Forecasting Financing Taxes And Advanced Topics

Forecasting for new construction

If your new business involves the construction of a facility such as a factory, warehouse, or storefront, then the construction costs will essentially result in an asset when the project is completed.

Accounting principles allow you to consider some of these construction costs as assets. For example, you can treat your materials and equipment costs as assets. (Conversely, labor, architect fees, and licensing are usually entered as expenses.)

It's important to remember that your asset doesn't depreciate during the construction phase. However, depreciation begins once the facility is completed and you start using it. To accurately reflect this change, we suggest utilizing two asset entries.

Entry #1: Construction costs as an asset

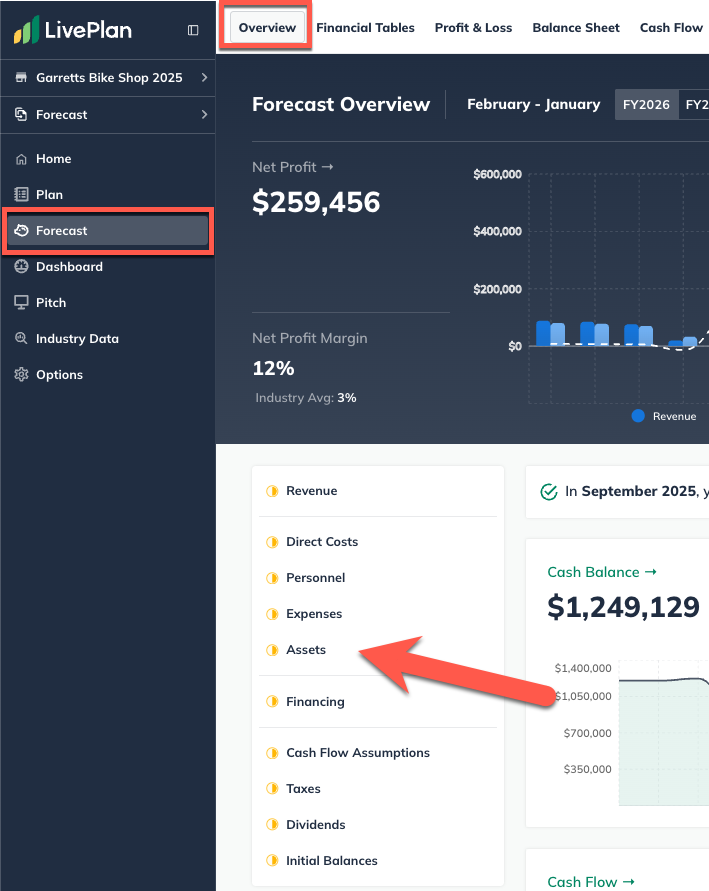

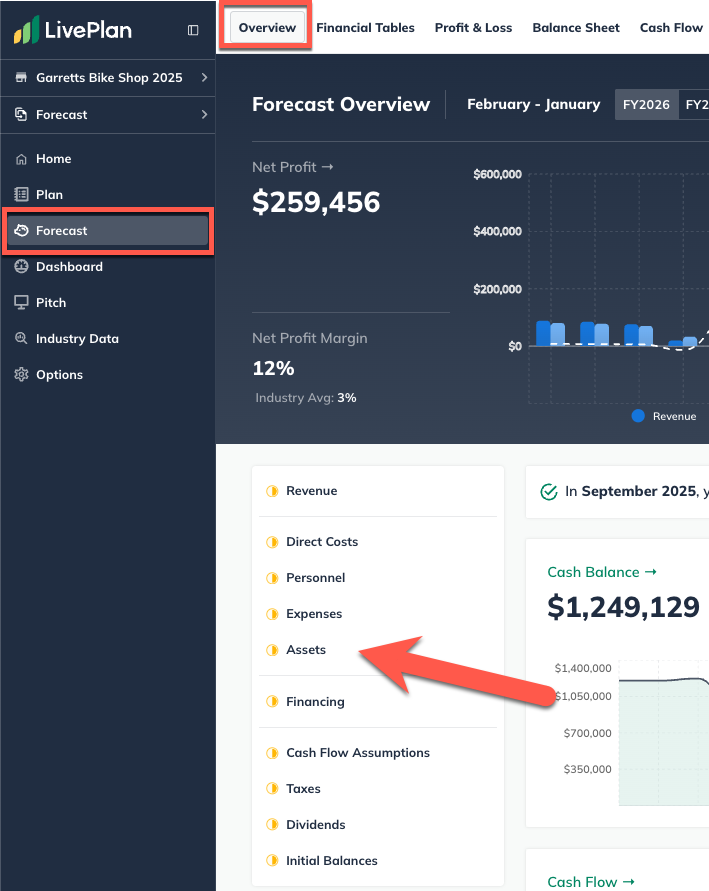

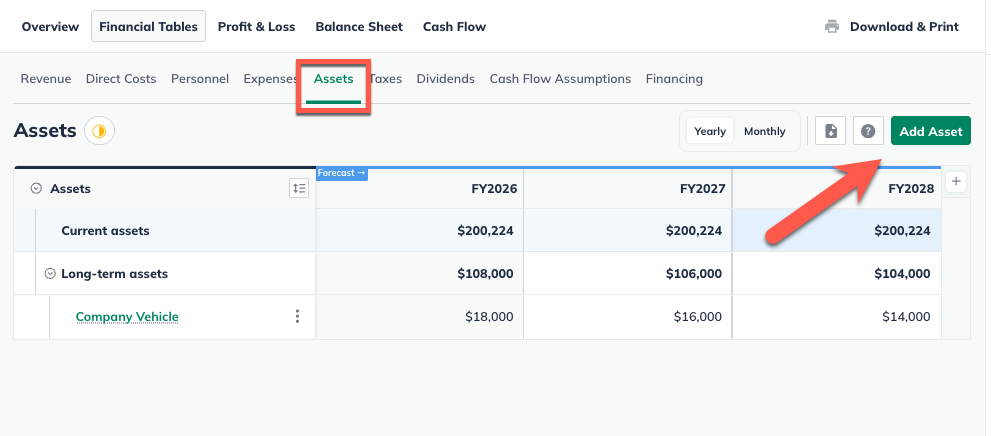

In the Forecast section, click Assets:

