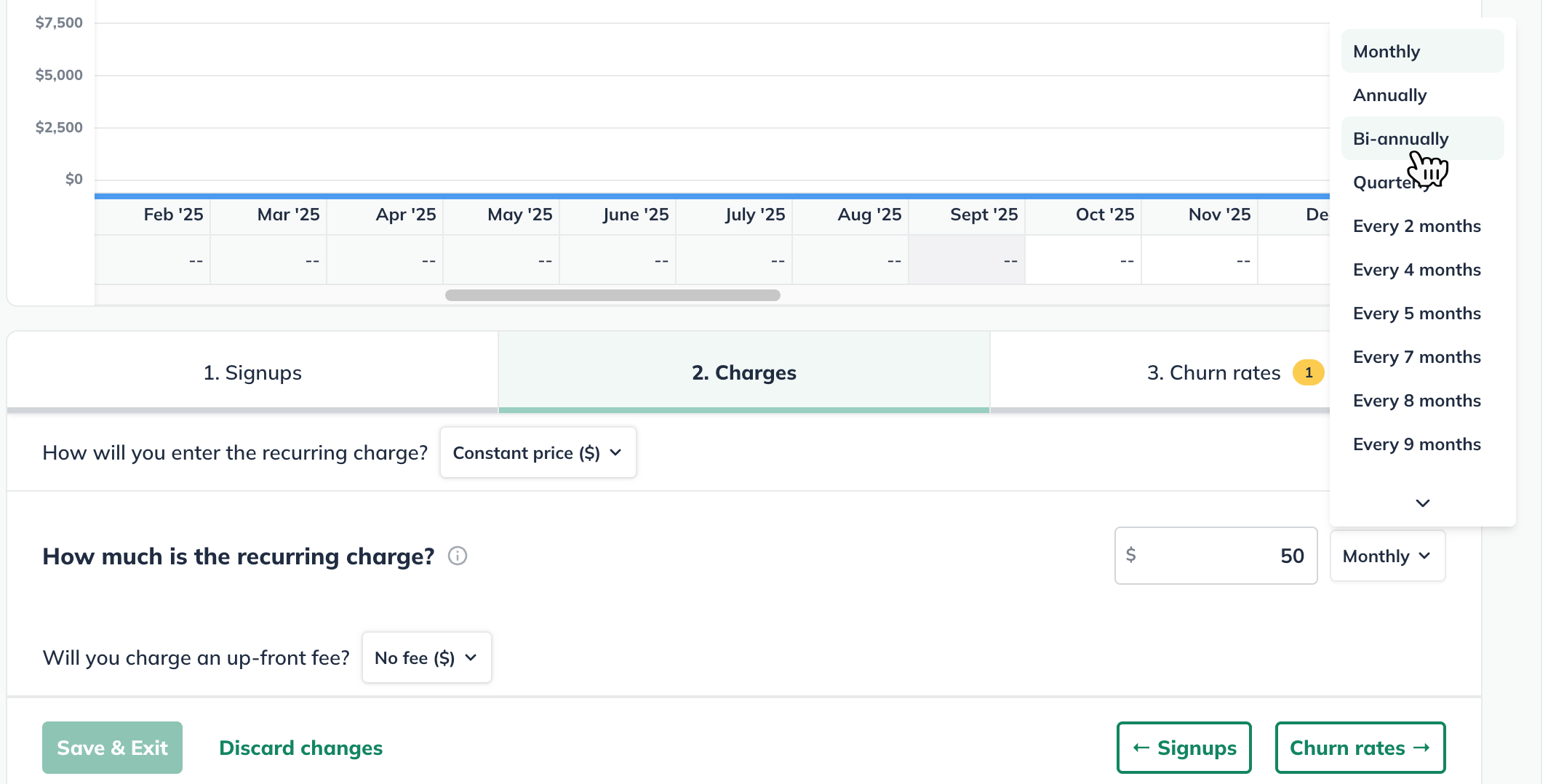

Indicate how often you will charge your customers. This is your renewal period (for example, are your customers charged monthly, quarterly, every six months, etc.):

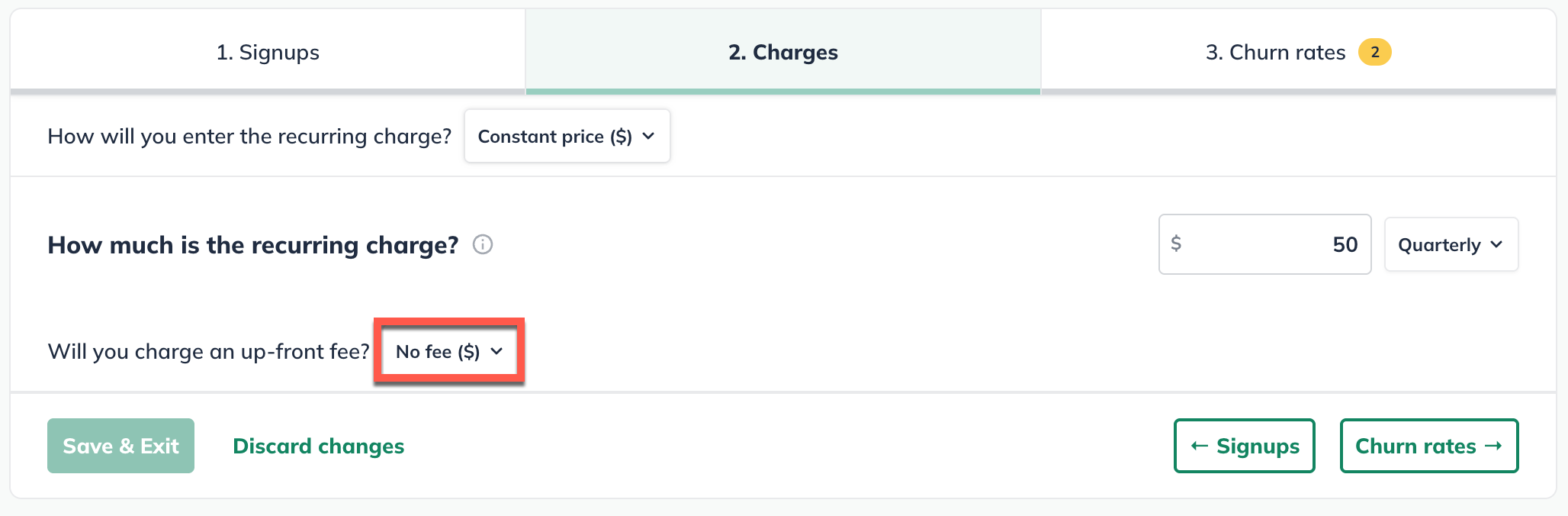

If you charge a setup fee (or other one-time charge) when customers sign up, enter that amount. If there is no initial charge, click No fee:

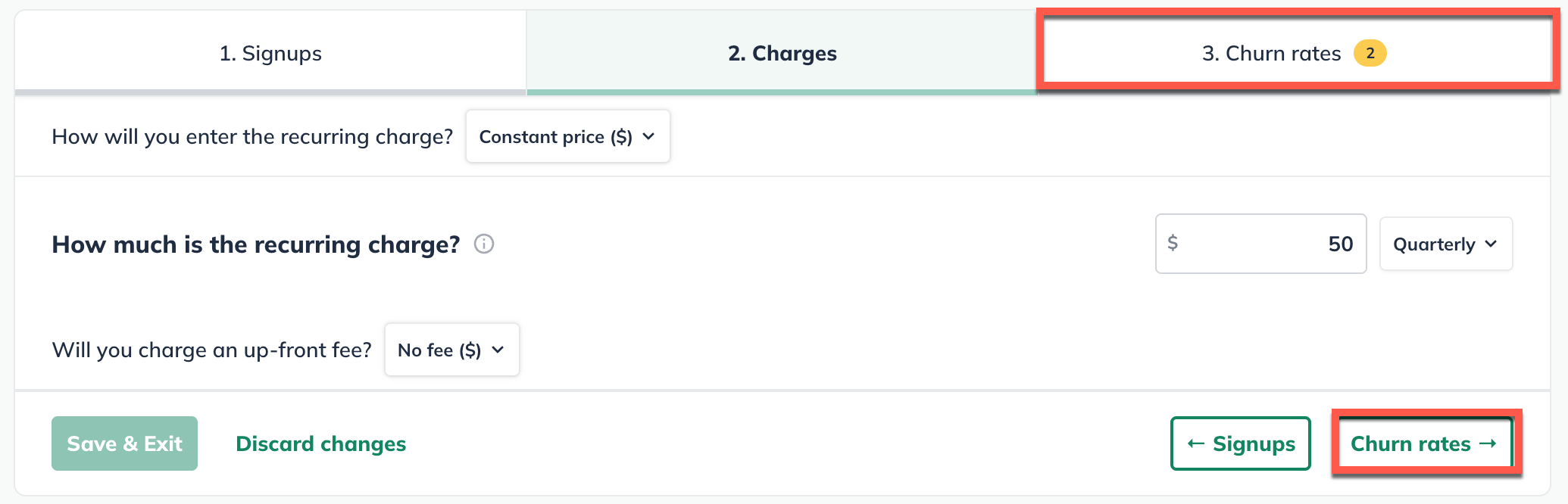

Click on the Churn rates step at the top or the Churn rates button at the bottom to set the churn rate:

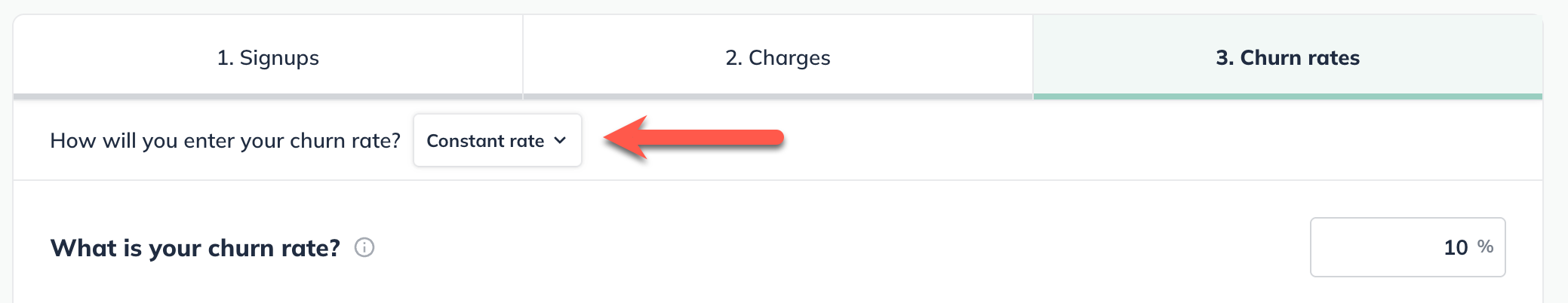

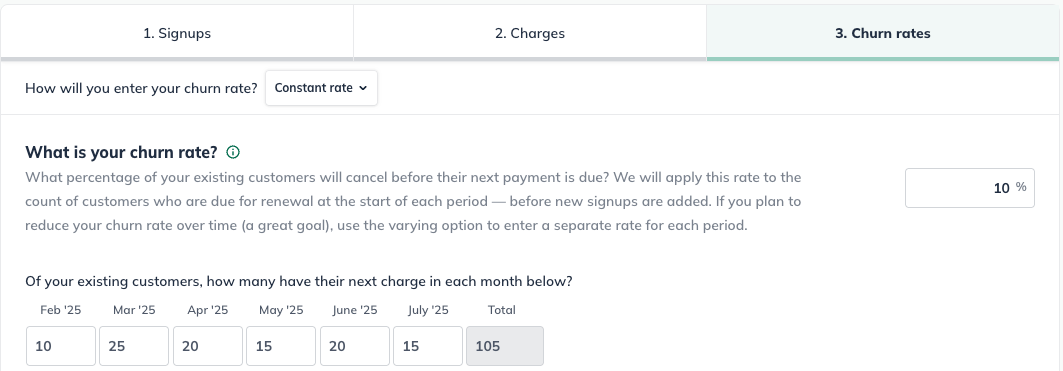

Churn Rate is the percentage of customers that cancel your service in a given month—when they leave, they’ve “churned out” and are no longer subscribing. For your business to grow, you need to add customers at a faster pace than they are canceling their subscriptions.

If you're not sure how to estimate your churn rate, start with the number of customers you expect to cancel in a given month, and divide that by the total number of customers that you forecast at the beginning of that month.

Click Save & Exit

Note: If the renewal period you specified is monthly, then the churn rate applies to monthly renewals. If your renewal period is quarterly, then the churn rate applies only to quarterly renewals (and not for the months in between).

Churn rate is applied to the number of customers you have at the beginning of each month, before any new signups are added. Subscribers are not charged for the period in which they've canceled.

Starting recurring revenue before the forecast start date

If your subscription began before the forecast's start date (Say you have an existing business rather than a start-up), begin your revenue stream following the steps above. Under When will this revenue start, choose Before plan start date:

Then, enter the number of new sign-ups, up-front fee, renewal charge, and period:

Finally, before entering the churn rate, you'll be able to indicate how many of your existing customers will have a renewal charge happening in the months listed:

Entering your numbers here helps LivePlan calculate your customer retention and revenue accurately. LivePlan will also apply the churn rate to your existing customers, so you can accurately forecast how many of them will cancel in the initial months of your forecast.

If you are forecasting for an existing company, and your subscription charge happens every 2-12 months, then LivePlan will also use this information to calculate the prepaid revenue for these existing subscribers. The data will appear in your Initial Balances input. For more details, see Entering initial balances for an existing company.

