Performance Tracking And Dashboard

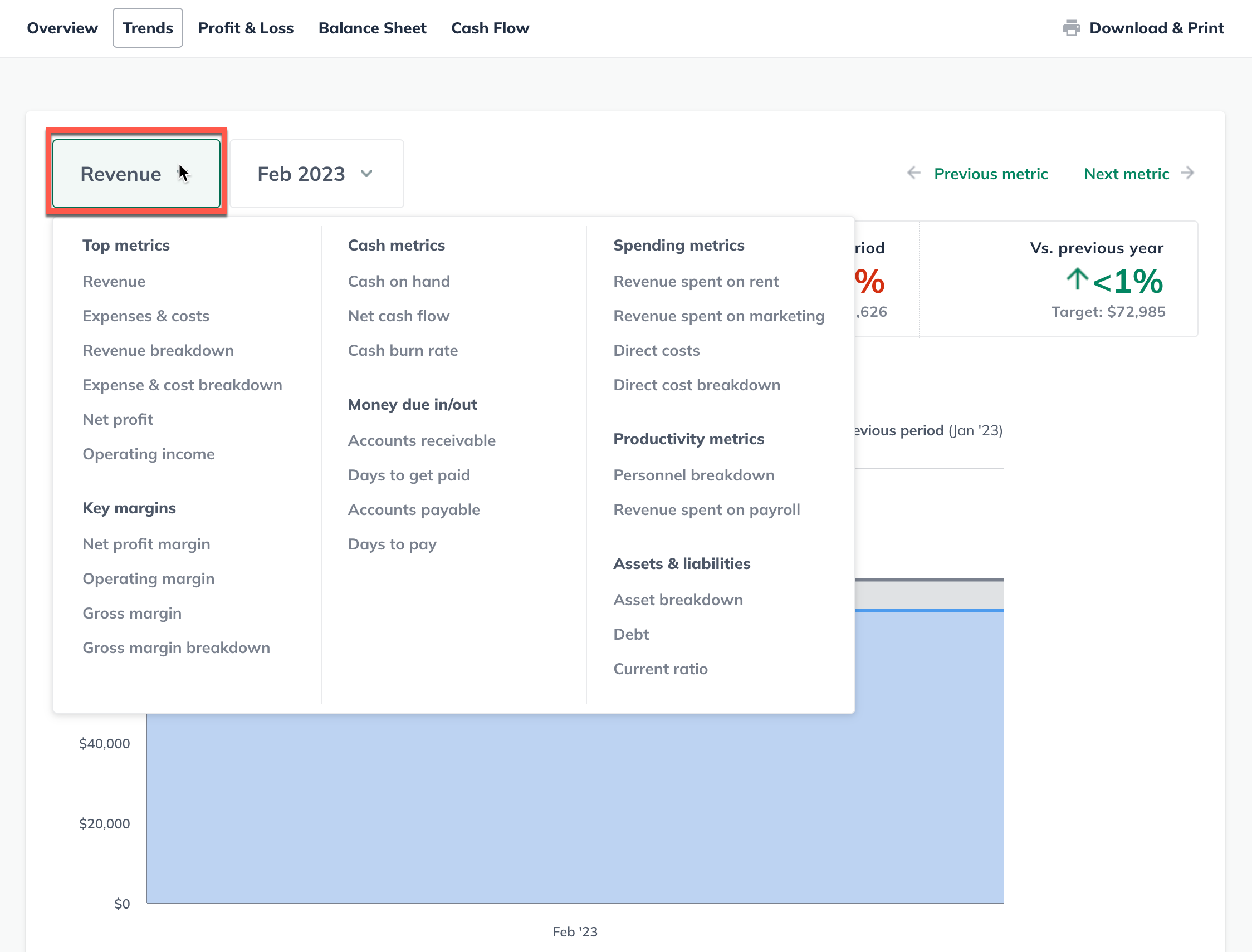

Metrics and ratios available on the LivePlan Dashboard

Top metrics Key margins Cash metrics Money due in/out Spending metrics Productivity metrics Assets & liabilities

Once you've connected LivePlan to your accounting solution and imported your actuals (or entered them directly), the Dashboard section will give you a useful set of performance metrics. This data helps you track the health of your business over time.

