Forecasting Financing Taxes And Advanced Topics

Entering loans, interest, and loan payments

Loan entries are money you've received that you'll need to pay back to the lender. When you enter a loan, you'll specify your loan's interest percentage and length, and LivePlan will calculate the forecasted interest and payments automatically. The app also incorporates the correct principal and interest payments into your financial statements.

Note: Don't enter your loan payments as a separate expense. LivePlan adds them to the forecast for you.

Adding a new or future loan

Use this method for loans you'll place anytime after the start date of your forecast.

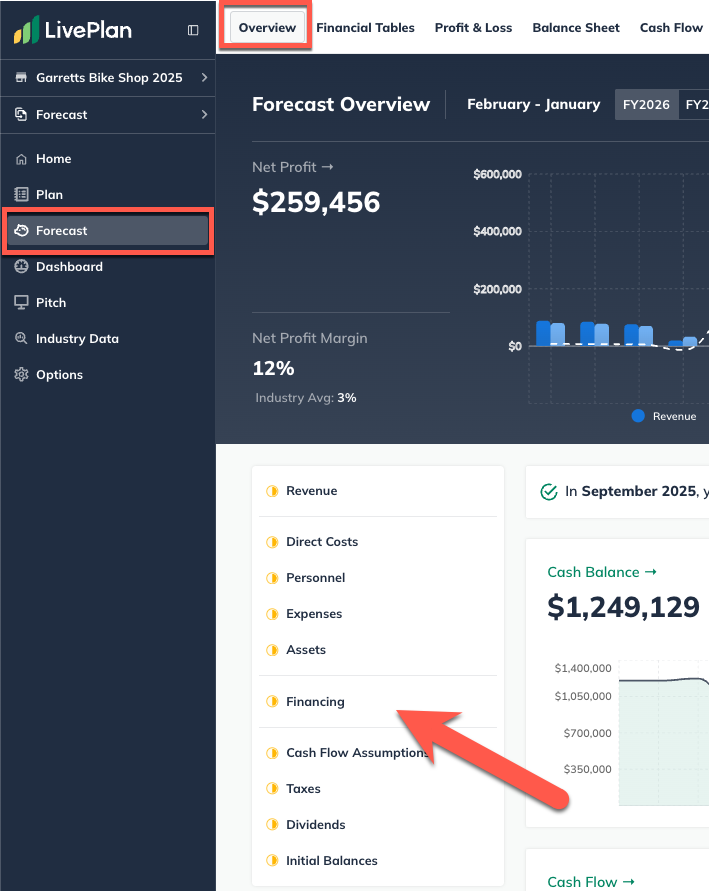

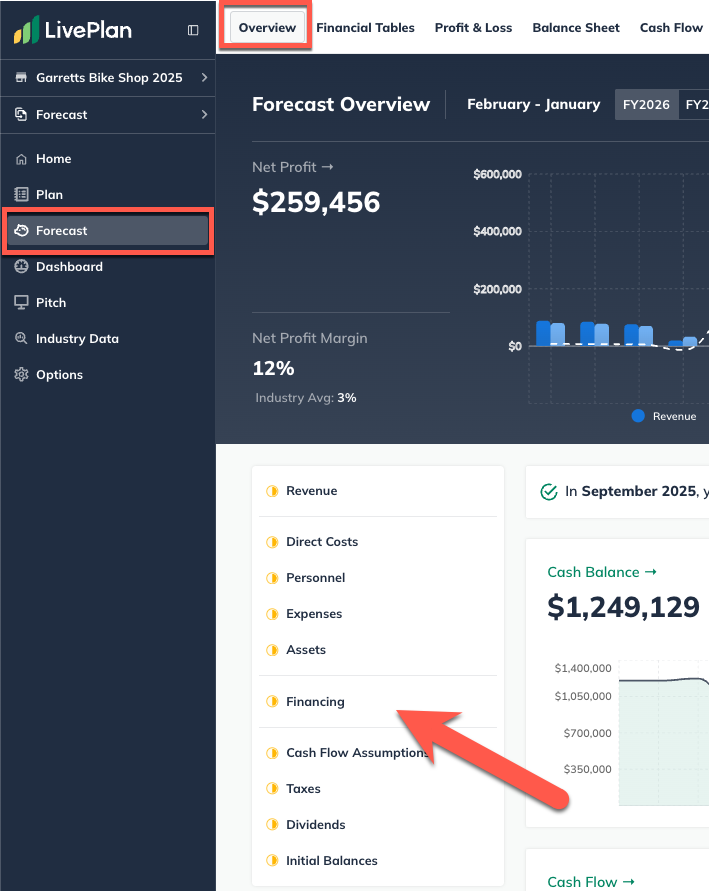

Click on the Forecast section and select Financing:

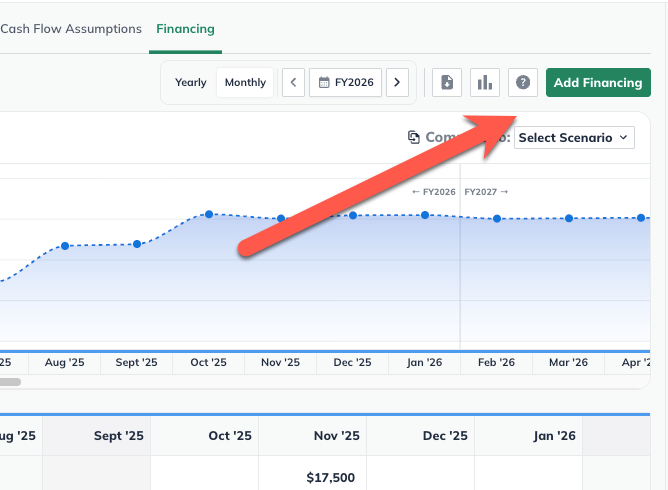

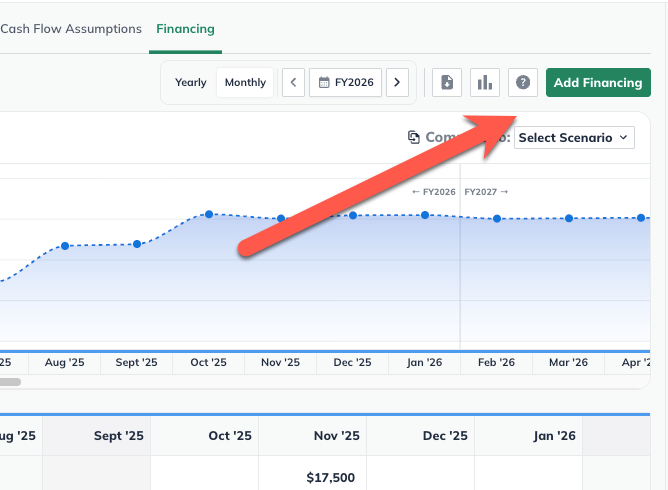

Click Add New, located below the Financing table

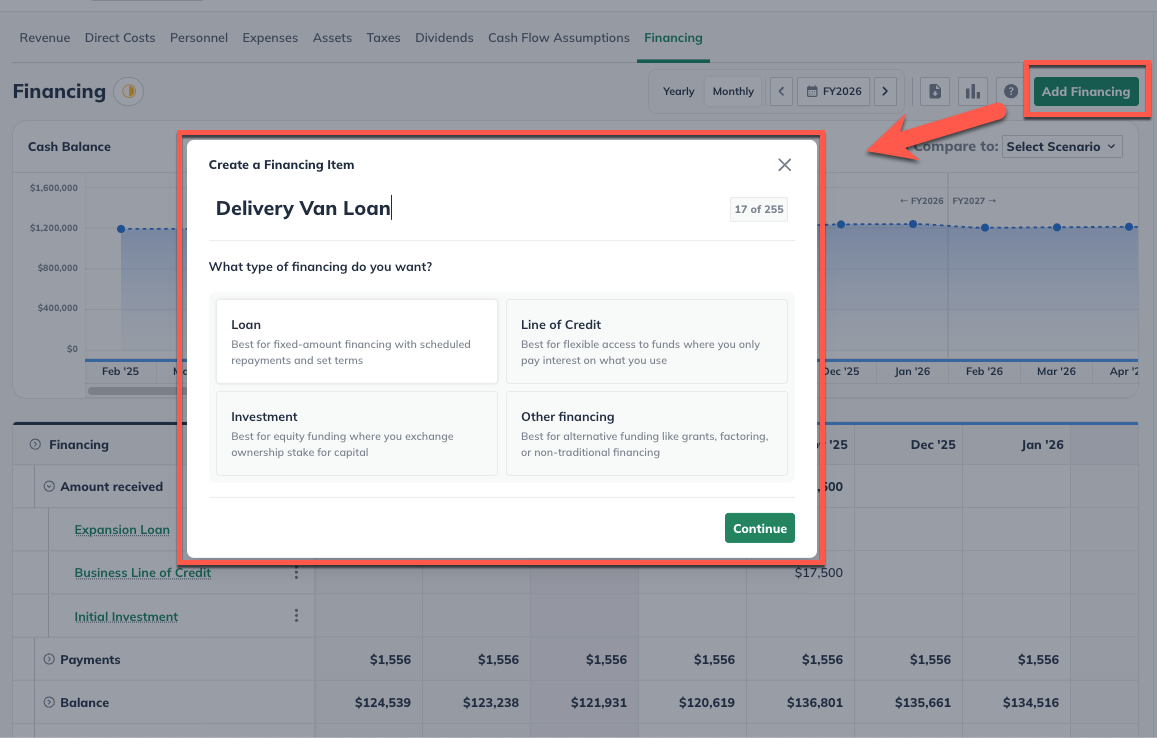

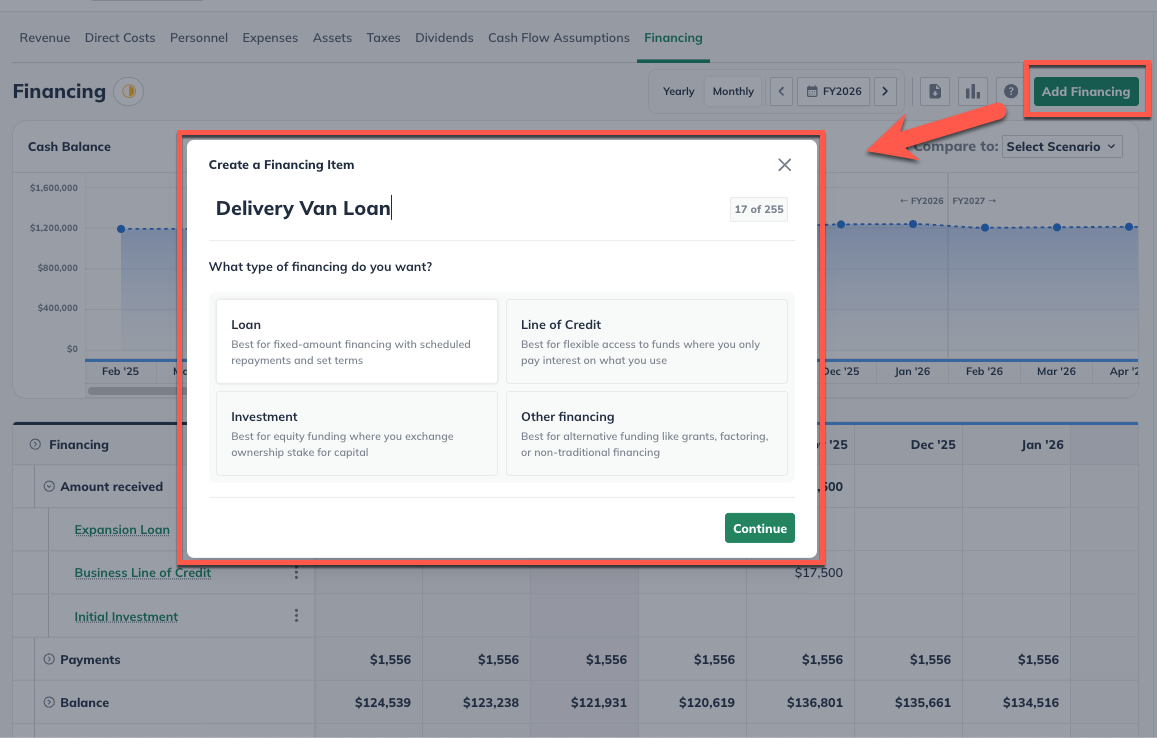

Select Loan

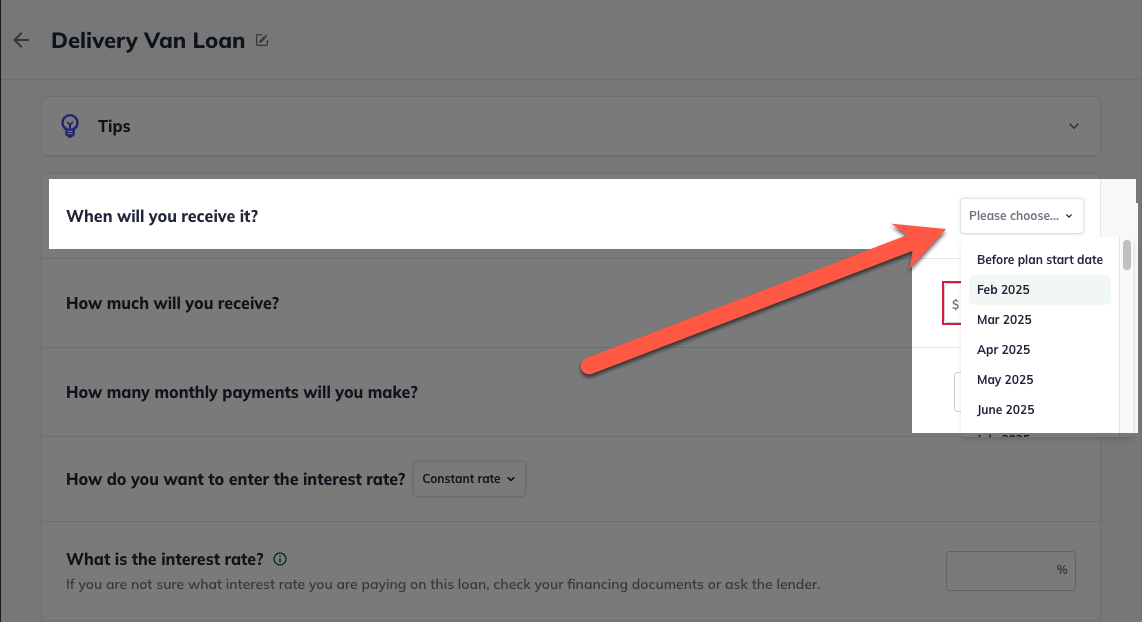

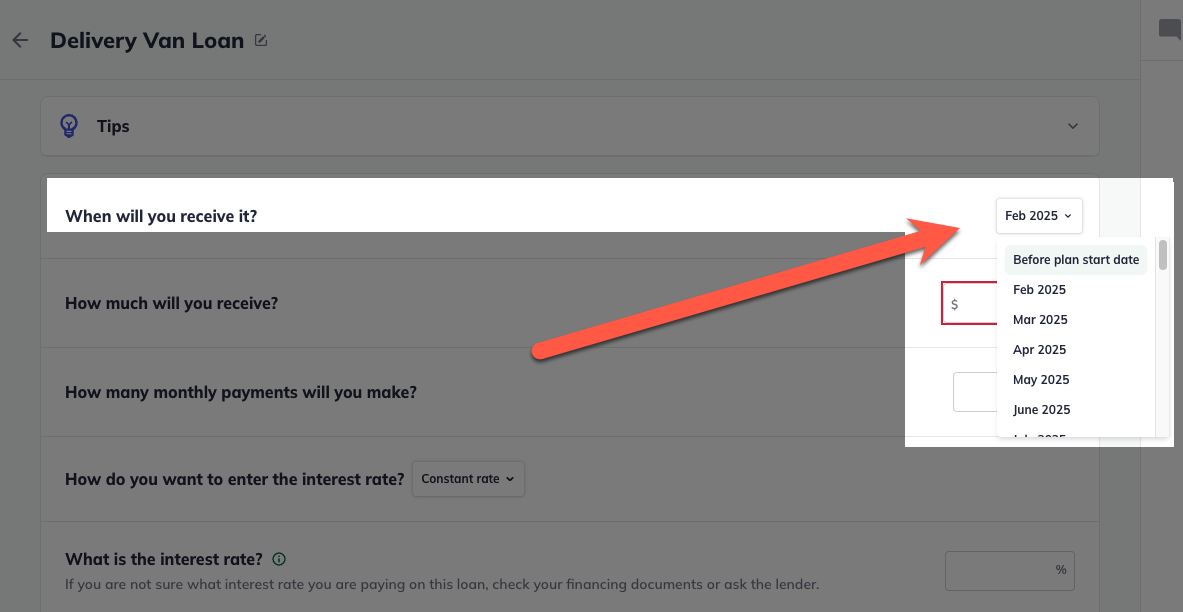

Enter a name for the loan, and select the month in which you'll receive it:

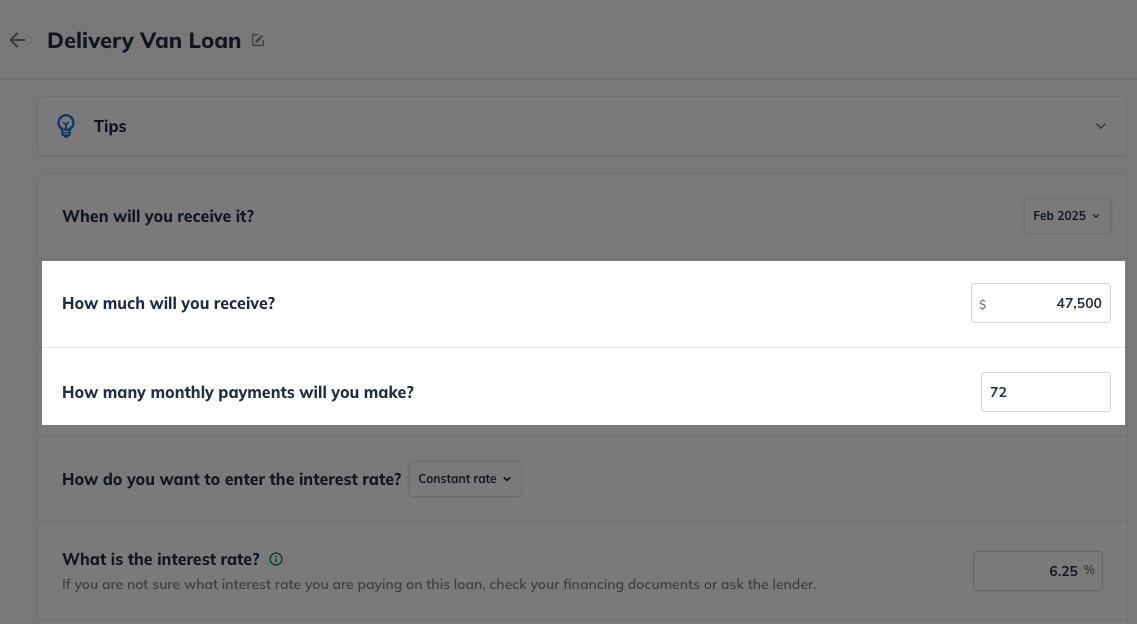

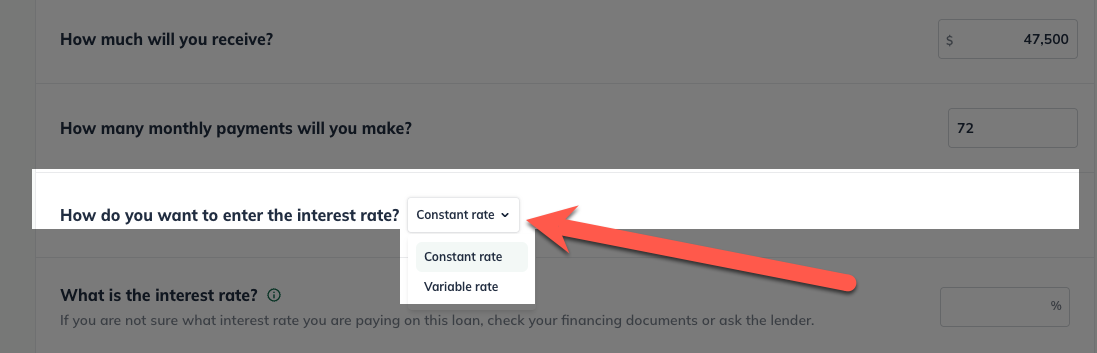

Enter the amount of the loan and the length of the loan:

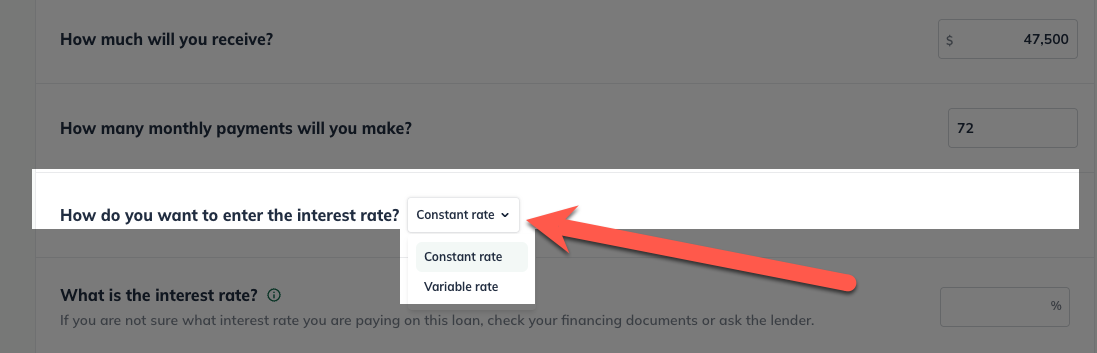

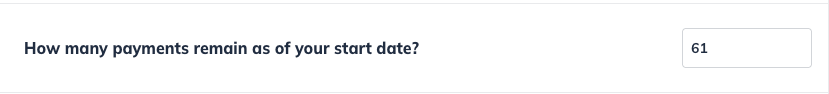

Choose either Constant rate or Variable rate under What is the interest rate:

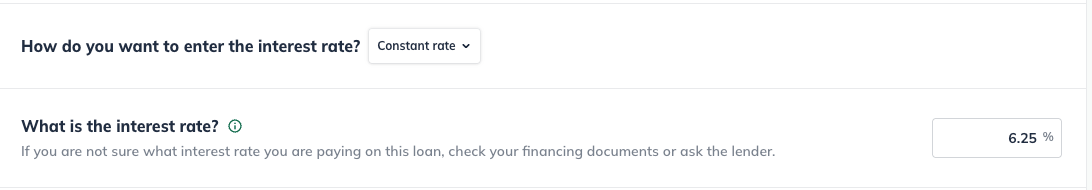

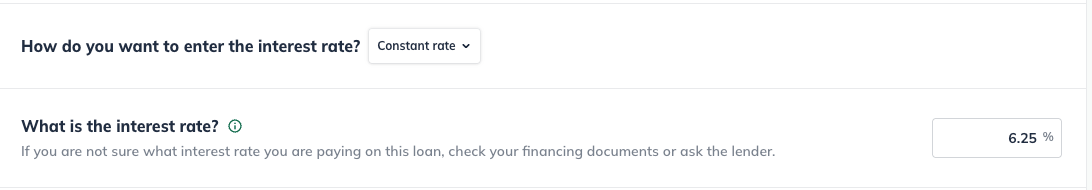

If the interest rate will remain constant throughout the forecast period, select Constant rate and enter the interest rate:

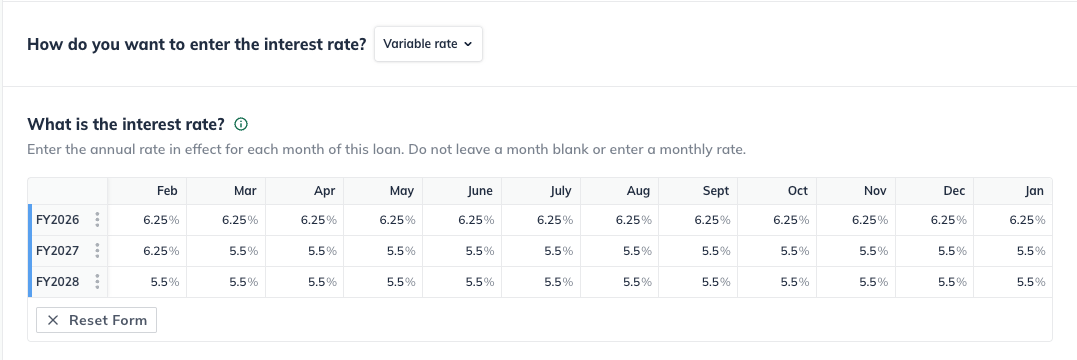

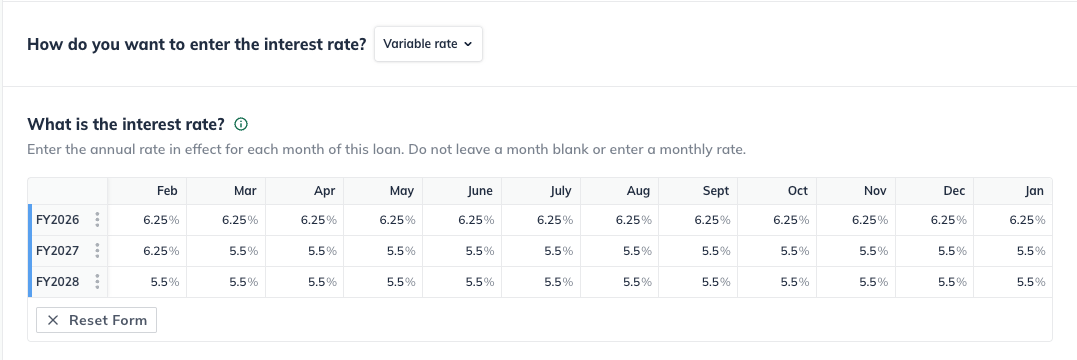

If the interest rate will vary during your forecast period, select Variable rate and plot the interest in the chart. If the interest rate changes over time, you can input different rates for each month (monthly detail) or each year (annual detail):

For more information on entering variable loan interest rates in LivePlan please see Managing variable interest rates

Click on the arrow to the left of any forecast item for an expanded breakdown of principal and interest payments.

Adding a pre-existing loan

Pre-existing loans are loans you receive before the start of your forecast. The steps for a pre-existing loan differ slightly from those for a future loan.