To edit an existing revenue stream:

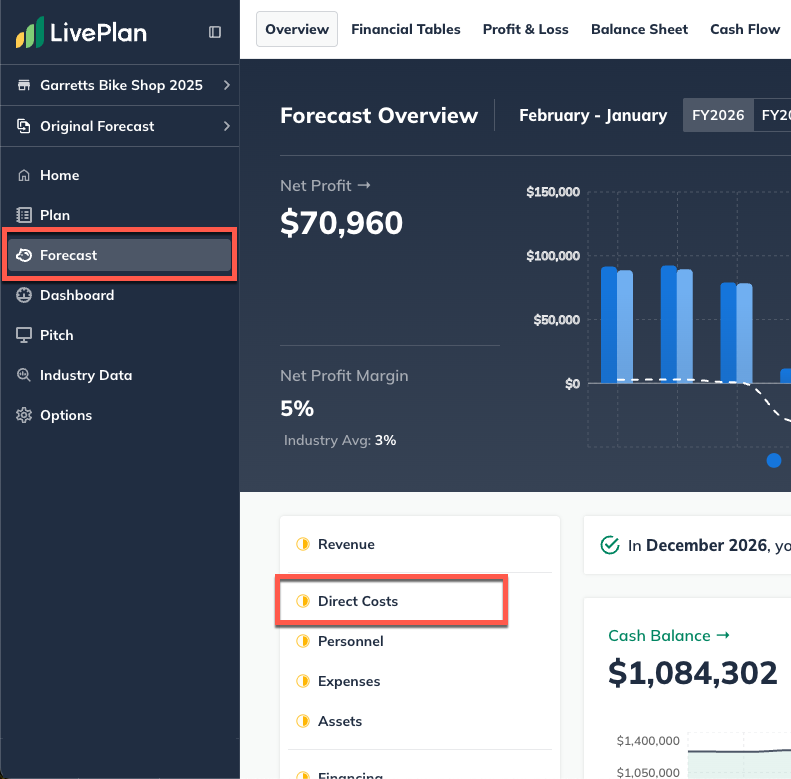

To edit an item that you have already entered in the forecast (such as a revenue stream, expense, or asset), first navigate to the Forecast Overview. Next, click on the section that contains the entry you wish to edit.

Find the table of your entries at the bottom of the page, then click on the green title of the item you want to update.

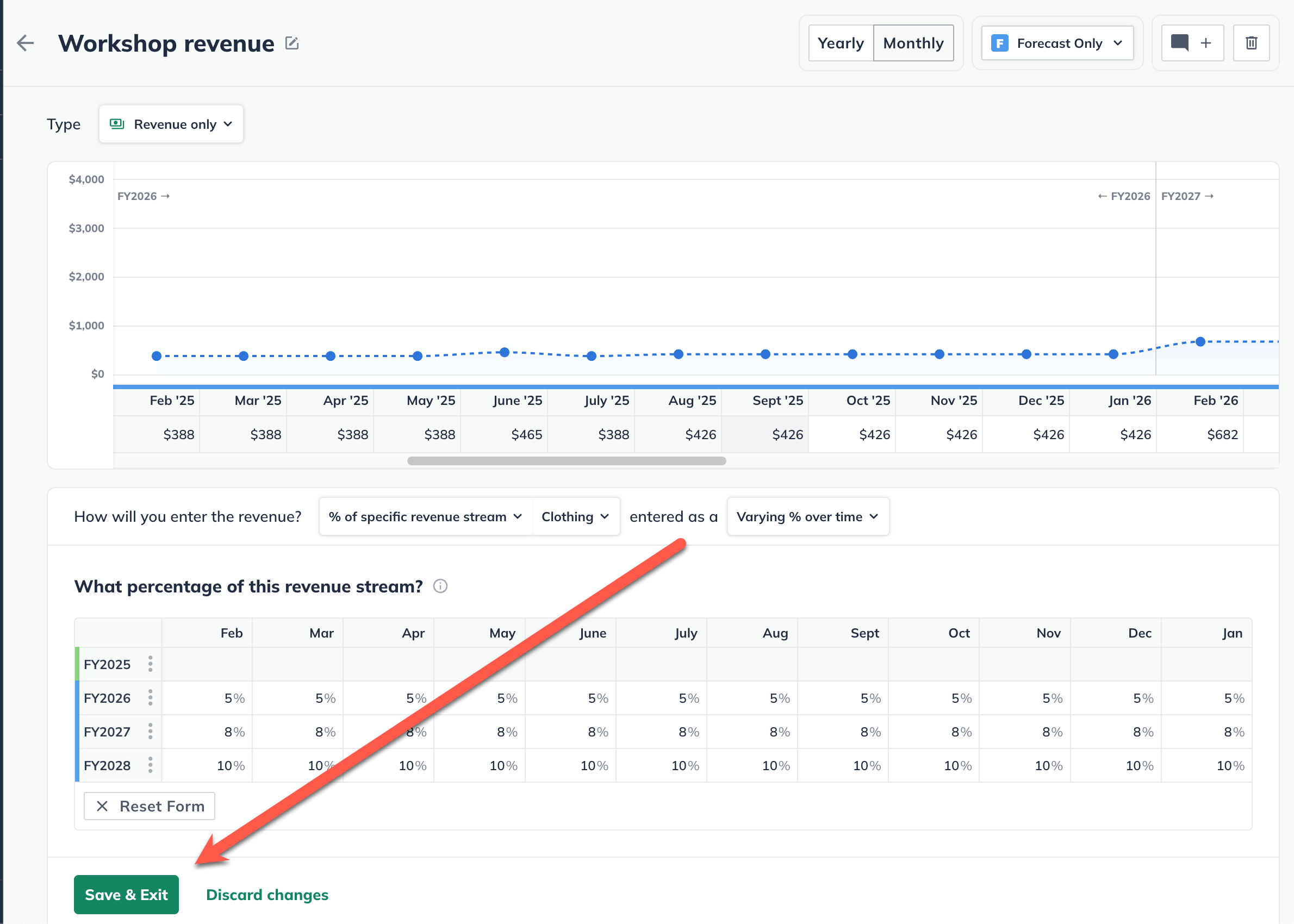

You can edit any part of your entry. Click Save & Exit when you're done:

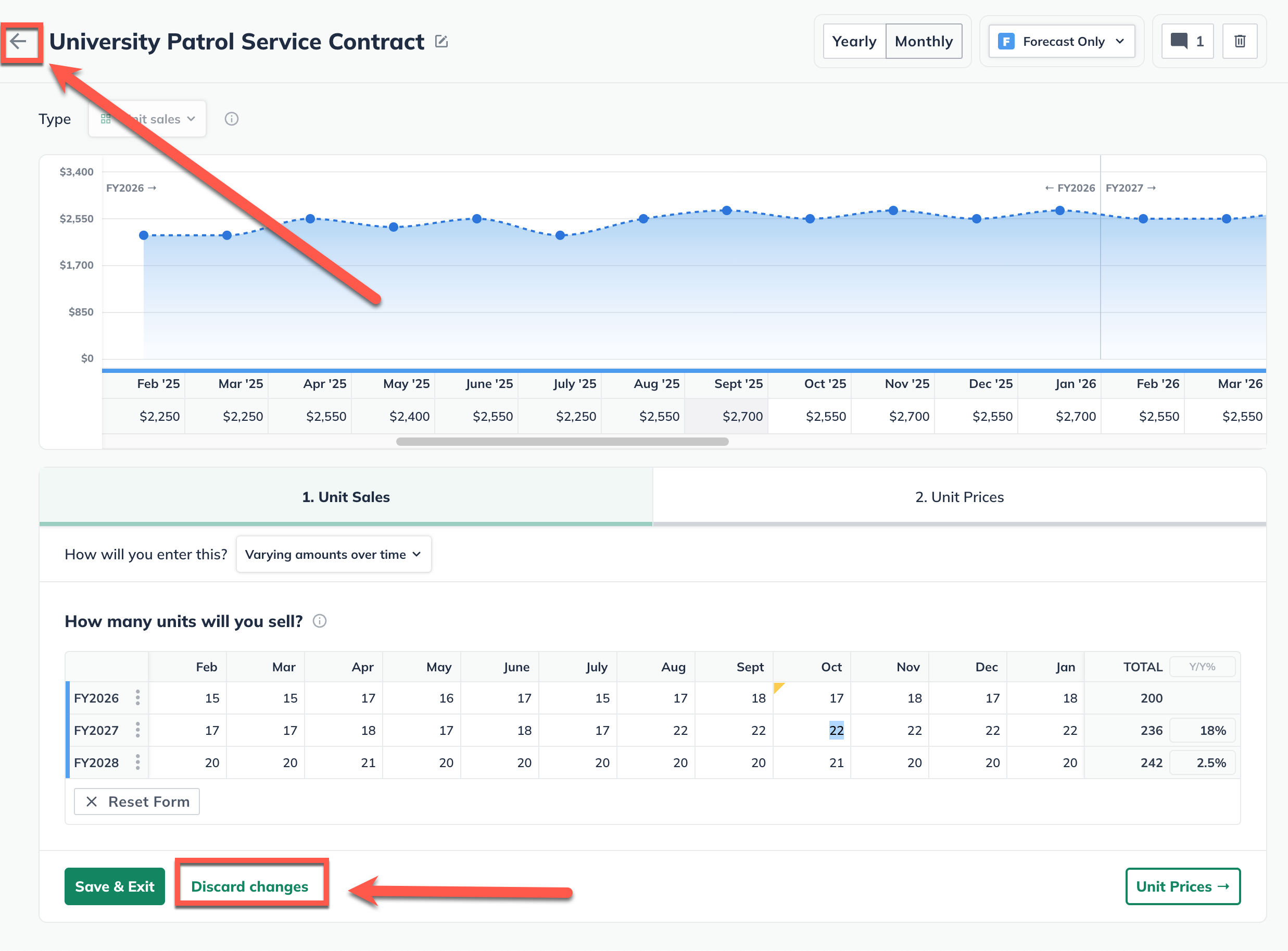

To discard changes, click on the back arrow in the upper-left corner of the editor window or click on Discard changes at the bottom:

Note: In certain tables, such as the Personnel and Financing tables, you may need to click the triangle icons to expand the lines so you can access the editable entries, as shown below:

For more details, see How do I edit or delete forecast entries?

To delete a revenue stream:

Forecast items can be deleted from two different places: from the forecast table or list, or from within the editor overlay when viewing a single forecast item.

In the forecast tables:

Click on the action menu (three vertical dots) to the right of the forecast item and select Delete:

In the forecast editors:

Click the More actions dropdown near the top-right of the forecast editor and select Delete:

Note: If a direct cost has been linked to this revenue stream, it will be automatically removed upon the deletion of the revenue stream.

Adding a one time customer cost

Understanding the costs of acquiring a customer is essential for the success of any subscription-based business. If you need to set up a direct cost upon customer sign up, you can do so using a direct cost linked to your subscription revenue.

Note: A direct cost entered for a specific revenue stream can only be linked to one revenue stream at a time.

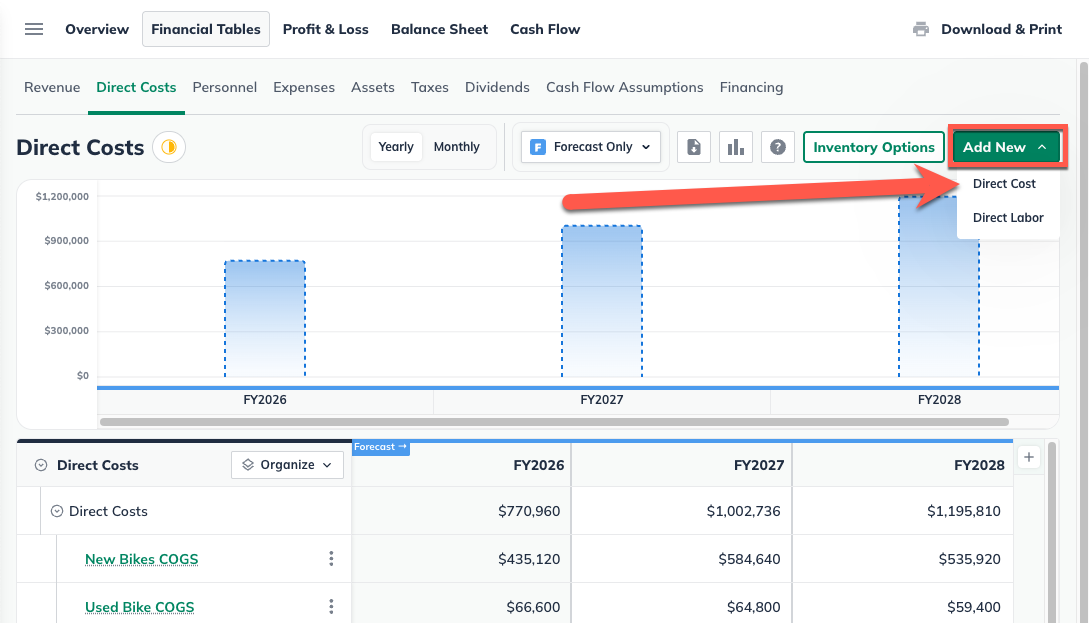

In the Forecast section, select Direct Costs:

Click the Add New button and select Direct Cost:

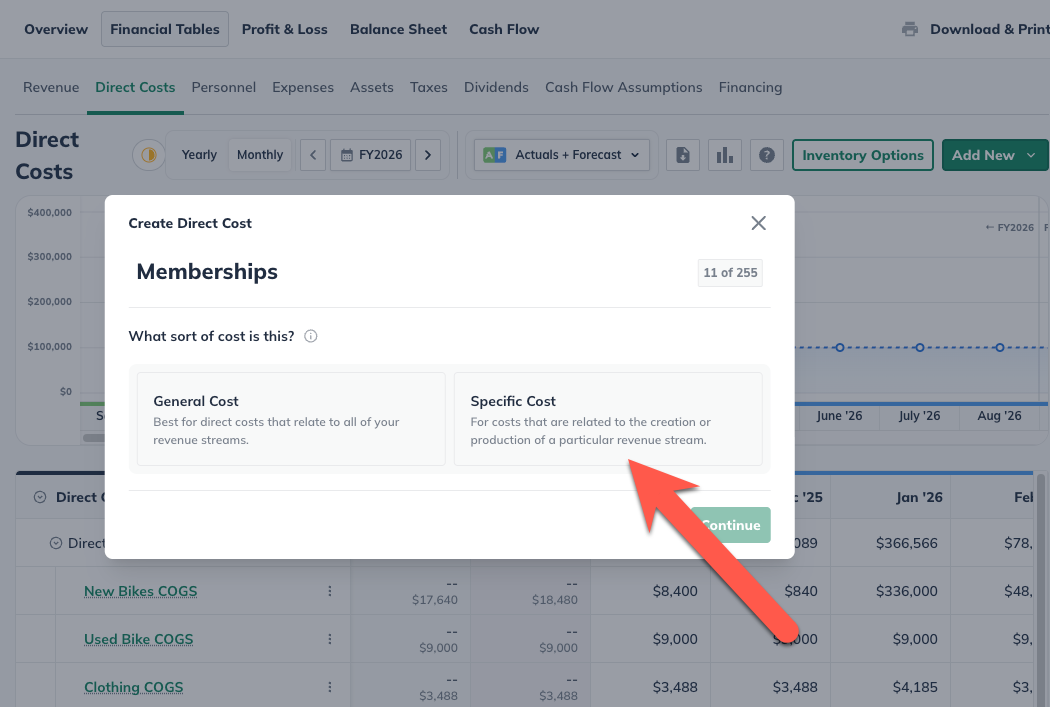

In the pop-up, enter a name for the direct cost and select Cost for a specific revenue stream:

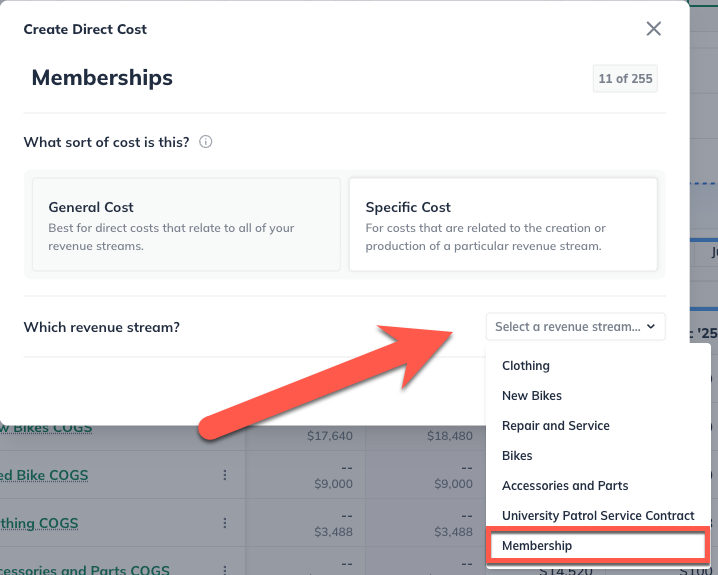

Select the revenue stream that this direct cost applies to:

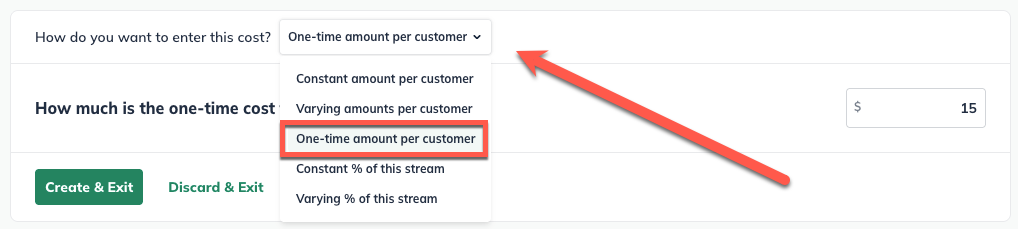

In the direct cost editor, select One-time amount per customer.

Click Create & Exit:

Where does this entry appear in the financial statements?

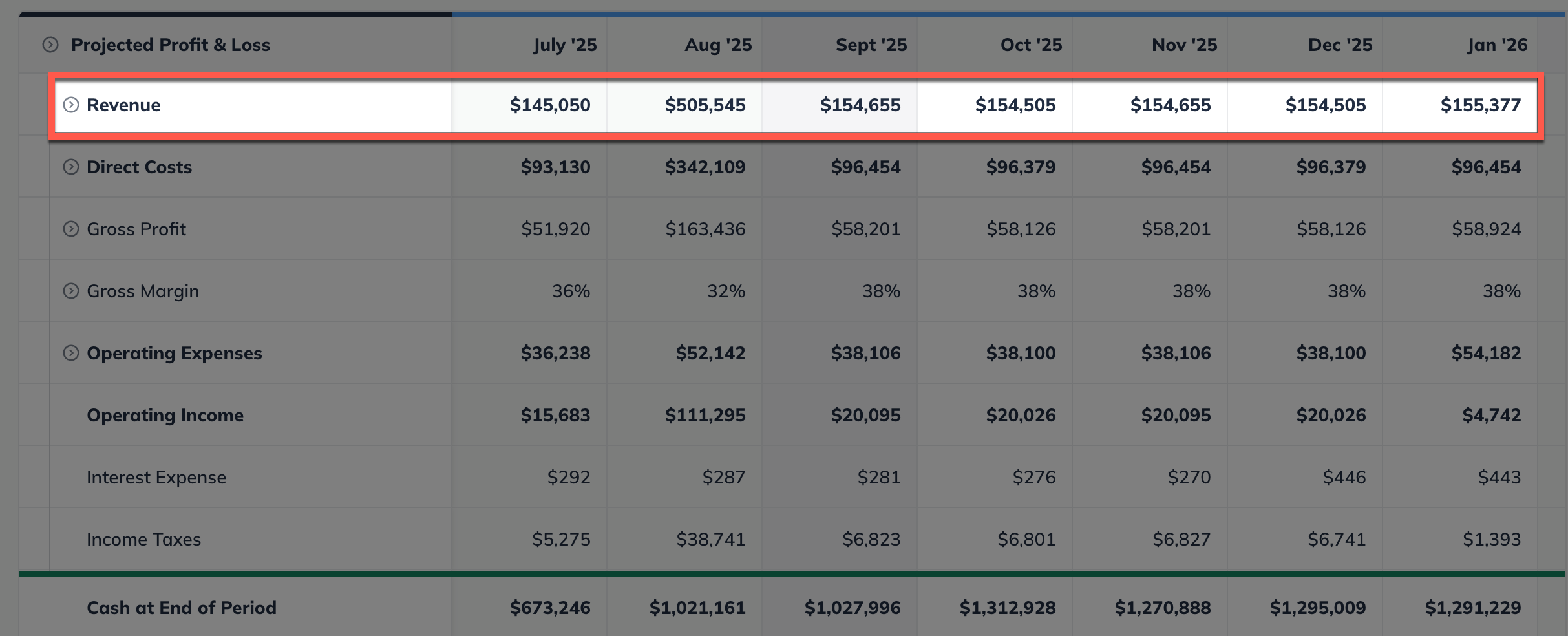

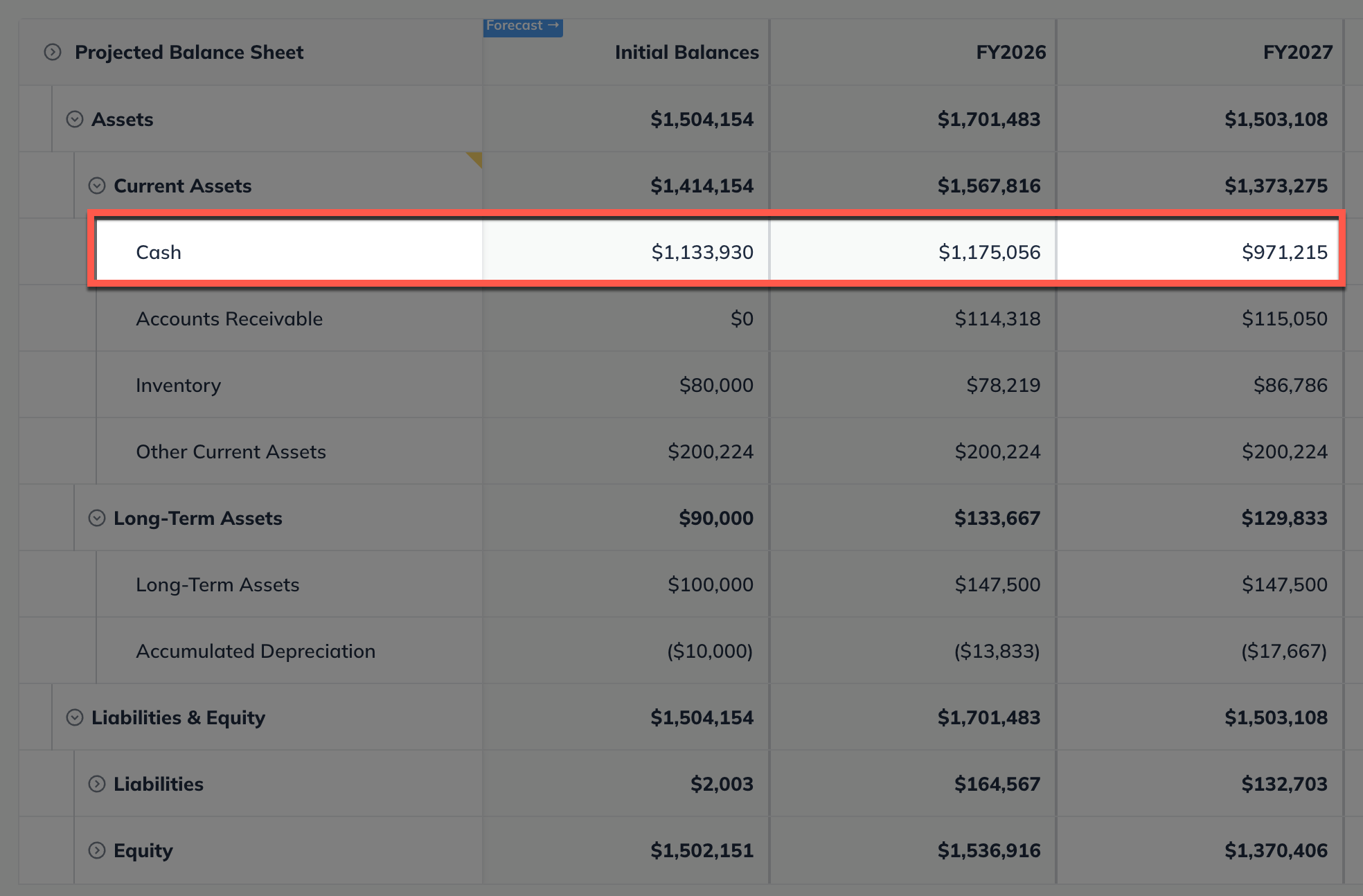

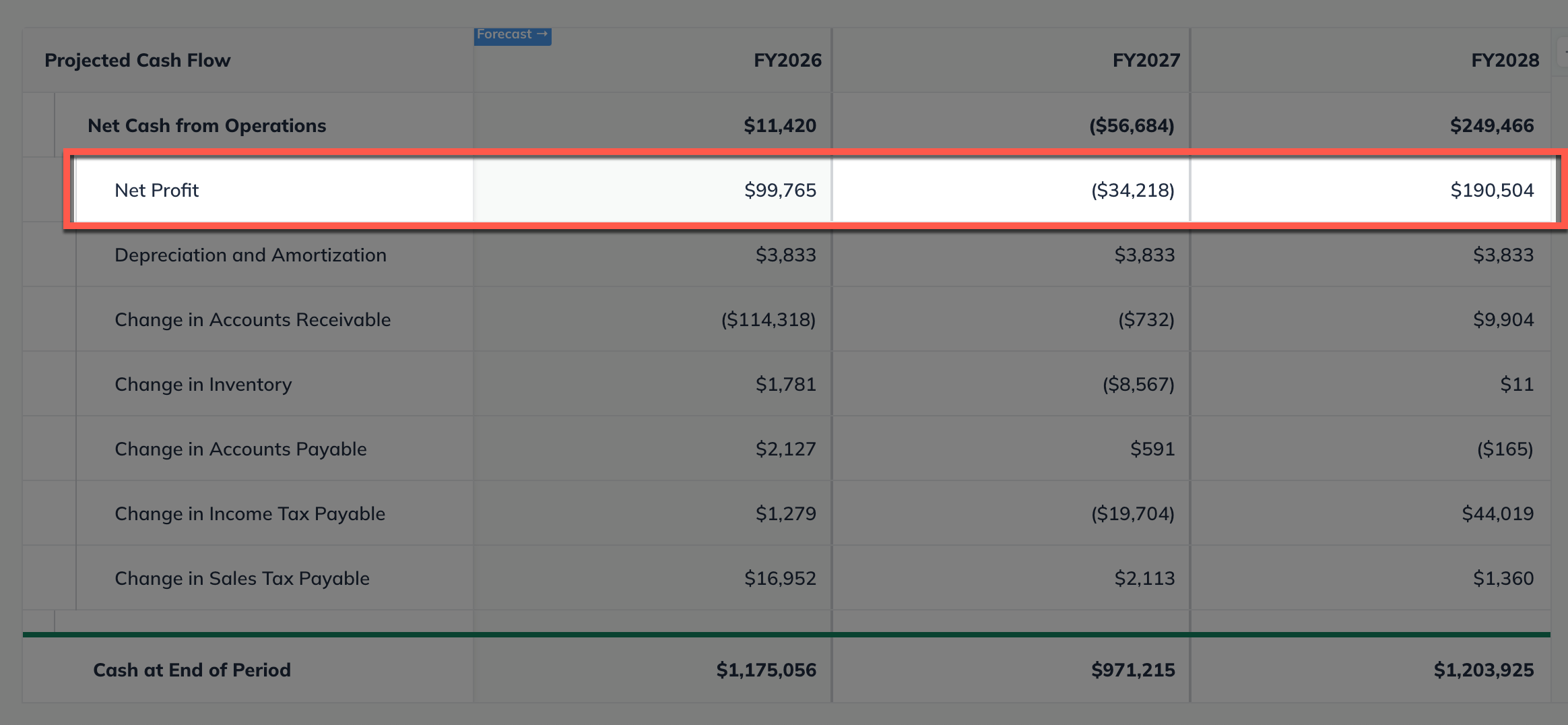

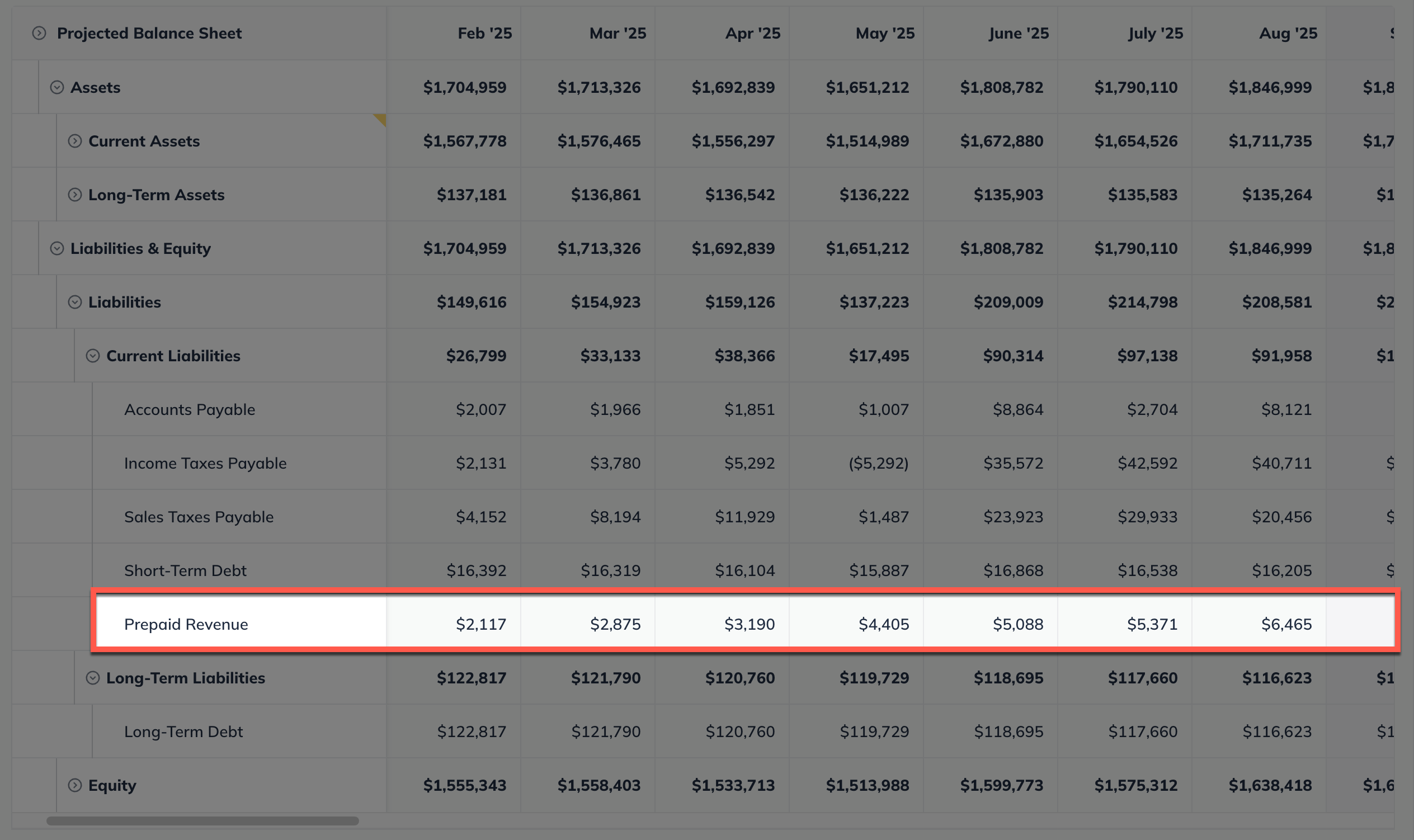

Your revenue streams will be used to calculate the highlighted lines the Profit & Loss, Balance Sheet, and Cash Flow table shown below:

Profit & Loss

Balance Sheet

Cash Flow Statement

If you've set your Multi-month charges to "Spread out multi-month charges," you will also see a Prepaid Revenue line on your balance sheet. Read Changing the setting for multi-month charges.

Modeling capacity limits in recurring revenue streams

Some businesses, like SaaS companies, can model customer capacity without worrying too much about space, inventory, or staffing. Many others, like fitness studios, classes, or childcare programs, face physical capacity limits. This section will outline three different techniques to model customer capacity limits into your forecast.

Note: Our Customer Advocacy Team is happy to answer any questions you may have. To contact them, please use the link below or email us directly at help@liveplan.com Contact the LivePlan Customer Advocacy Team

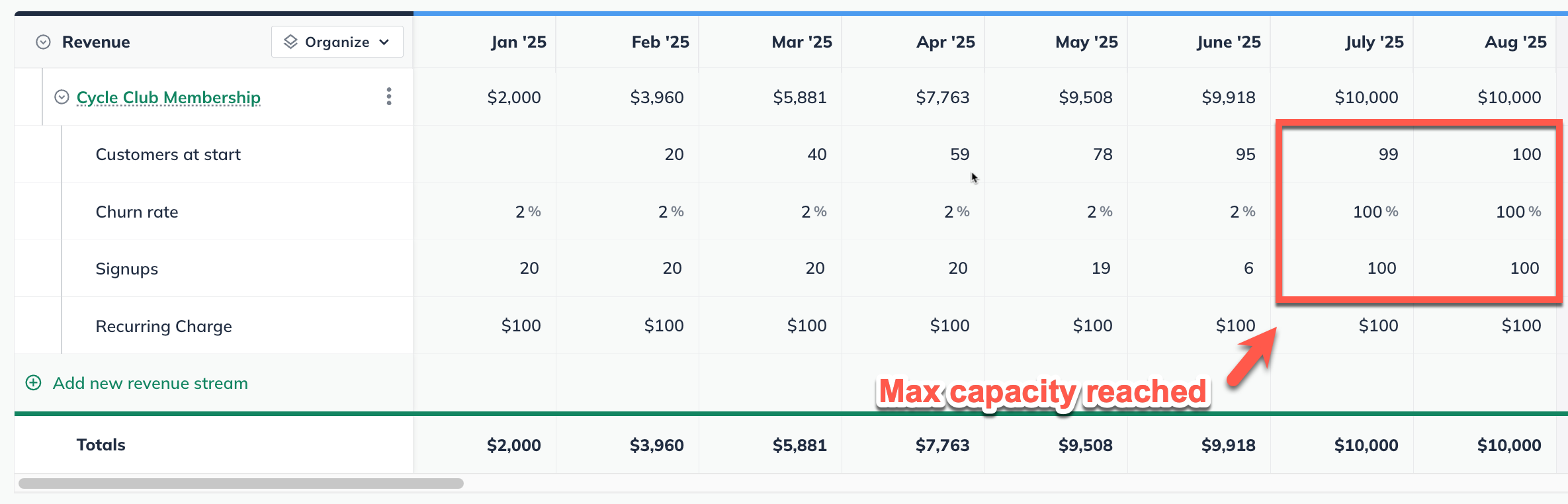

Capping and resetting signups by cycle

If you want something simpler or something that works well for seasonal or session-based revenue, this approach may work better. With this method, you reset your forecast each cycle. You set churn to 100% and add back the full number of signups for each period. It’s a quick way to model fixed-capacity programs that restart regularly and include initial signup fees.

Examples of businesses that might use this type of capacity modeling:

Seasonal athletic or enrichment courses

Childcare programs by session or term

Event-based memberships

Training cohorts or workshops

Example Model

In this example, we'll set a customer cap of 100. Once we hit our customer cap, we set churn to 100% and add new signups that are equal to our cap of 100 each month. This keeps our customer count steady while giving us a high degree of control over our revenue. From there, our total customers stay at the capped limit until we choose to change or reset it.

This approach is especially useful for seasonal or session-based businesses that serve a new group of customers each cycle. It allows you to show signups restarting from zero and building back up with each new session. In the example below, a recurring membership wraps up in October, then resets in November, filling up again for the next cycle.

Slowing signups as you reach capacity

This technique models customer growth that naturally slows as you approach capacity. As your business nears its customer cap, it makes sense to reduce your signup rate to reflect that expected slowdown. It can be important to scale back your churn rate as well in conjunction with your signups. If churn stays proportionally higher while signups decline, your forecast may show more customers leaving than joining, even though you're close to full capacity.

Examples of businesses that might use this type of capacity modeling:

Gyms with limited membership slots

Classes with ongoing rotational signups

Co-working spaces with desk capacity

Clinics with a capped number of patients

Example Model

In this example, we'll model a membership cap of 300 customers for a private fitness studio. We start with a higher rate of signups and 12% churn in the early months, then gradually reduce both signups and churn as the business approaches its customer cap. This creates a realistic growth curve that reflects how signups naturally slow down as businesses near their capacity.

You can also reverse this pattern to adjust for seasonal changes, such as a dip in memberships during the holidays followed by a surge of new signups after the New Year. You then increase signups to show growth again as capacity fills. This method gives you the flexibility to model real-world patterns while keeping your new member fees consistent throughout your forecast.

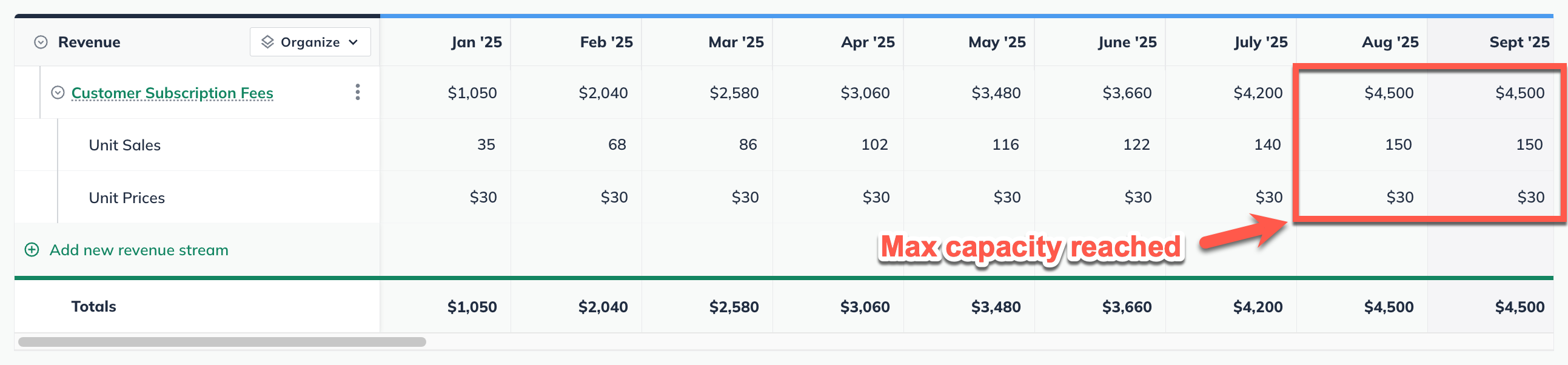

Using a unit sale to model recurring revenue

If the Recurring Revenue model isn’t capturing capacity limits the way you’d like, one of the simplest alternatives in LivePlan is to use a Unit Sale instead. Enter the total number of customers you’re serving each month—including both new signups and ongoing subscriptions—as Units Sold, and set the cost per unit to match the monthly fee you expect to collect per customer. This approach provides a clear and accurate way to reflect capped customer revenue without the added complexity of recurring revenue settings.

Example Model

In this example, we’re working with a customer cap of 150. Instead of tracking churn, we simply set the number of customer fees collected as our Units Sold. We then hold that number at the cap once it’s reached. This keeps things straightforward and gives you direct control over the total fees collected each month, without the need to adjust churn or signup rates.