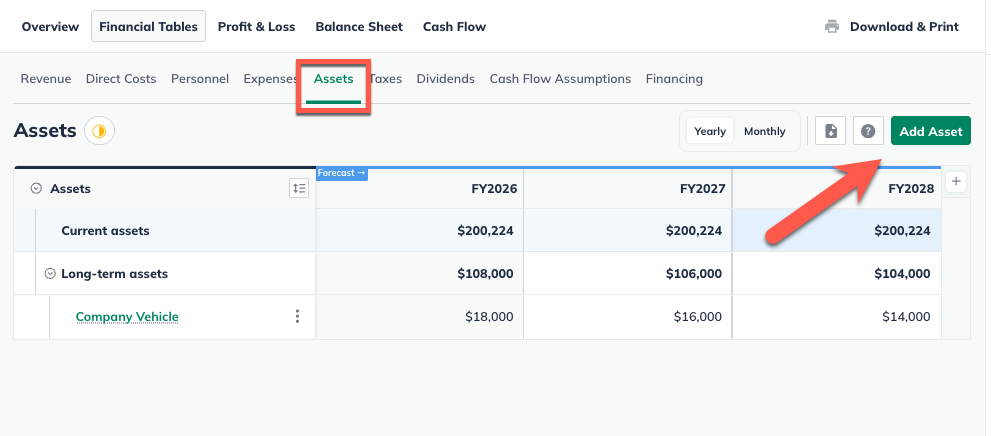

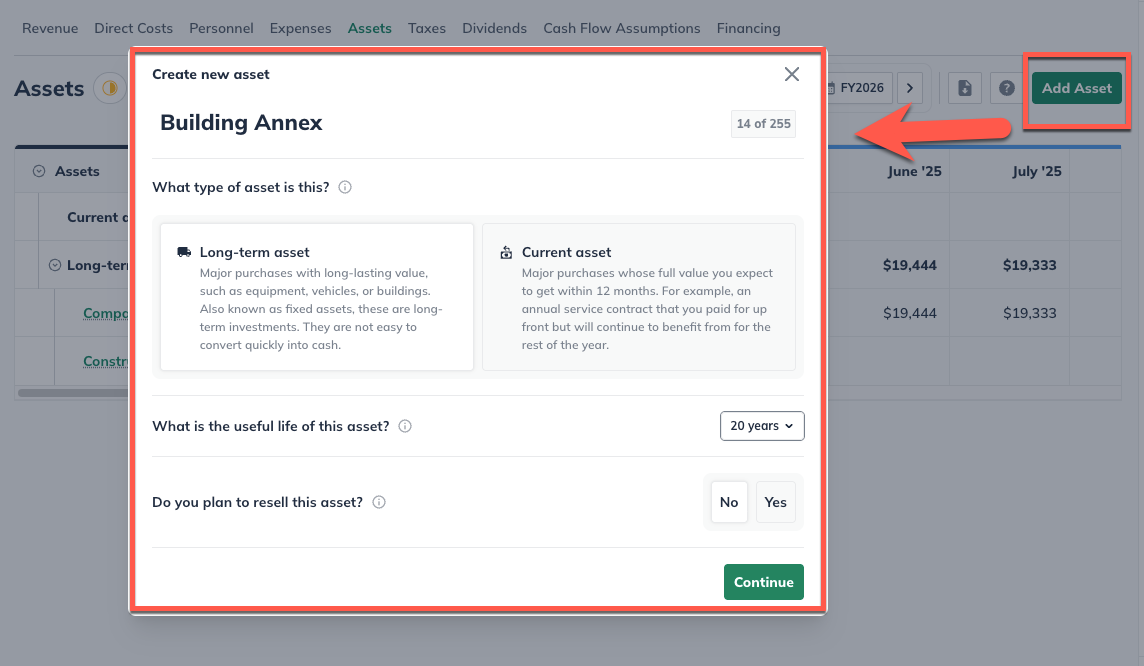

Click the Add Asset button near the top-right of the Assets table:

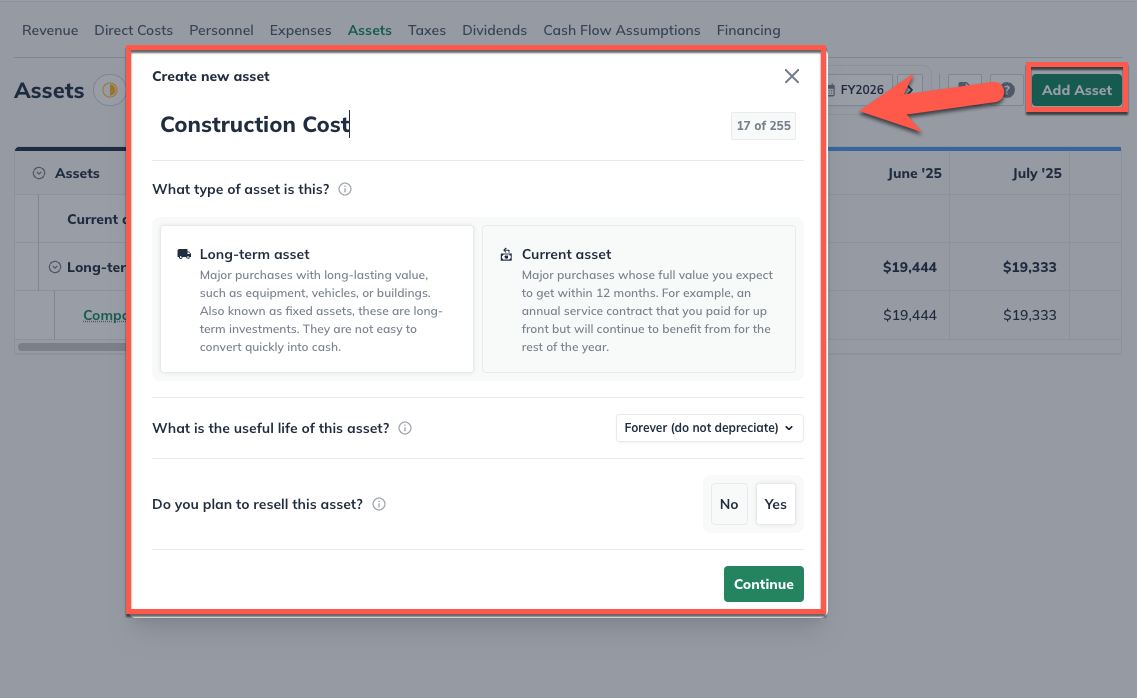

Give this asset a name reflecting your construction costs:

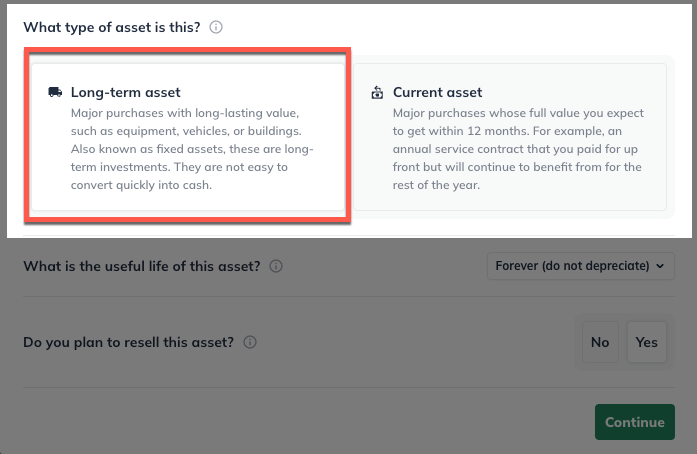

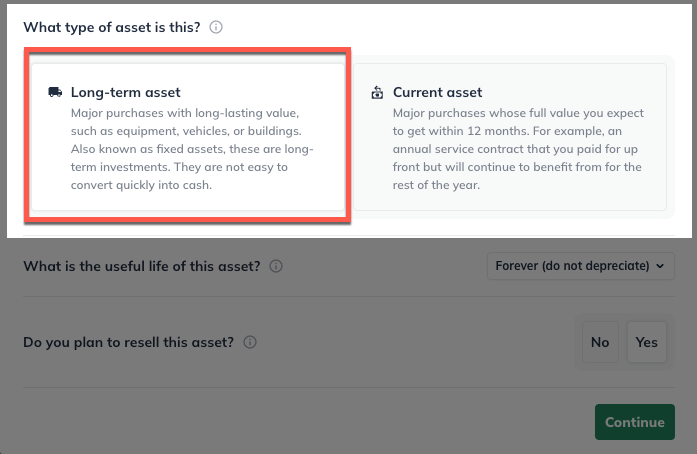

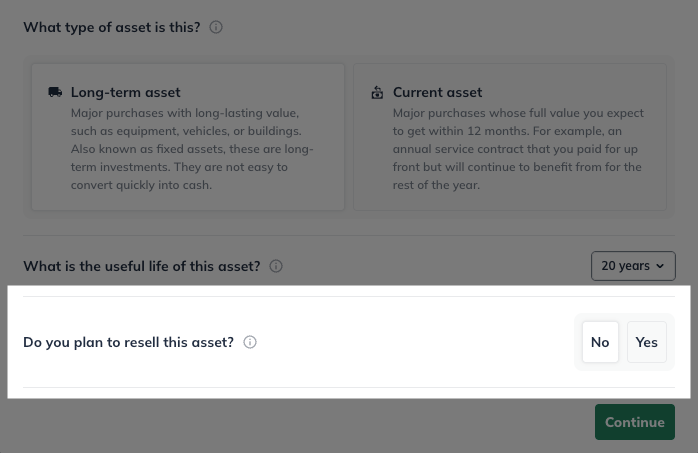

Select Long term as the type of asset:

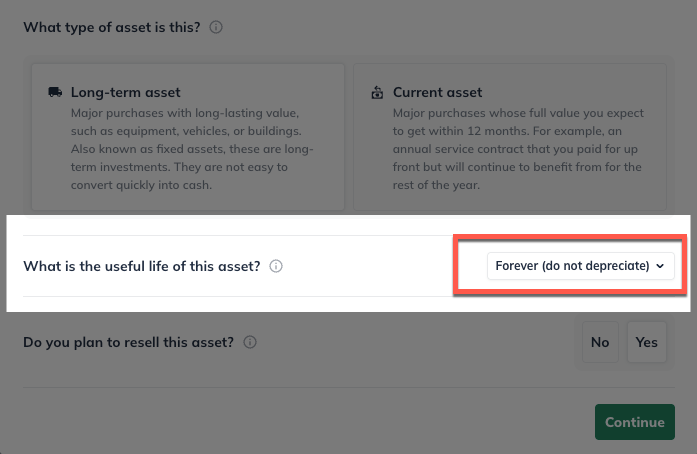

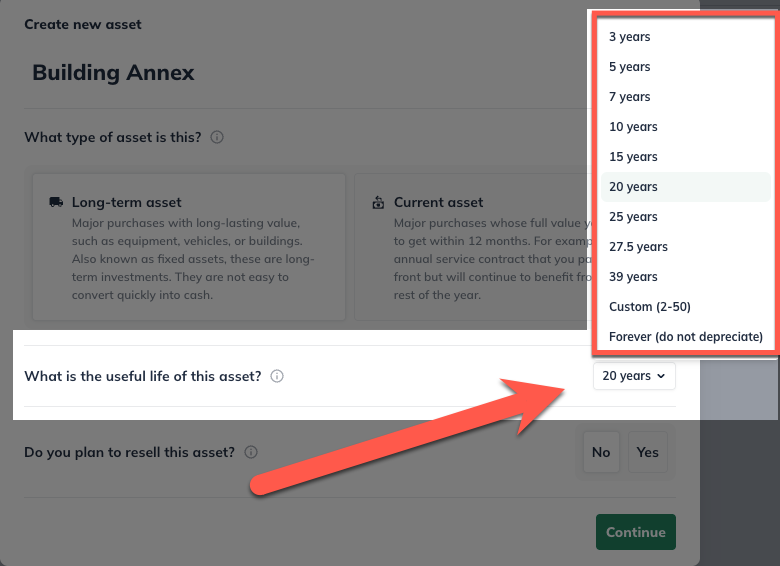

Select Forever (do not depreciate) from the pull-down menu. Then choose Yes, I plan to sell it.

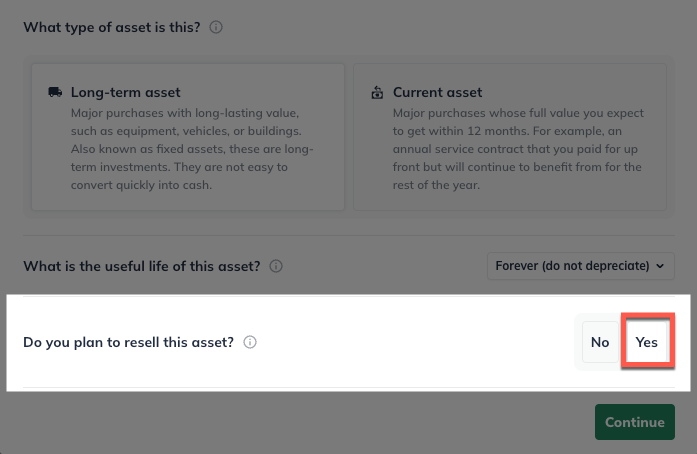

Select Yes, I plan to sell it, and click Continue:

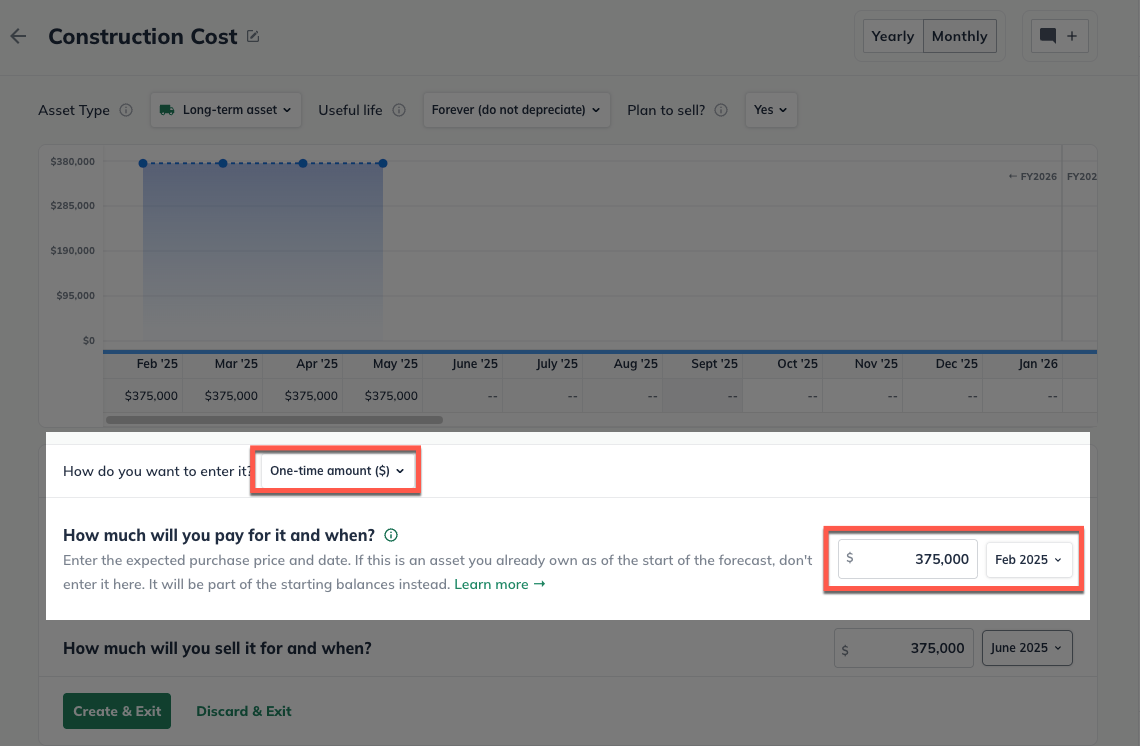

Select One-time amount. Enter the total cost you're forecasting, and choose the month construction begins. Click Type or Next to continue to the final step:

Click Create & Exit to add the asset to your forecast:

Note: This may seem odd since we aren't actually selling construction costs. But we'll represent this value again in the second asset entry, which represents the finished project.

Entry #2: Finished project as an asset

In the Forecast section, click Assets:

Click the Add Asset button near the top-right of the Assets table:

Give this asset a name reflecting the finished project.

Select Long term as the type of asset:

Choose the useful life. (For more on this, read Determining the useful life of a long-term asset.)

Indicate whether you plan to re-sell this asset in the future.

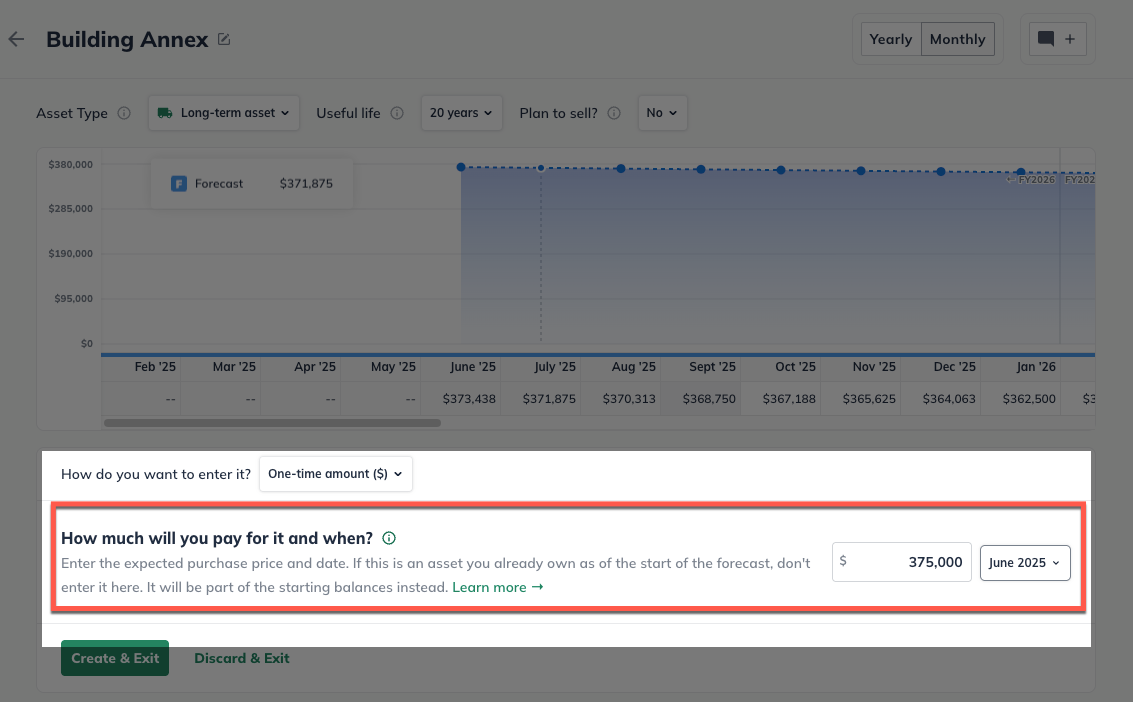

Select One-time amount. Enter the full amount of the project's value, and select the month in which the project is completed:

Click Create & Exit

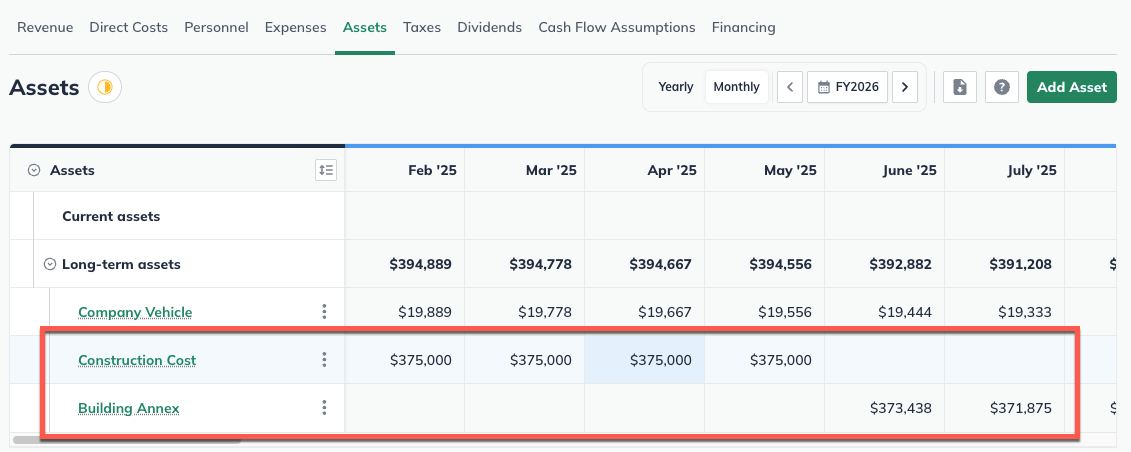

As shown in the table below, the asset value of the construction costs now carries forward without depreciation until the project is complete. Then, the finished project begins to depreciate:

Notes:

Since an Asset entry represents a large purchase, you may need a corresponding Financing entry to represent the source of the funds.

Remember that ongoing maintenance, painting refreshes, landscaping upkeep, etc., on the finished property will be considered Expenses.