This feature is available to LivePlan Premium users. To learn more about LivePlan Premium, please click here.

The metrics offered in the Dashboard will focus on the financial performance of your company - financial metrics are helpful indicators for any type of business.

These Dashboard metrics may not be the only metrics you need. Every business is different, so every business will need to watch different numbers, based on the needs of its industry and market.

Here's a complete list of the metrics available on the LivePlan Dashboard, presented in the order they're displayed in the Trends menu:

Top metrics

Metric name | What this metric is | It’s good news when values are lower/higher: | How it's calculated |

Revenue | Your revenue is the “gross” amount of money your business made from all of its revenue streams (products, services, subscriptions, etc.). | Higher ↑ | This metric shows your overall revenue for the period you have selected. |

Expenses & Costs | This metric includes both your overhead expenses and your direct costs. | Lower ↓ The less you spend on expenses and costs, the more potential profit you have left over. | This metric shows overall expenses for the period you have selected (including all special expenses and direct costs). |

Revenue Breakdown | See the description for revenue (above). | Higher ↑ | This metric shows you a breakdown of your revenue, by revenue stream, for the selected period. |

Expense & Cost Breakdown | See the description for expenses & Costs above. | Lower ↓ | This metric shows your expenses and costs for the selected period, broken down by expense category. |

Net Profit | Net profit is the amount your business made for the selected period, after your expenses are paid. | Higher ↑ A higher net profit means your business is hanging on to more of its revenue. | This metric subtracts your total expenses from your revenue to determine your net profit. |

Operating Income (or EBITDA) | Operating income is the amount of money a business makes before taxes. This metric shows your overall operating income. | Higher ↑ | This is your total revenue minus operating expenses (direct costs, wages, etc.) for the selected period. |

Key margins

Metric name | What this metric is | It’s good news when values are lower/higher: | How it's calculated |

Net profit margin | This is what people mean when they talk about “the bottom line” of your business. Net profit shows how much money your business made after paying all of its expenses. | Higher ↑ A higher net profit margin means your business is hanging on to more of its revenue. | This metric subtracts your total expenses from your revenue to determine your net profit. Then, it divides the result by your revenue to produce a percentage. |

Operating margin | Operating margin indicates how profitable (or potentially profitable) your core business is. This margin tells you how much of your revenue is available after you pay all the required costs of your regular operations — but before you make accounting adjustments for taxes and the like. | Higher ↑ | This metric is calculated by subtracting your operating expenses from your total revenue, and then dividing the result by the total revenue to produce a percentage. |

Gross margin | Gross margin shows the percentage of your revenue that's eaten up by the direct costs of what you sell. | Higher ↑ Hanging on to more of your revenue is always good news. | To calculate this metric, your direct costs are subtracted from your revenue, and then divided by the revenue to produce a percentage. |

Gross margin breakdown | See the description for gross margin (above). | Higher ↑ A higher gross margin means your business is hanging on to more of its revenue. | This metric shows the breakdown of your gross margin percentages by revenue stream. |

Cash metrics

Metric name | What this metric is | It’s good news when values are lower/higher: | How it's calculated |

Cash on hand | Cash on hand is the amount of money your business has available for immediate spending. It's important to have enough cash on hand to pay the bills, payroll, and taxes, as well as to handle any unexpected expenses. | Higher ↑ More cash on hand means greater security and flexibility to make business decisions. | This metric shows your cash balance at the end of the selected period. |

Net cash flow | Net cash flow is difference between the money coming in to your business, and the money going out as bills are paid. | Higher ↑ A higher net cash flow means that you have more money coming in than going out, which is good news. | This metric shows your overall cash flow for the selected period. This is the same as what's shown on the cash flow statement. |

Cash burn rate | This metric shows you the rate at which your company is using up its cash. | Lower ↓ A lower burn rate means that you’re holding on to your cash longer. | This metric calculates the difference between the ending and starting cash balances for a period - determining how much cash has been lost (or gained). |

Money due in/out

Metric name | What this metric is | It’s good news when values are lower/higher: | How it's calculated |

Accounts receivable | Your accounts receivable balance equals the amount your customers still owe you for past purchases. (A cash-based business won't have any receivables.) | Higher ↑ A higher A/R balance means more money is coming in. | This metric shows your average accounts receivable balance at the end of the period you've selected. |

Days to get paid | If you make a cash sale today, that money is immediately available to use. But, if you agree to invoice your customer for future payment, you have to wait for that payment to come in. This metric tells you how long it takes, on average, for your customers to pay you for sales on credit or invoices. | Lower ↓ You want to get paid as soon as possible, so you have more available cash to work with. | To calculate this metric, your average accounts receivable balance is divided by your revenue in the selected period. The result is then multiplied by the length of the selected period to translate it into the equivalent number of days. |

Accounts payable | Accounts payable includes all of the bills and payments on debts that you owe to your suppliers or creditors. | Lower ↓ A lower A/P means you have fewer outstanding debts. | This metric shows your average accounts payable balance at the end of the period you've selected. |

Days to pay | Suppliers offer terms for purchases on credit, typically requiring payment within 15 days, 30 days, or longer. It’s good for you to take advantage of that time. If suppliers give you the option to hang on to your cash for now and pay your bills later, your business will be stronger for it. This metric shows how long it takes you, on average, to pay your suppliers for purchases on credit/invoice. | Higher ↑ You want to hang on to your cash for as long as you can without risking ill will or penalties from your suppliers. |

Your average accounts payable balance is divided by your direct costs in the selected period. The result is multiplied by the length of the selected period to translate it into days. |

Spending metrics

The ratio of revenue that you spend on rent, marketing, and payroll for your company can tell you a lot about the health of your business. If you import actuals from your accounting solution into the Dashboard, you'll be able to access these metrics:

Metric name | What this metric is | It’s good news when values are lower/higher: | How it's calculated |

Revenue spent on rent | It depends | This metric takes the expense you designated as rent in the forecast, divides that total by your revenue, and expresses it as a percentage. | |

Revenue spent on marketing | It depends | This metric takes the expense(s) you specified as marketing in the forecast, divides that total by revenue, and then expresses it as a percentage. | |

Direct costs | Direct costs (aka Cost of Goods Sold or COGS) are the costs required to provide a product/service. When revenue increases, direct costs increase. Think of the raw materials in a manufacturing business. The more stuff you sell, the more material you need to buy. Service businesses tend to have few or no direct costs. | Lower ↓ The less revenue you spend to create or deliver your products, the more potential profit you have left over. | This metric shows your overall direct costs for the selected period. |

Direct cost breakdown | See the description for direct costs (above). | Lower ↓ The less revenue you spend to create or deliver your products, the more potential profit you have left over. | This metric shows your direct costs in the selected period, broken down by revenue stream. |

Revenue spent on rent

This metric helps you figure out how much of your company’s revenue to spend on rent for a workspace. Aiming for a lower percentage here may make it easier for your business to absorb fluctuating costs in other areas, such as inventory and personnel. But a low percentage doesn’t always mean you’re paying lower rent. A more expensive property can still have a low rent-to-revenue ratio, if its location brings more revenue to the business. For example, a storefront in a more expensive location may bring in more customer traffic and revenue. Keep in mind that the percentage of revenue companies spend on rent varies a great deal by industry and region. So, for this benchmark, it’s best to compare your company to those in the same industry and region. A good place to do that is in the Benchmarks section of LivePlan.

Revenue spent on marketing

This metric helps you estimate how much of your company’s revenue to spend on advertising, promotions, and other marketing activities to generate sales. The ideal amount to spend on marketing depends on several factors. If you can spend less on marketing and still generate the same revenue, then that’s typically the most efficient and profitable thing to do. However, if you spend less on marketing than your competition does, you run the risk of potential customers not knowing who you are. Also, revenue spent on marketing tends to be higher for smaller businesses and startups. More established and larger businesses tend to spend less revenue on marketing. This makes sense because startups often need to spend more on marketing to survive and grow compared to larger, more established companies.

Productivity metrics

Metric name | What this metric is | It's good news when values are lower/higher: | How it's calculated |

Personnel breakdown | The personnel breakdown shows you Salaries & Wages and Employee-Related Expenses as a single, combined number and also as a segmented breakdown. | Lower ↓ | This metric combines the Salaries & Wages and Employee-Related Expenses lines from the Profit & Loss statement for the selected period. |

Revenue spent on payroll | Learn more about this metric here.

| It depends | This metric takes the total of salaries & wages plus employee-related expenses, divides that total by revenue, and expresses it as a percentage. |

Revenue spent on payroll

This productivity metric helps you estimate how much of your company’s gross income to spend on payroll. For this metric, payroll includes salaries and wages for on-staff and contract employees, plus employee-related expenses (benefits, taxes, etc.). Spending too much of your revenue on personnel can result in your business being unprofitable. On the other hand, spending too little can make it difficult to attract and keep good employees. This metric can also tell you something about a company’s efficiency. If two similar companies generate the same revenue, but one does it with 30% fewer people, the more efficient company will clearly be more profitable.

Keep in mind that this percentage may vary quite a bit by industry. So, for this benchmark, it’s best to compare your company to those in the same industry, as in the Benchmark section. Your own actuals for this metric won't appear in the Benchmarks, however, because this data isn't available to LivePlan when you connect your accounting solution.

Assets & liabilities

Metric name | What this metric is | It's good news when values are lower/higher: | How it's calculated |

Asset breakdown | With the asset breakdown, you can track assets by category to ensure they are in line with the goals set out in your forecast. | Higher ↑ | This metric shows the Total Assets line from the balance sheet. It's divided into individual asset accounts (Cash, AR, Inventory), Other Current Assets, and Long-Term Assets Less Depreciation |

Inventory on hand | This metric helps you track your inventory so you can better understand its trends and make sure you don't tie up too much of your working capital in inventory. | Higher ↑ Simply put, having inventory is better than not having it. This is true as long as you don’t have too much cash tied up in inventory. | This metric shows the ending balance of the Inventory line on the balance sheet for the selected period. |

Debt | This metric helps you track outstanding debt so you know how much you still owe, and can make sure you're paying it down as planned. | Lower ↓ | This metric shows the sum of the ending balances of short-term and long-term debt for the selected period. |

Quick ratio | Higher than 1.0 | This metric takes current assets and subtracts inventory from it, and then divides that total by current liabilities. | |

Current ratio |

| Higher than 1.0 | This metric takes current assets and divides that by current liabilities. |

Inventory on hand (days) | See description above (for inventory on hand) | Higher ↑ Simply put, having inventory is better than not having it. This is true as long as you don’t have too much cash tied up in inventory. | This metric shows the days of inventory available for the selected period. |

Quick Ratio

This metric helps you estimate your company’s ability to pay off its outstanding bills and short-term debt. In other words, it tells you whether your company has enough cash and accounts receivable to pay the debts that are due within the next 12 months.

Here are some examples of quick ratios:

A quick ratio of 1.0 indicates that a business has just enough cash available to pay off its short-term debts.

A company with a quick ratio of 2.0, on the other hand, has $2.00 of cash/liquid assets available to cover every $1.00 of current liabilities. A company in this situation has twice as much cash/liquid assets it needs to cover its short-term debt.

On the other end of the spectrum, a company with a quick ratio of .5 only has fifty cents to cover each $1.00 of its short-term debt. This ratio can spell disaster if the debts suddenly become due and payable.

Quick ratio is very similar to current ratio (below). However, the quick ratio doesn’t include inventory in the assets you could potentially use to pay off your debts - this is because inventory can be difficult to sell quickly for cash. As a result, the quick ratio is a more conservative estimate of how easily your company could pay off its short-term debts.

Current Ratio

Just like the quick ratio, the current ratio metric tells you if your company has enough cash and accounts receivable to pay debts that are due within the next 12 months.

As mentioned above, the current ratio also includes inventory as part of the liquid assets you could use to pay off short-term debt. The examples of quick ratio would be the same for the current ratio - a ratio of greater than 1.0 is the best-case scenario.

The current ratio is a less conservative estimate of how easily your company could pay its short-term debt. If your inventory is difficult to liquidate quickly, then the quick ratio may be a more usable metric.

If you're not sure what metrics to watch in your business, these articles from our learning websites may be helpful: