Forecasting Revenue Expenses Direct Costs Personnel

Entering expenses

If your company is just getting started, you can include any one-time or short-term start-up expenses in the early months as you get up and running. If you need help with what to add, the LivePlan Assistant can suggest Expense entries based on your company description.

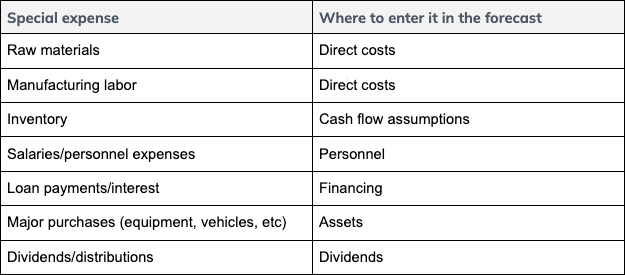

There are quite a few special expenses covered elsewhere in the forecast, so you want to avoid adding any of those to the Expenses page.

The table below indicates where to enter the most common special expenses:

(For more, see What is the difference between direct costs and expenses?)

Adding an expense

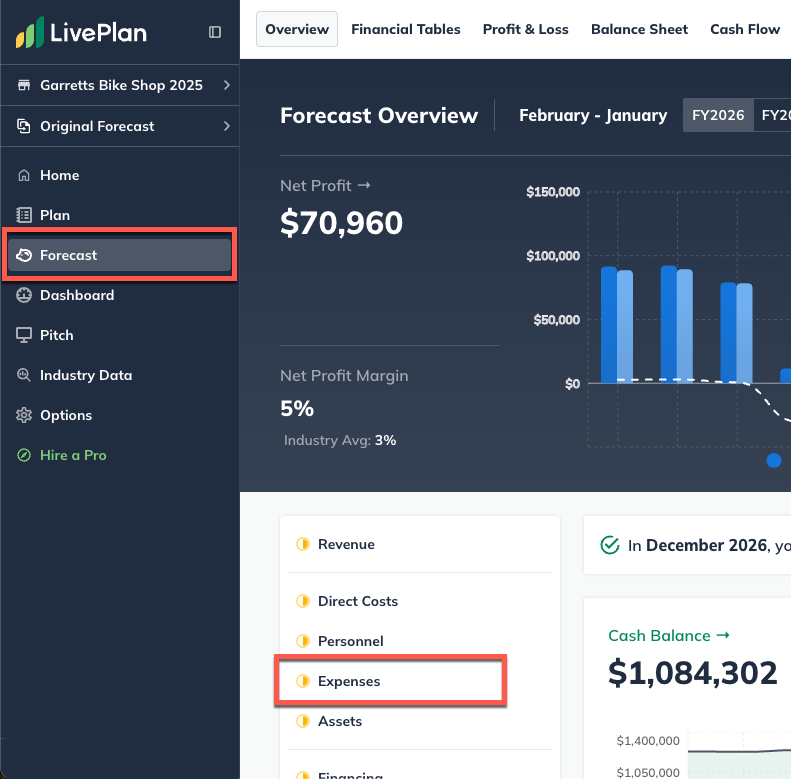

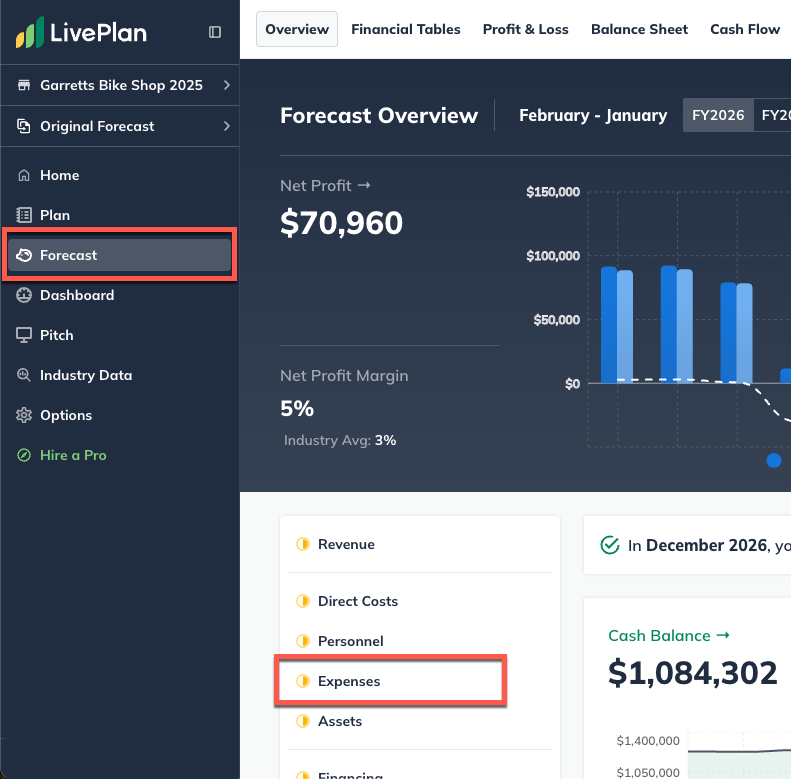

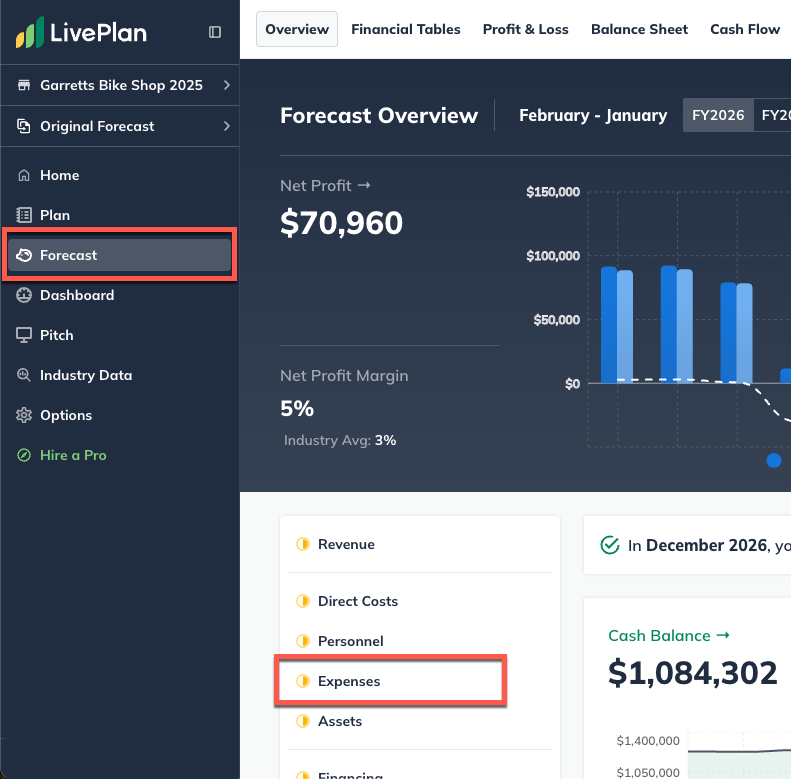

In the Forecast Overview select Expenses:

Click the Add Expense button:

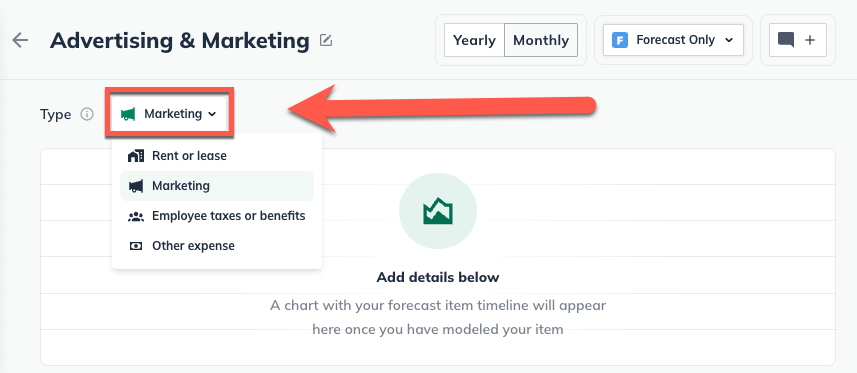

Enter a name for the expense and select the type of expense:

The expense type determines where the cost will appear on your Profit & Loss.

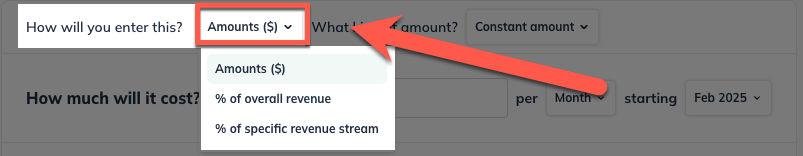

Select whether the expense will be entered as a dollar amount, as a percentage of overall revenue, or as a percentage of a specific revenue stream:

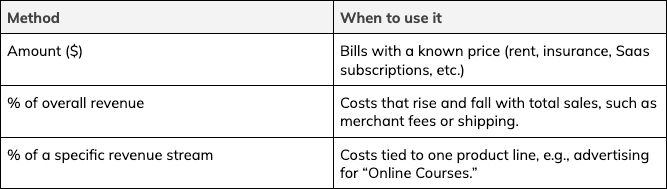

If you choose % of overall revenue, indicate the percent of your total revenue that should be allocated to this expense and show when the expense will begin. This can be either a constant percentage:

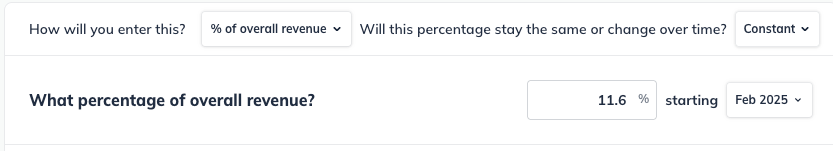

Or a varying percentage:

If you choose Percent of specific revenue stream, you will see an additional field where you select the revenue stream to which the expense is related:

Once a revenue stream has been selected, it will be displayed alongside the calculation metric.

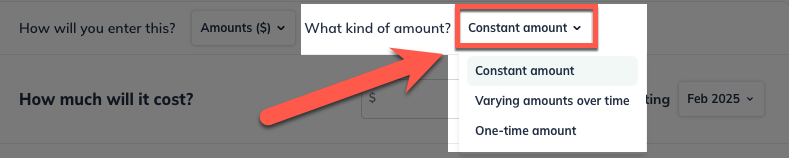

Next, choose your method for forecasting this expense. If you are forecasting a dollar amount, you will have the options for a Constant amount, Varying amounts over time, and a One-time amount entry.

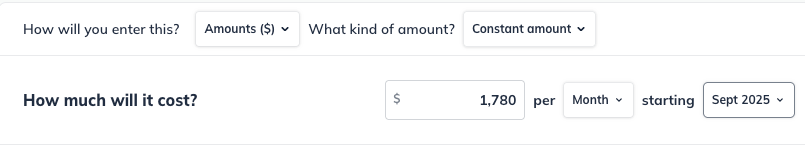

If you choose Constant, enter the amount you'll spend on this expense per month or year (either as a dollar amount, percentage of a single revenue stream, or percentage of overall revenue,) and when that expense will begin:

If you choose Varying over time, enter how much you will spend in the months in which you'll spend it:

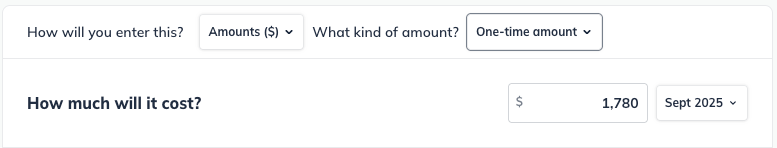

If you choose One-time amount, enter how much the expense will cost and when it will occur:

Click Create & Exit:

Editing an expense

To edit an item that you have already entered in the forecast (such as a revenue stream, expense, or asset), first navigate to the Forecast Overview. Next, click on the section that contains the entry you wish to edit.

Find the table of your entries at the bottom of the page, then click on the green title of the item you want to update.

You can edit any part of your entry. Click Save & Exit when you're done:

To discard changes, click Discard Changes:

Note: In certain tables, such as the Personnel and Financing tables, you may need to click the triangle icons to expand the lines so you can access the editable entries, as shown below:

Changing an expense to a direct cost

If you have created a line entry for an expense and need to move it to the direct cost category, you can move the line item from one page in the Forecast to another using the Change Item option.

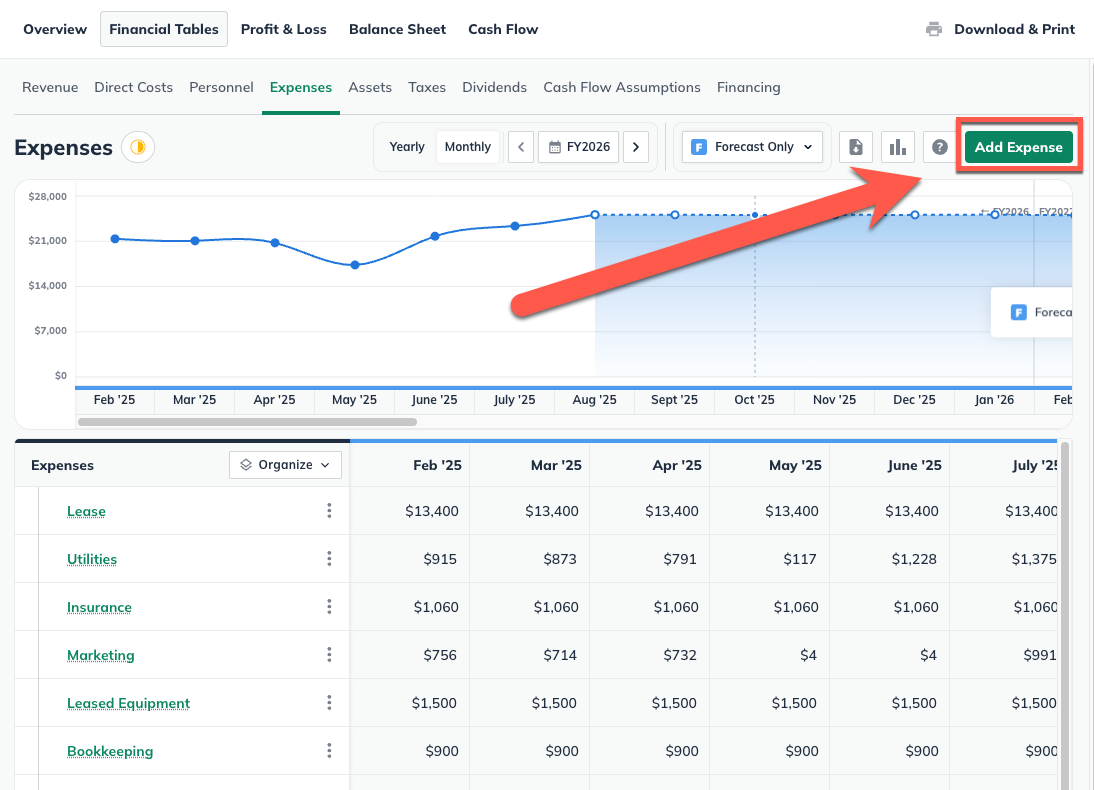

Click the Forecast tab in the left sidebar, then click Expenses:

Click the box of the line entry that you’d like to move. This brings up the actions menu above the forecast table. Select Change Item, then Confirm:

You’ll see that the line entry is now on the Direct cost page of your forecast and can be edited and adjusted there.

Deleting an expense

Forecast items can be deleted from two different places: from the forecast table or list, or from within the editor overlay when viewing a single forecast item.

In the forecast:

Click the action menu (three vertical dots) to the right of a forecast item and select Delete:

In the editor:

Located in the top-right of the forecast editor, click the trash can icon to delete an entry.

Where does this entry appear in the financial statements?

Profit & Loss Statement

Your expense entries appear in an itemized list in the Profit and Loss table as Operating Expenses:

Balance Sheet

The expenses are calculated in the Balance Sheet and Cash Flow table but not explicitly. Instead, your expenses are used to calculate your available cash, which appears in the Assets portion of the Balance Sheet:

Cash Flow Statement

In the Cash Flow, your expense entries are calculated into the lines shown below: