Forecasting Financing Taxes And Advanced Topics

Entering a previously-owned asset for a start-up business

Sometimes, an entrepreneur might start a new business using assets they already own. One example would be an avid gardener who has had a truck for a few years. If this gardener were starting a farm stand business, he might want to use that truck as a delivery vehicle, which would make it an asset in the business plan forecast.

To represent a pre-owned asset in your forecast requires two entries:

One Asset entry representing the remaining value of the asset

One Financing entry representing the invested value of the asset

Two entries are required because, essentially, the business is taking ownership of the asset—or, put another way, purchasing it from the owner. The owner then invests the "purchase price" in the company. When you make the entries in your LivePlan forecast, the Asset entry is calculated as a large expenditure. You'll also need a Financing entry representing the same amount to keep your financials in balance.

Entry #1: Pre-owned asset

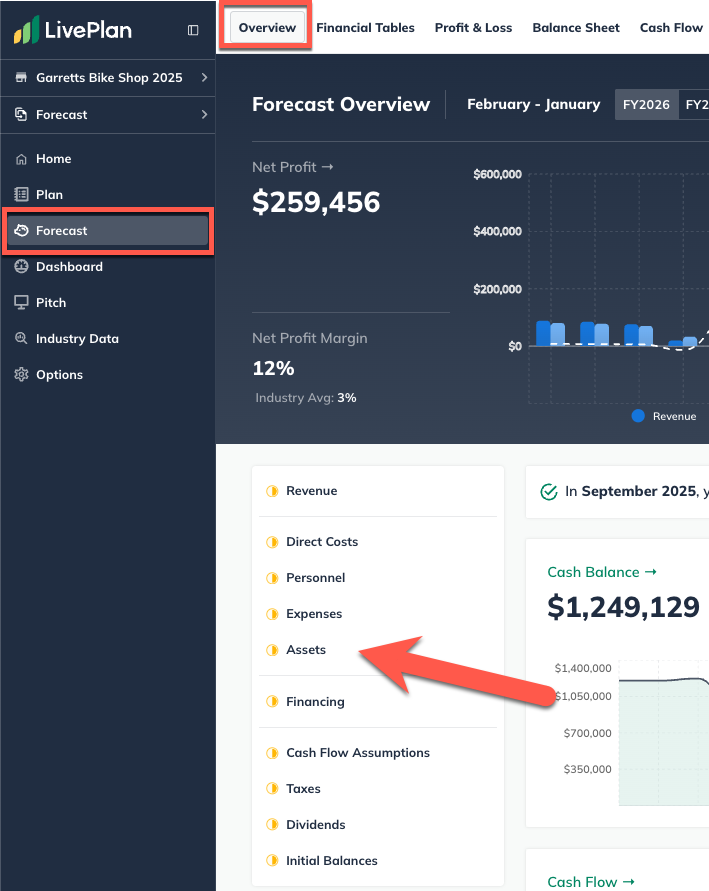

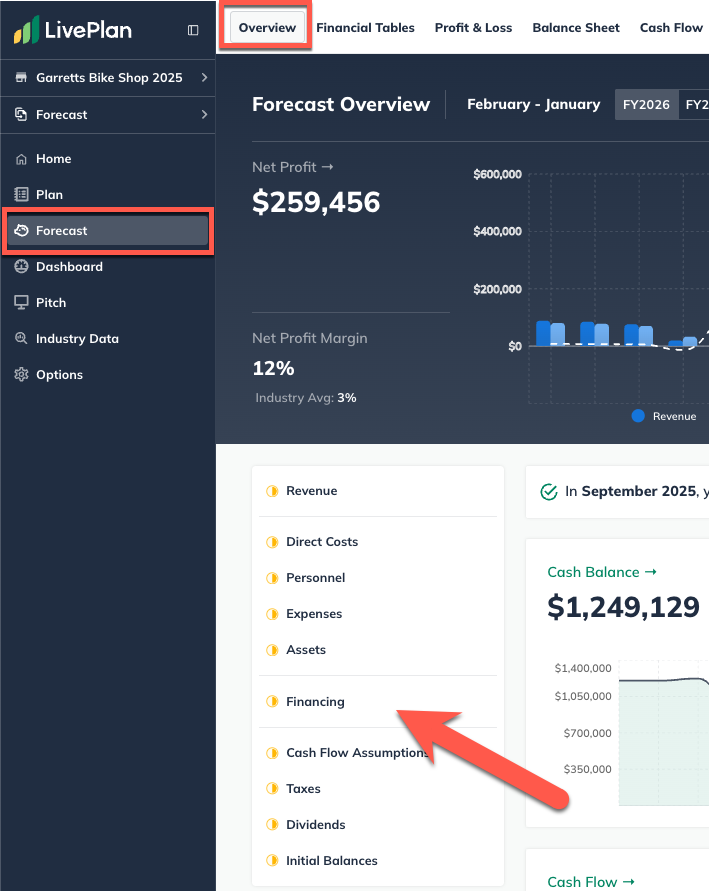

In the Forecast Overview, click Assets:

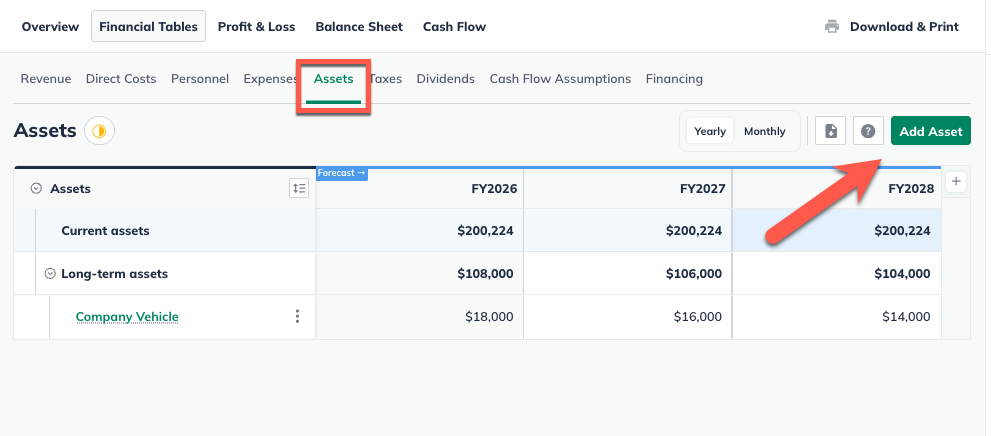

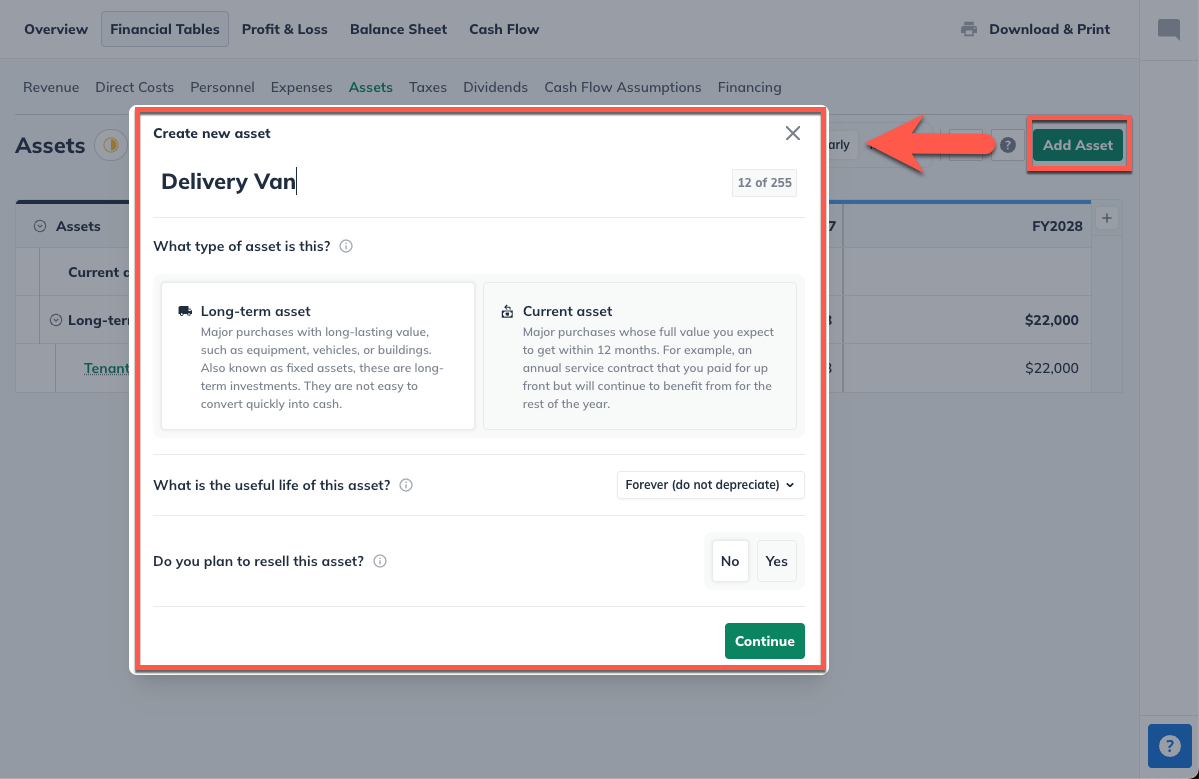

Click Add Asset and enter a name or a short description for the asset:

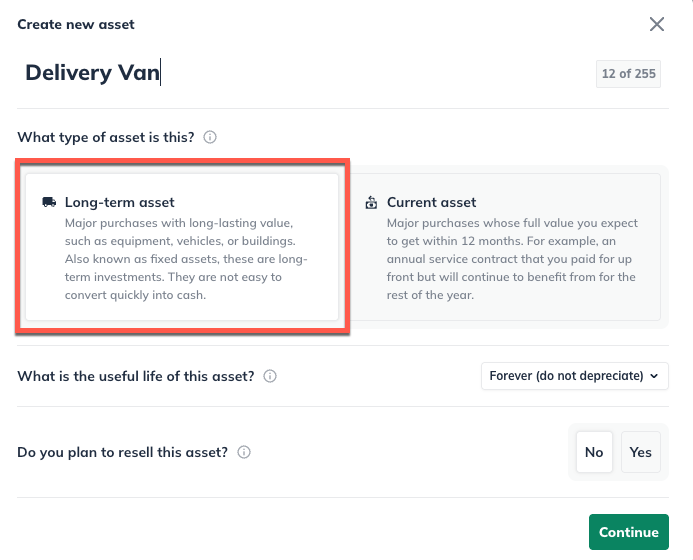

Under Type, choose Long-term asset:

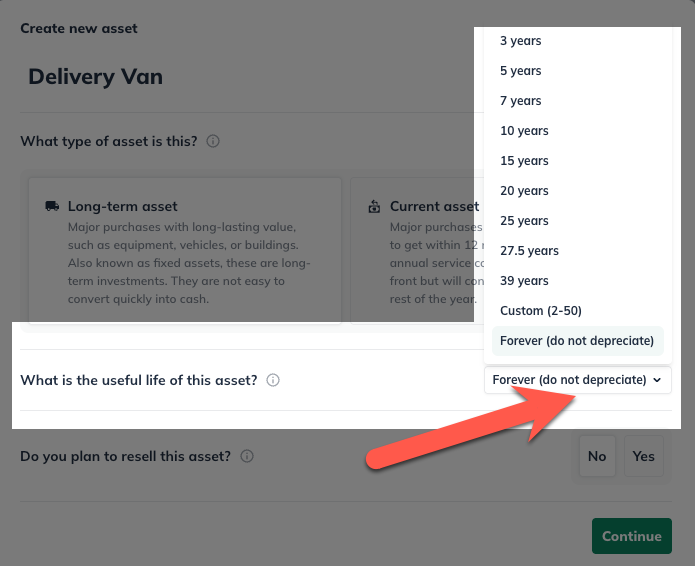

Indicate the asset's useful life below, which will help LivePlan calculate the depreciation. If this asset doesn't depreciate, choose Forever (do not depreciate) at the bottom of the list:

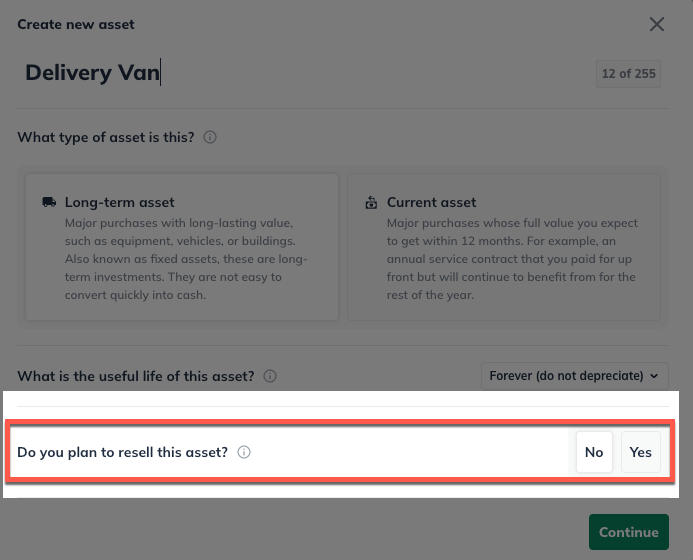

Indicate whether you plan to sell this asset during the period covered by your forecast:

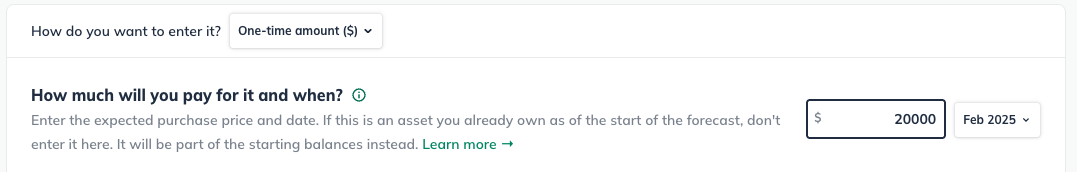

Select One-time amount ($) and enter a dollar amount representing this asset's remaining value. So, if you have owned it for a number of years, it has depreciated in that time. Enter the remaining value as of the start of your forecast.

Select the first month of your forecast as the start date of the asset:

Note: You may notice instructions for this entry that tell you to enter an asset you already own in Initial Balances. The Initial Balances, however, are designed for existing businesses. If your business is a start-up, you can ignore that instruction and proceed with this asset entry. If your company is already in business, you will enter this asset in your Initial Balances.

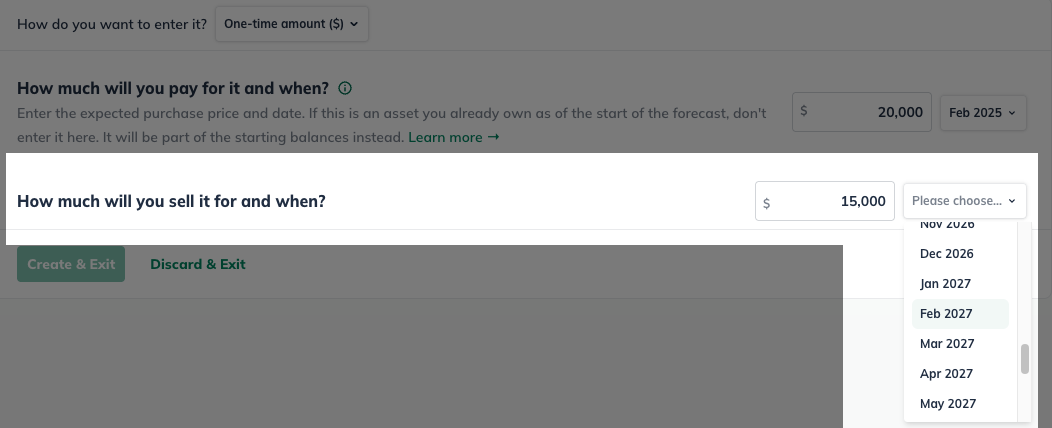

Lastly, if you indicated you plan to resell the asset, input how much you will sell it for.

Click Create & Exit.

You'll now create an Investment entry to balance this asset entry.

Entry #2: Invested value of the asset

In the Forecast Overview, click Financing:

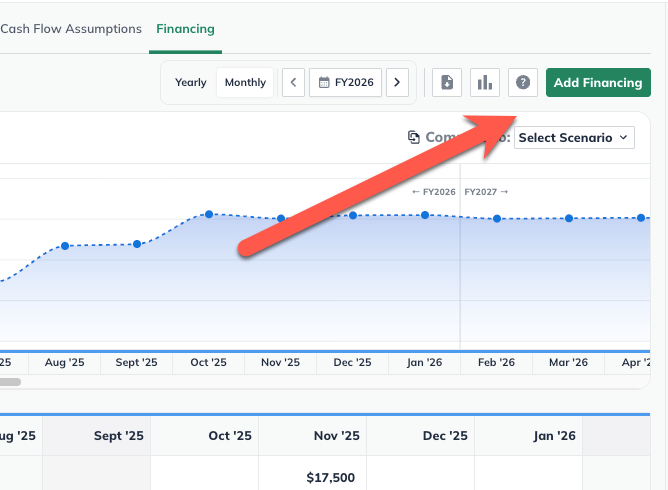

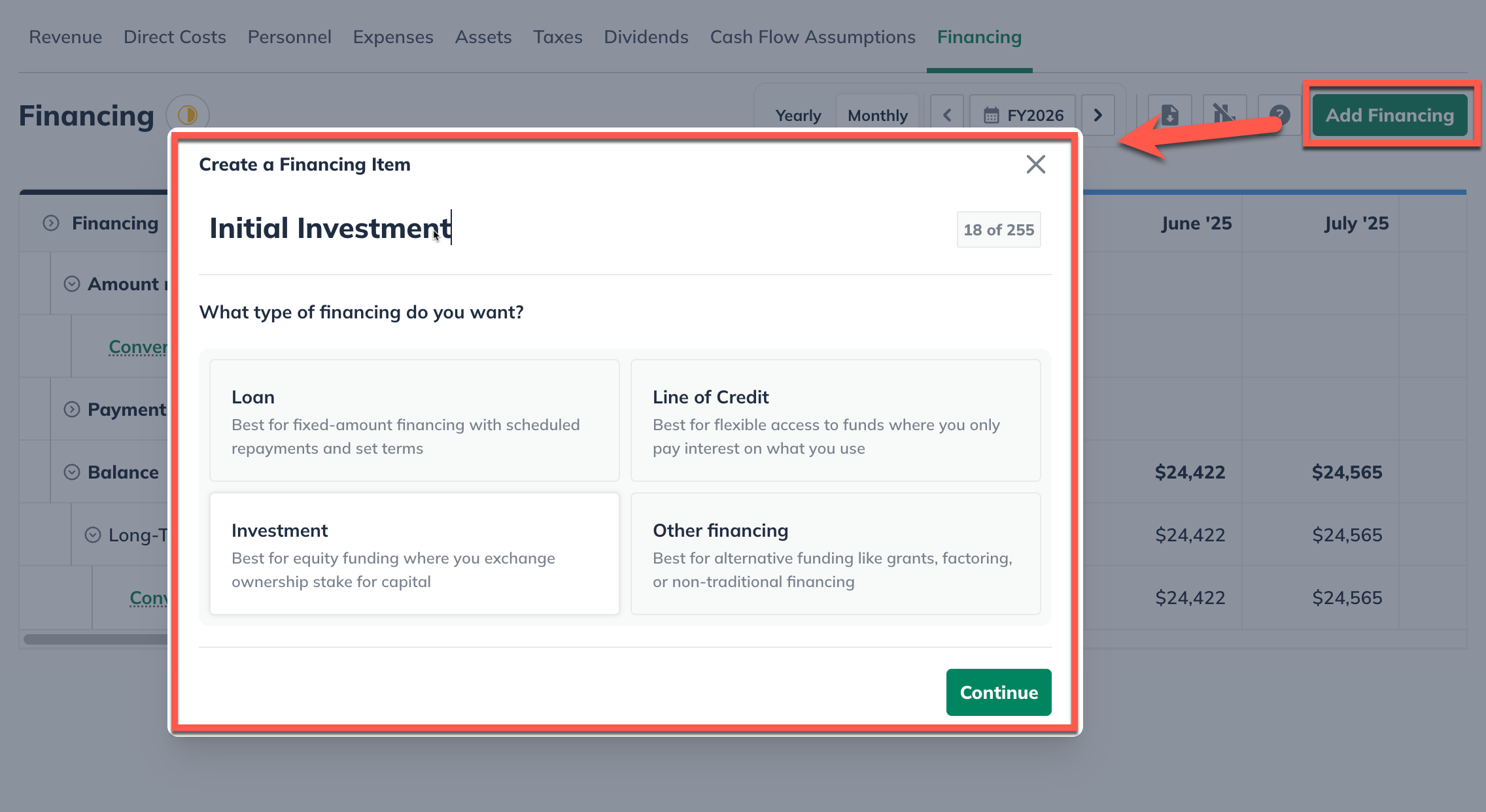

Click Add Financing and select Investment:

Enter a name for the investment.

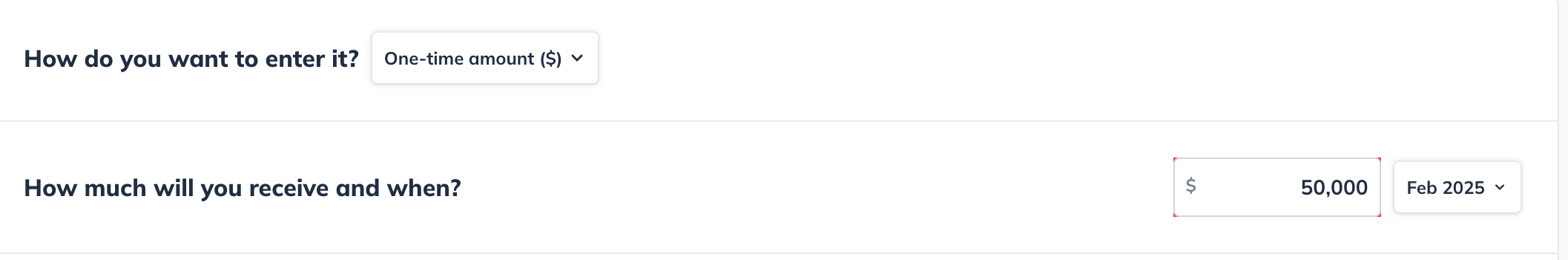

Click One-time amount. Then, enter the same amount you entered for the asset's value. Select the first month of your forecast as the start date of this entry:

Click Create & Exit:

Note: While you may not be physically putting this amount of cash into your business, the value of the existing asset you are contributing is indeed an investment. This value is represented by the two forecast entries provided.