Forecasting Financing Taxes And Advanced Topics

Entering asset purchases

How are assets different than expenses?

Customarily, long-lasting purchases (called "assets") are treated differently than regular expenses. Consider two purchases as an example: a company work van and a tank of fuel to power it. The fuel is a short-lived purchase - buy it in January, use it in January. That's how regular expenses work.

The van is different, though. It's an expensive purchase and won't be gone at the end of the first month. A good van will deliver value for years to come, so it makes sense to spread out its cost over time. That's the idea behind asset purchases.

When you enter an asset into your forecast, LivePlan will place its full value in your financial statements and then calculate the value it will lose (through amortization or depreciation) each month over its useful life.

If you plan to get a loan to pay for an asset (as in the company van example), be sure to add that loan separately on the Financing page. All we're doing here is adding the asset itself.

Note: Not all assets are covered here. Cash, accounts receivable, and inventory are assets too, but we address those separately in our forecast. Just focus here on long-lasting purchases like equipment, vehicles, or furniture. You can also use this feature to spread out the expense of annual contracts or other short-term assets.

Adding a long-term asset

A long-term asset continues to provide value for several years (like a company van, a building, or office equipment). For more details, see What is the difference between a long-term asset and a current asset?

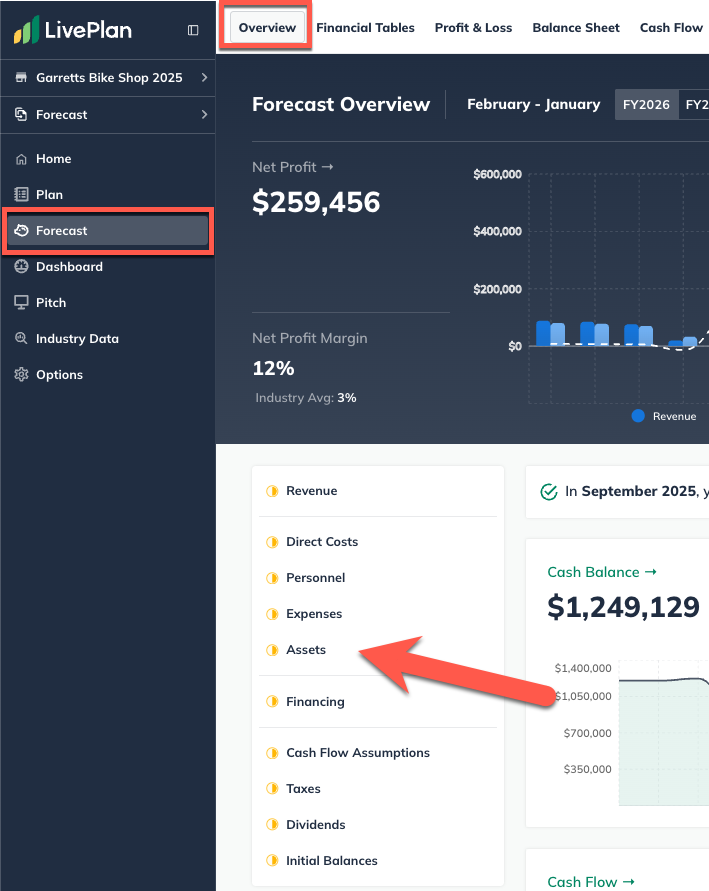

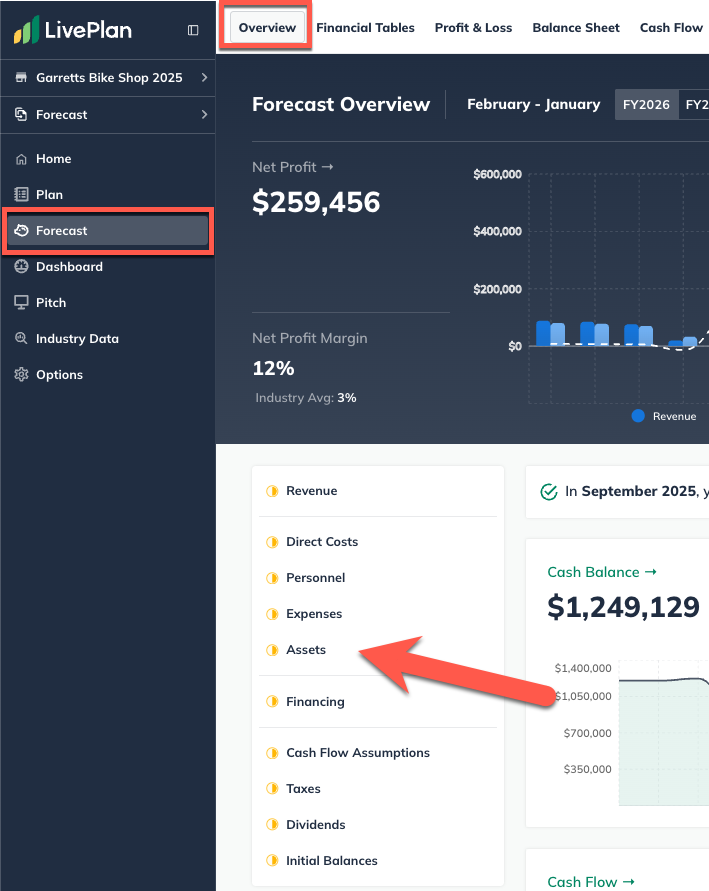

In the Forecast Overview, click Assets:

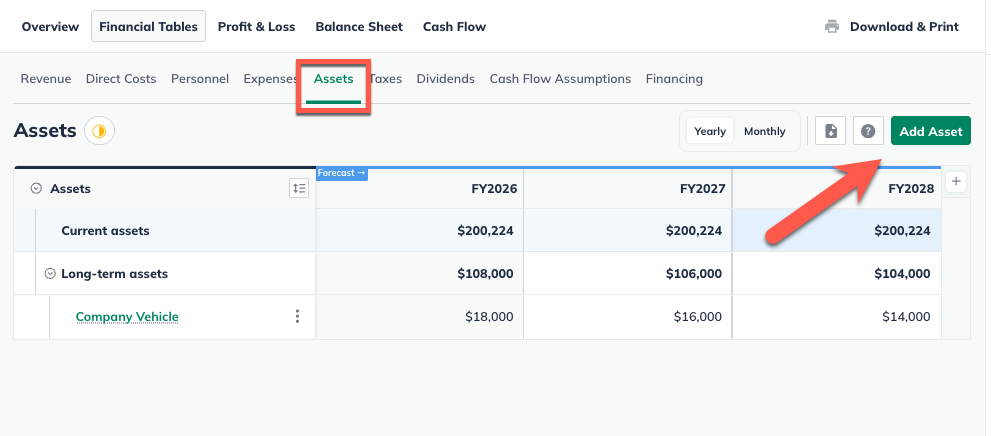

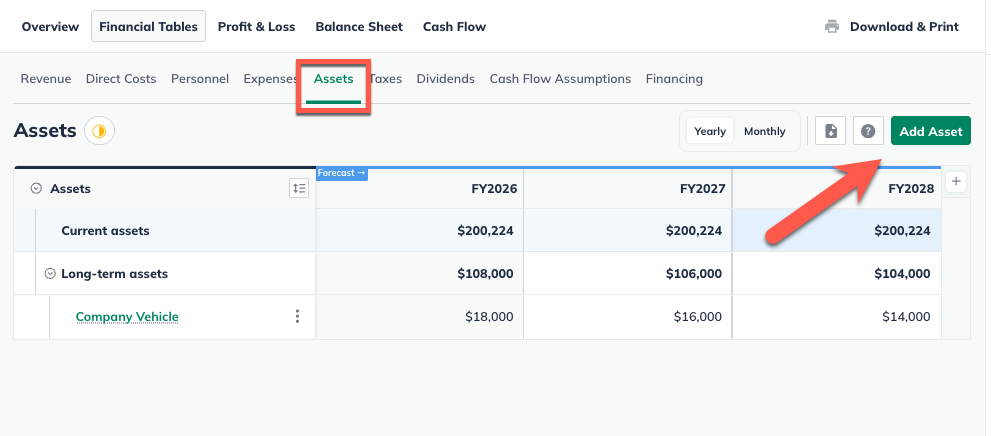

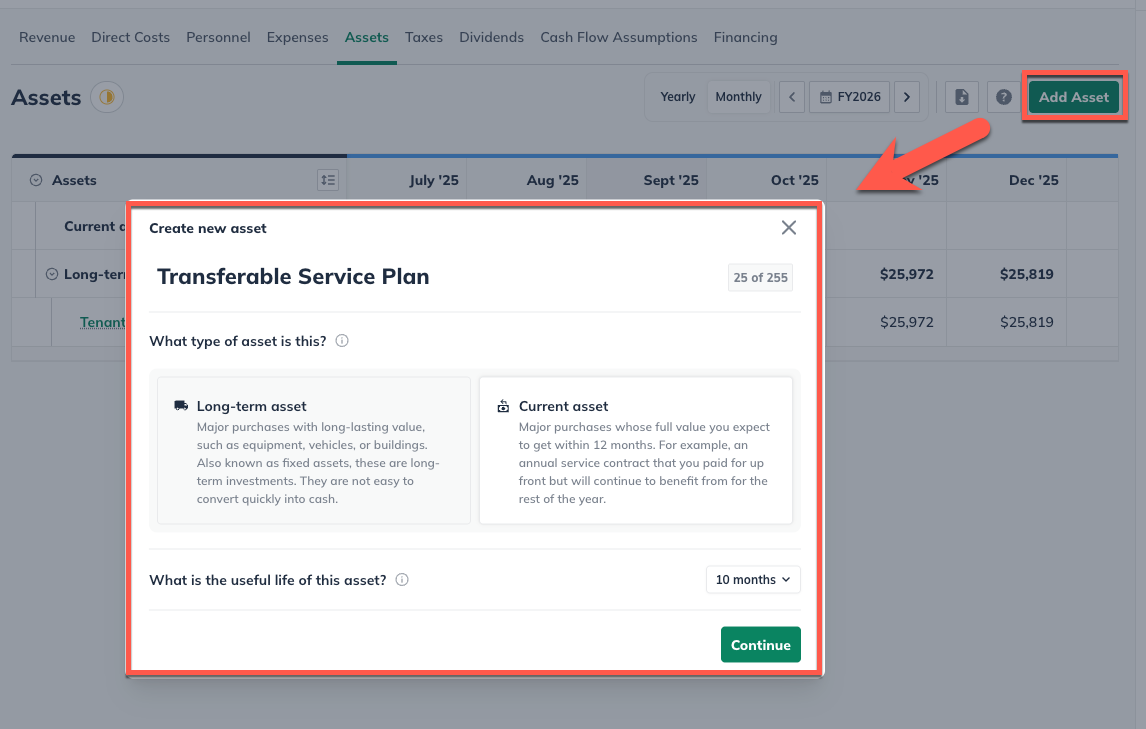

Click Add Asset and enter a name or a short description for the asset:

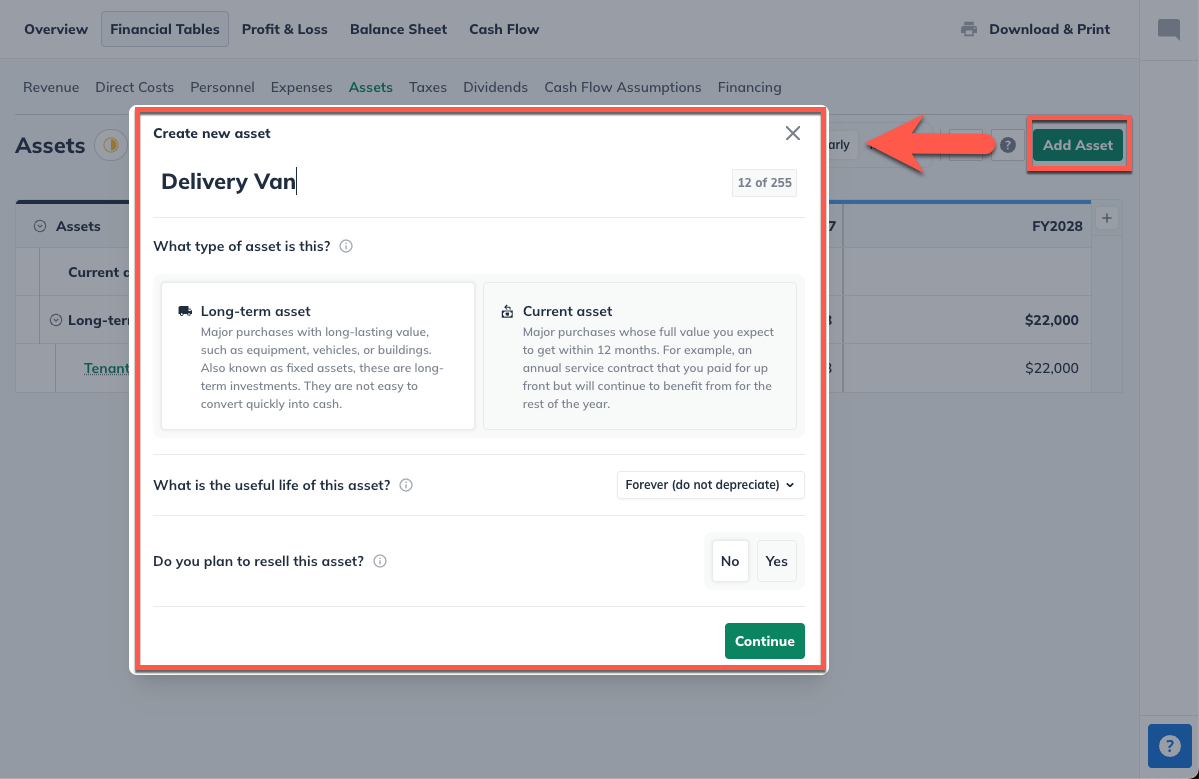

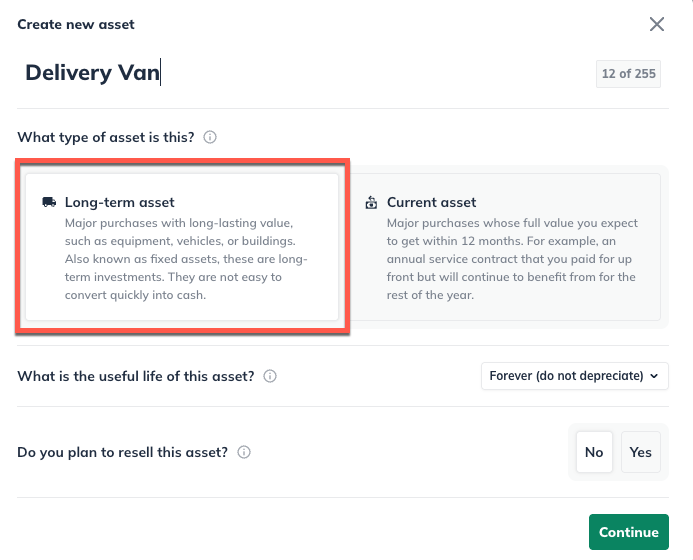

Under Type, choose Long-term asset:

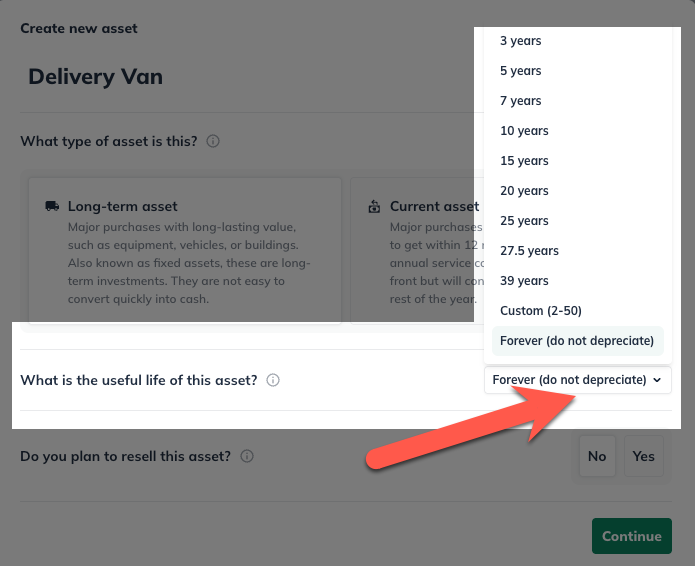

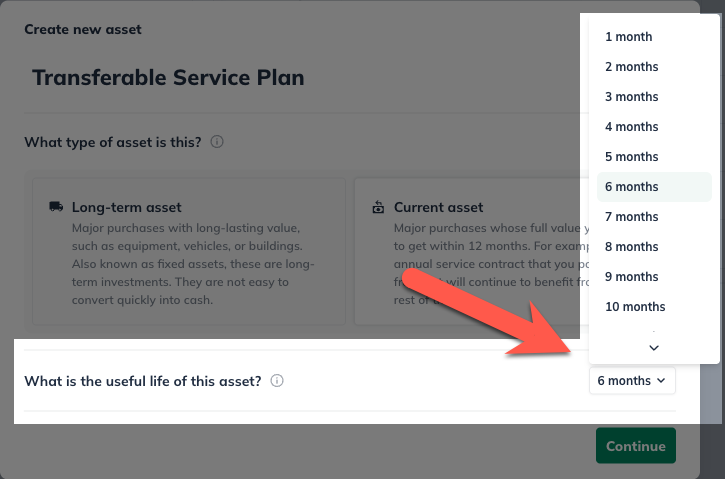

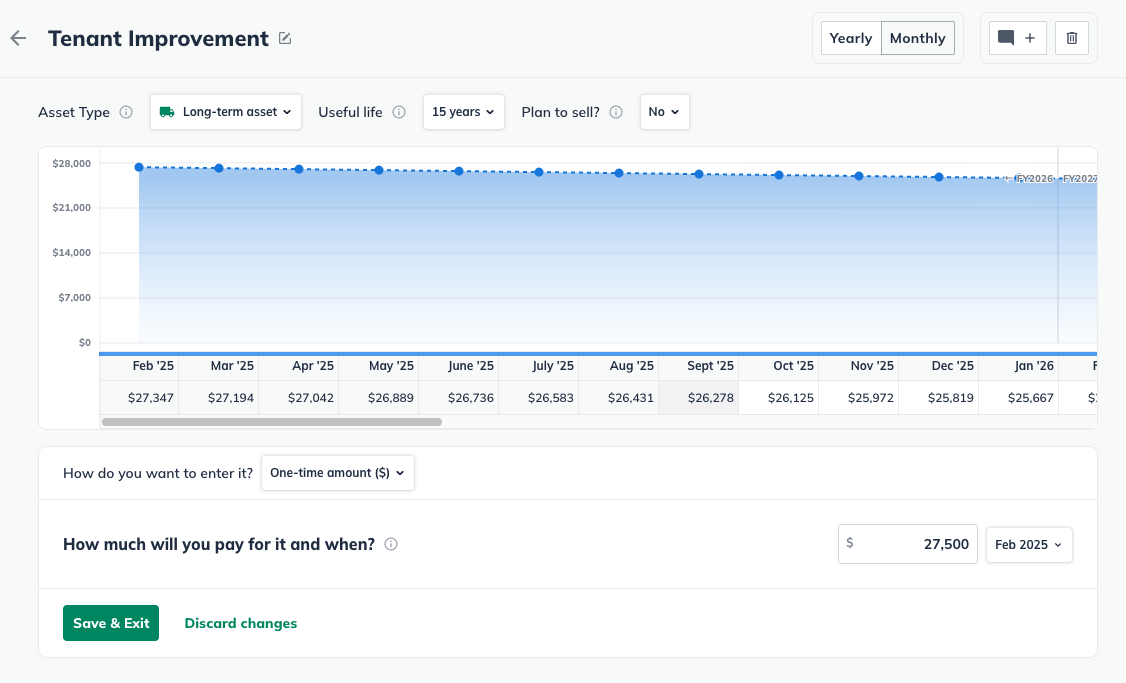

Indicate the asset's useful life below, which will help LivePlan calculate the depreciation. If this asset doesn't depreciate, choose Forever (do not depreciate) at the bottom of the list:

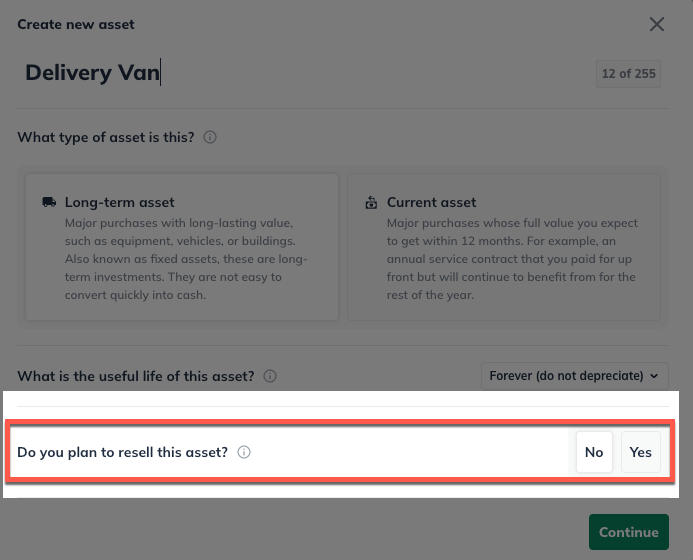

Indicate whether you plan to sell this asset during the period covered by your forecast:

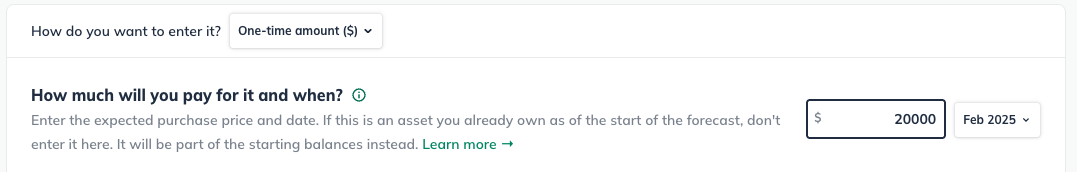

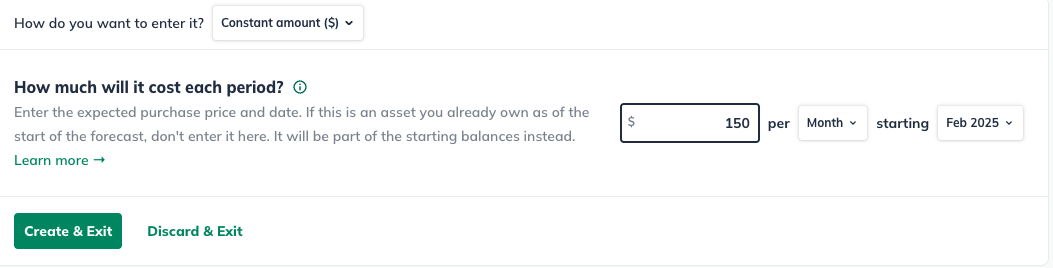

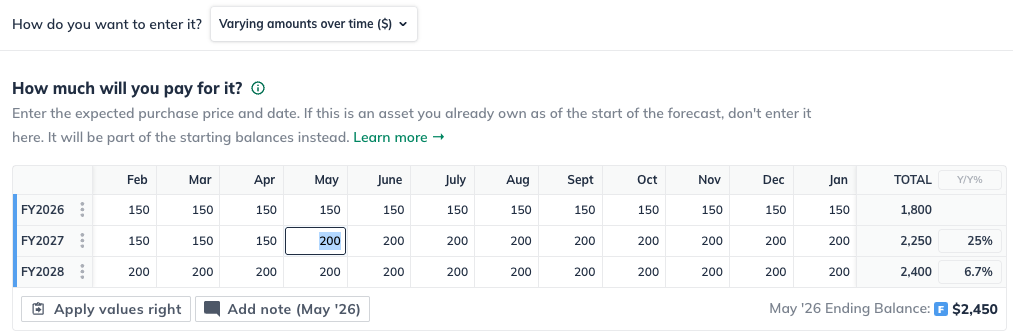

Choose how you want to enter the asset. Will you pay a one-time amount for it, the same amount per month/year, or varying amounts per month/year for it?

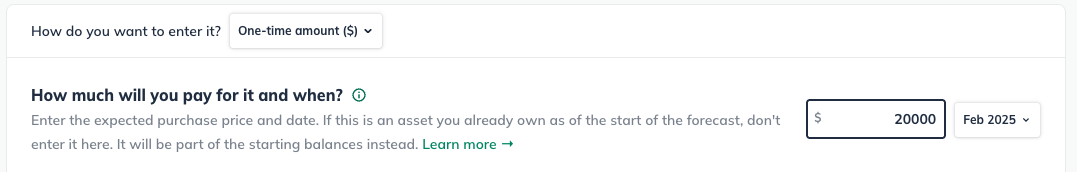

If you choose One-time amount, enter the expected purchase price and purchase date:

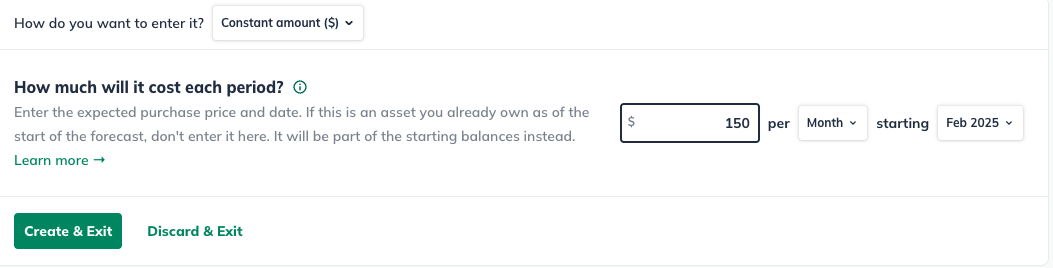

If you choose Constant amount, enter how much you will pay for it (per month or year) and when that payment will begin:

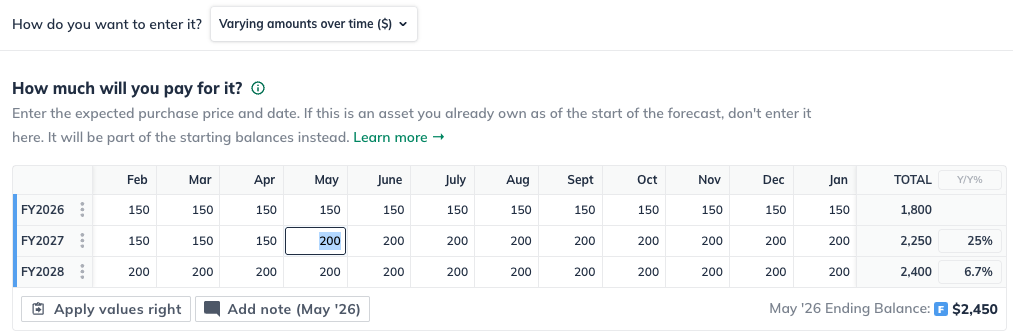

If you choose Varying amounts over time, enter the amounts you'll pay and which months/years you'll make those payments in:

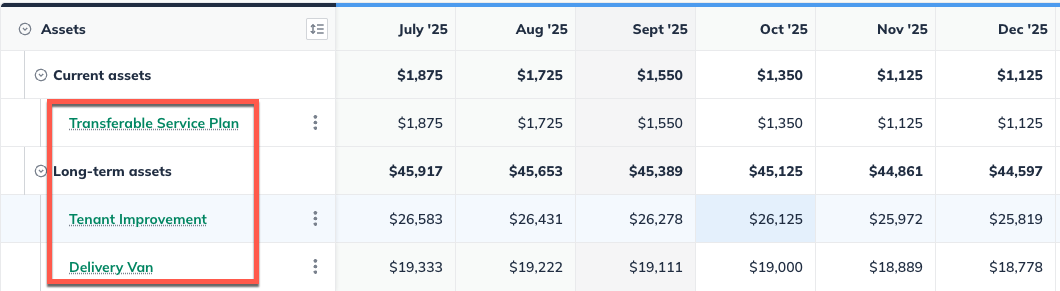

Click Create & Exit. Your long-term asset will appear in the assets table:

Determining the useful life of a long-term asset

For more details on how to choose the useful life of an asset, see Depreciation and Amortization: Determining the useful life of an asset.

Adding a current asset

A current asset is used up within 12 months (for example, an annual service contract). For more details, see What is the difference between a long-term asset and a current asset?

In the Forecast Overview, click Assets:

Click Add Asset and enter a name or a short description for the asset:

Under Type, choose Current asset:

Indicate the length of time this current asset will provide value so that LivePlan can amortize that value. If you don't want to amortize it at all, choose the Keep at full value option at the bottom of the list:

Choose how you want to enter the asset. Will you pay a one-time amount for it, the same amount per month/year, or varying amounts per month/year for it?

If you choose One-time amount, enter the expected purchase price and purchase date:

If you choose Constant amount, enter how much you will pay for it (per month or year) and when that payment will begin:

If you choose Varying amounts over time, enter the amounts you'll pay and which months/years you'll make those payments in:

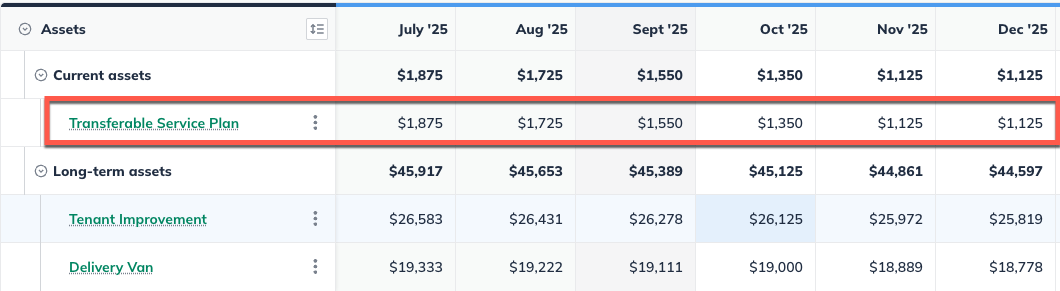

Click Create & Exit. Your current asset will appear in the assets table:

Adding special types of assets

These articles offer instructions for entering some special types of assets:

Editing or deleting an asset

This is how you edit an asset in the forecast:

Clicking on the name cell of the forecast item that you wish to edit:

This will bring up the asset editor window where you can make your edits.

You can find step by step details for editing your forecast entries in this article: How do I edit, delete, and copy forecast entries?

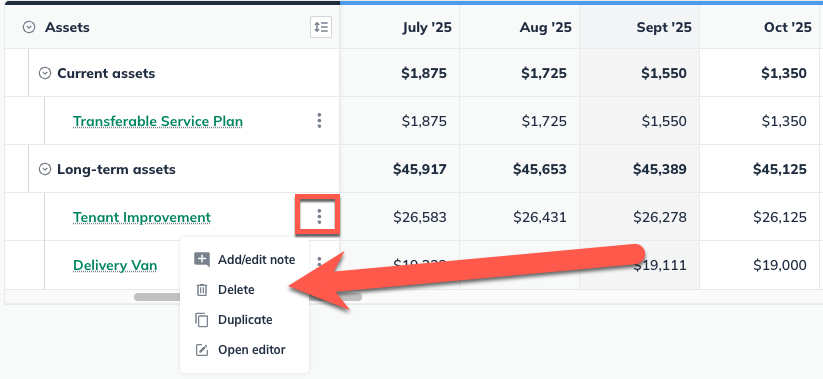

To delete an asset:

Forecast items can be deleted from two different places: from the forecast table or list, or from within the editor overlay when viewing a single forecast item.

In the forecast: Click on the action menu (three vertical dots) to the right of the forecast item and select Delete:

In the editor: Click the More actions dropdown near the top-right of the forecast editor and select Delete:

Where does this entry appear in the financial statements?

Assets fall under two classifications: Current Assets and Long-term Assets, and these two entries appear in different parts of the financials. Only the depreciation and amortization of an asset are listed in the Profit and Loss statement, as this is the only part of the asset considered an expense of daily operations.

The amortization of a current asset will appear under Operating Expenses as Amortization of Other Current Assets in the Profit & Loss, as shown below:

The depreciation of a long-term asset will appear in the P&L under Depreciation & Amortization, as shown below:

In the Balance Sheet, a current asset will appear under the Current Assets heading as Other Current Assets, with its value decreasing month to month as the asset is amortized:

Long-Term Assets appear in the Balance Sheet as shown below. You can see the value of the assets and their depreciation on separate lines:

In the Cash Flow statement, both short-term and long-term assets appear as shown below. The value of the asset purchase appears as a negative cash flow, and the Depreciation & Amortization appears as a positive cash flow. This value doesn't mean depreciation is a source of income. Instead, the positive depreciation amounts are adjustments to the cash value of the asset:

A Gain or Loss from Sale of Assets line will appear on the Cash Flow statement under Net Cash From Operations if an asset is forecasted for resale. This represents the difference between the cash your company receives from the sale and the asset's book value at the time of sale. If the asset is on a depreciation schedule, any sale price above or below its depreciated value will result in a gain or loss, which will be recorded in the cash flow for the specific month and year when the sale occurs.