Forecasting Setup And Management

Reading the Profit and Loss (P&L) statement

How to read the profit and loss statement

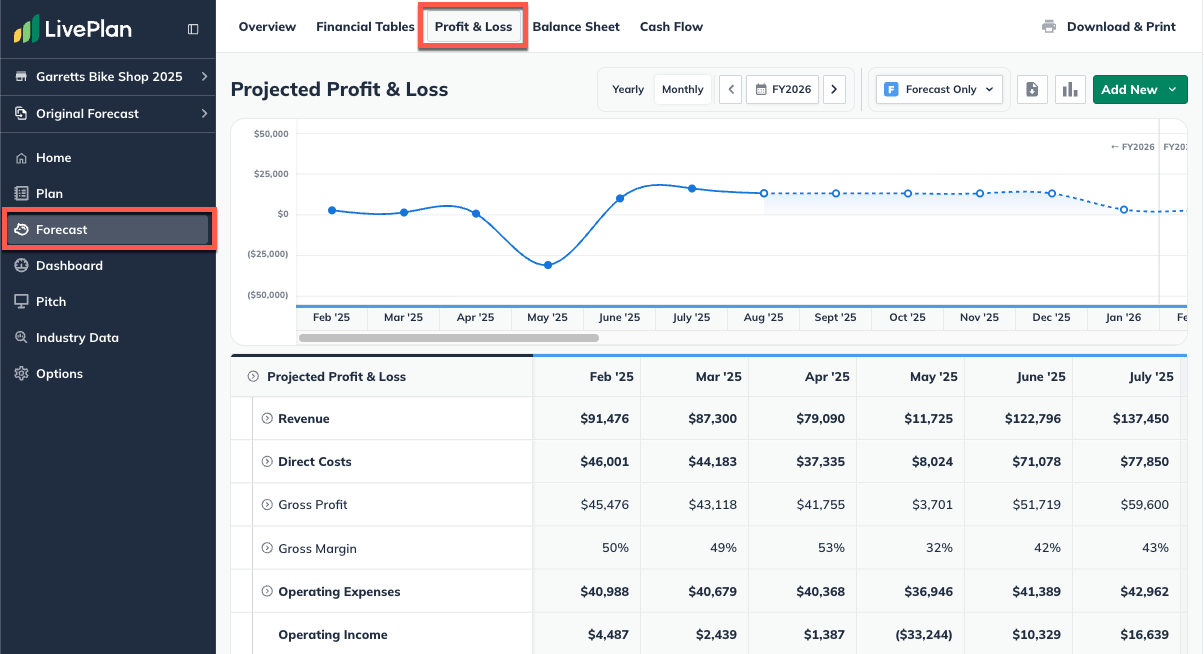

To locate the profit and loss statement (P&L) in LivePlan, click on the Forecast Overview and then Profit & Loss, located in the top menu bar:

Here's a quick line-by-line explanation of the P&L:

Note: You can expand and collapse lines of this table to see more details.

Revenue: The top line of the P&L is the money that you have coming in from sales (before any deductions). In a sense, the top line of your income statement is just as important as the bottom line (net profit) - all of the direct costs and expenses will be taken out of this beginning number. The smaller your top-line revenue number is, the smaller your expenses need to be if you’re going to stay profitable.

Direct Costs: Also referred to as the Cost of Goods Sold (COGS), these are the costs that go into making your products or delivering services. You wouldn’t include items such as rent for an office space in this area, but you would include the things that directly contribute to the product you sell. For example, to a bookstore, direct costs are what the store pays for the books it sells, but for a publisher, direct costs include authors’ royalties, printing, paper, and ink. If you only sell services, it’s possible that you have few or no direct costs. For more details, see What is the difference between direct costs and expenses?

Gross Margin: Gross margin (or gross profit) is the difference between the revenue and direct costs on your P&L. Gross margin tells you two important things: how much of your revenue is being funneled into direct costs (less is better) and how much you have left over for all of the company’s overhead expenses. If your gross margin is smaller than the amount you need to cover your expenses, you’re not going to be profitable.

Operating Expenses: Operating expenses are a list of all of your overhead expenses, excluding your direct costs. This includes everything your company pays for to keep the doors open: rent, payroll, utilities, marketing, etc.

Operating Income: Operating Income is also referred to as EBITDA, or earnings before interest, taxes, depreciation, and amortization. This line is a simple statement of your profitability, although there will be some additional subtractions, as shown below.

Interest Expense: Here is where you'll see any interest payments that your company is making on its loans.

Income Taxes: This line will reflect the income tax amount that has been paid or the amount that you expect to pay.

Depreciation and Amortization: These are expenses associated with your asset purchases, both short-term and long-term. Over time, long-term assets lose their value or depreciate. With short-term assets (like copyrights or patents), the value is amortized, or distributed, over a number of months.

Total Expenses: Total expenses take into account all of the expense items in the P&L. This total includes your Direct Costs, Operating Expenses, Interest Expenses, Income Taxes, and Depreciation & Amortization.

Net Profit: Net profit, also referred to as net income or net earnings, is the proverbial "bottom line." Remember that this number started at the top line, with your revenue from sales. Then, everything else was subtracted from that initial sum. If this number is negative, you’ll know that you’re running at a loss. Either your expenses are too high, your revenue is in a slump, or both—and it might be time to reevaluate your strategy.

Net Profit %: Net Profit Percentage is the percentage of revenue that is net profit. For example, if the Revenue is $100 and the Total Expenses are $50, then the Net Profit is $50, resulting in a Net Profit % of 50%.

Actuals + Forecast

When Actuals + Forecast is on, the Profit & Loss table will show a blend of past accounting data and future projections. The past accounting data will come from the Dashboard and requires you to either directly add accounting data or connect it to an accounting solution.

Editing the Profit and Loss

In LivePlan, you can't adjust the numbers in the Profit and Loss directly. Instead, you'd edit the individual forecast entries that calculate into the P&L. Click on the Forecast tab of LivePlan and then navigate to the page of entries you need to edit. You can click on any entry to update its contents.

Some lines of the P&L can be expanded to show the individual forecast entries that are calculated into them. For these lines, you'll see an expand/collapse arrow to the left. Clicking that will expand the line.

To adjust the numbers on the P&L, you can click on any of the green links for revenue streams, direct costs, direct labor, or expenses. This will open the entry and allow you to edit the numbers related to that item directly. For more details, see How do I edit or delete forecast entries?

Adding revenue and expenses from the profit and loss statement

LivePlan also allows you to add revenue streams, direct costs, personnel, or expenses from the profit and loss statement. To do this, click Add New, located near the top-right of the statement:

Next, select which entry you would like to add:

Where is EBITDA in the LivePlan forecast?

EBITDA stands for Earnings Before Interest, Taxes, Depreciation, and Amortization. It's a financial metric used to evaluate a company's operating performance without the impact of financial and accounting decisions. Essentially, EBITDA provides a clearer picture of a company's operational effectiveness by removing the effects of financing, accounting decisions, and taxes.

In LivePlan, EBITDA is referred to as Operating Income. You can quickly check your operating income on the Profit and Loss statement.

After the Operating Income line, you can locate the interest expense, income taxes, and depreciation & amortization on the following three lines.

These entries are calculated from the data entered into the Financing, Taxes, and Assets sections of your LivePlan forecast.