In the Forecast Overview click Financing:

Click the Add New button, located below the Financing table:

Select Loan:

Enter a name for the loan, and select Before plan start date under When will you receive it:

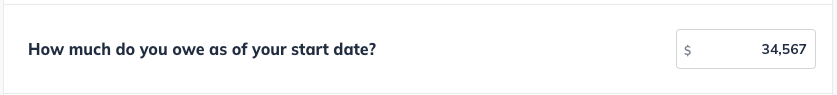

Enter the amount you still owe on this loan as of the start date of your plan and how many payments you have left to make before this loan is paid off:

Indicate how many payments you have left to make before this loan is paid off:

Choose either Constant rate or Variable rate under What is the interest rate:

If the interest rate will remain constant throughout the forecast period, select Constant rate and enter the interest rate:

If the interest rate will vary during your forecast period, select Variable rate and plot the interest in the chart. If the interest rate changes over time, you can input different rates for each month (monthly detail) or each year (annual detail):

For more information on entering variable loan interest rates in LivePlan please see Managing variable interest rates

Click Create & Exit to finalize the entry and return to the financing table.

If you own an up-and-running business, you'll need to provide your total asset, liability, and equity balances as of the start of your LivePlan forecast. Please see Entering starting balances for an existing company for more details.

If you need to represent a loan that doesn't match the standard repayment schedule, please see Entering a loan with a custom payment schedule.

Managing variable interest rates

In some cases, the interest rate on a loan can change over time due to refinancing or adjustable-rate loans. LivePlan allows you to represent these varying interest rates within your financial forecast.

Follow the steps under Adding a New or Future Loan or Adding a Pre-Existing Loan to enter the initial details of your loan.

If your forecast uses monthly detail, input the annual percentage rate (APR) for each month. Use the Apply values right button to automatically apply the interest rate from the currently selected month to all future periods in your forecast:

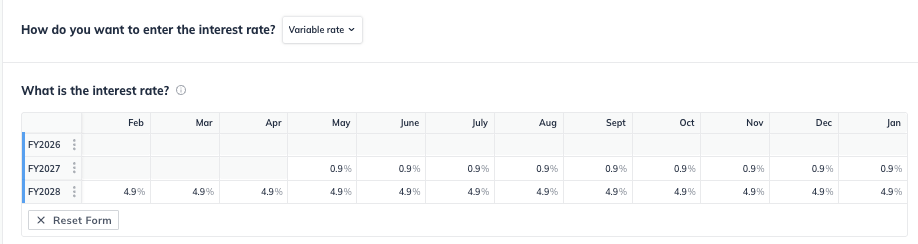

Example: In the screenshot below, the plan starts in February 2025, and the loan is received in May 2026. The initial APR of 0.9% is an introductory rate, set to apply to May 2026 through January 2027. At the start of FY2028 (February 2026), the rate changes to 4.9%.

By managing variable interest rates within LivePlan, you can create a more accurate and flexible financial forecast, reflecting the true cost of your loans over time. LivePlan automatically adjusts the interest expense and principal payments based on the interest rates entered.

Viewing the payment schedule of a loan

To expand the payment schedule of a loan, click on the triangle to the left of Financing:

This will show additional detail for all financing entries, including the principal and interest breakdowns. Click again to hide details.

Clicking on the arrow again will collapse all financing entries into the condensed view.

Adding special types of loans

Sometimes, your loan will have special terms. View more information on these loans, or click on the links below to find instructions on common types of specialty loans:

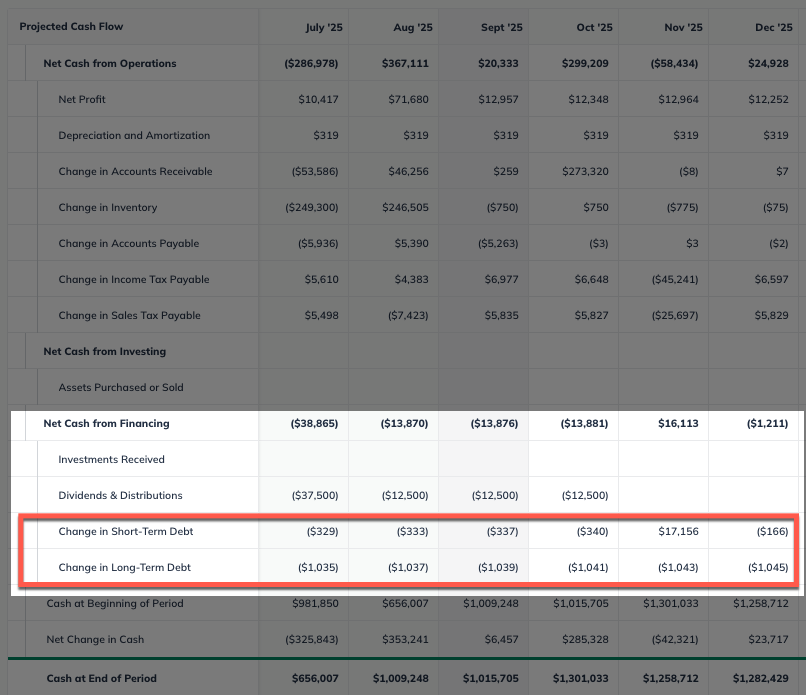

Where does this entry appear in the financial statements?

(For more details, see How LivePlan handles loans and other financing.)

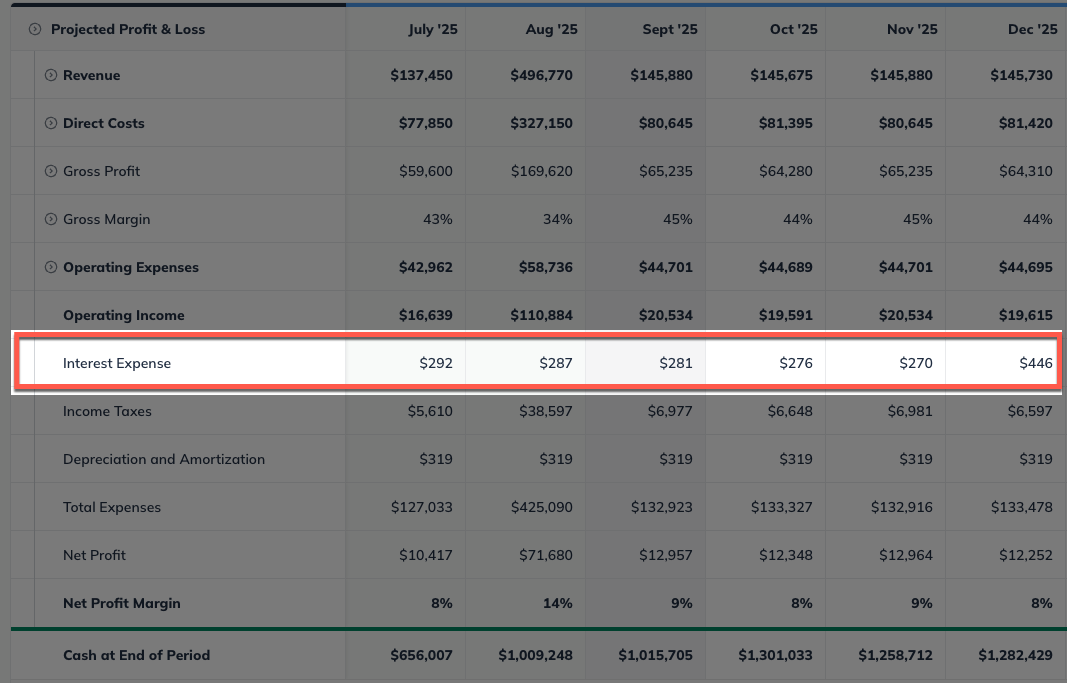

Only the interest portion will appear in your Profit and Loss table when you enter a Loan or an Other entry. This is because the interest is the only actual cost your business incurs in the loan:

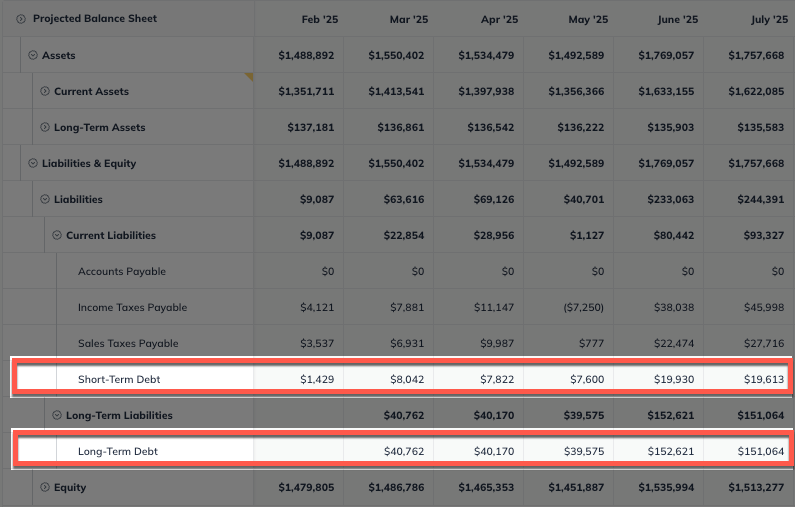

Loans will appear on one or two lines of the Balance Sheet, depending on their length. A loan that will be paid back within 12 months appears as Short-Term Debt. A loan of longer than 12 months will be divided into Short-Term Debt and Long-Term Debt. For more on this, read What is the difference between short-term debt and long-term debt?

In the Cash Flow, similarly, loans (or portions of loans) may be considered Short-Term Debt or Long-Term Debt: