Forecasting Financing Taxes And Advanced Topics

Entering loans with custom terms

Custom loan terms allow for the precise modeling of financial obligations as they truly exist, rather than forcing a fit into a standard mold. This feature ensures financial forecasts are accurate and reflect a business's unique financial arrangements. LivePlan will still calculate the interest automatically if needed, but you can flexibly enter the loan's timing and payments.

Entering a loan with interest-only payments

An interest‑only loan is a financing arrangement in which the borrower pays just the periodic interest that accrues on the outstanding balance for a defined window, leaving the principal untouched until a later “amortizing” phase (or an end‑of‑term balloon). These loans appear in many settings: developers often secure them during construction so cash can flow into building costs before a property starts generating rent; SaaS start‑ups use them as short‑term “bridge” capital while they ramp revenue; vineyards and other seasonal producers rely on them to keep working‑capital needs low until harvest; and equipment lenders sometimes pair interest‑only draws with future step‑up payments that match an asset’s earning curve. In every case, the hallmark is a flat principal balance throughout the interest‑only period—each month’s payment equals nothing more than that month’s interest charge.

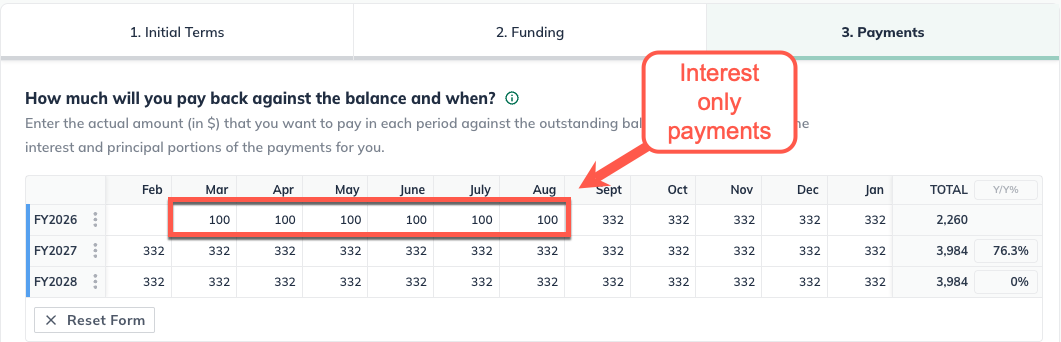

LivePlan models this behavior accurately, but one detail to check: the payment you enter for each interest‑only month must exactly match the interest LivePlan calculates on the current balance. If you enter even a dollar more, the extra is treated as principal reduction; a dollar less is flagged as under‑payment, and the unpaid amount capitalizes. Practically, that means converting the annual rate to a monthly decimal (e.g., 12 % ÷ 12 = 1 %), multiplying by the principal, and typing that figure into the Payment grid for every interest‑only month. When done correctly, your Financing table will show a perfectly level principal line, your Profit & Loss will record the interest expense each month, and cash‑flow statements will mirror the real‑world outlay—giving you a clean forecast until the amortizing payments kick in.

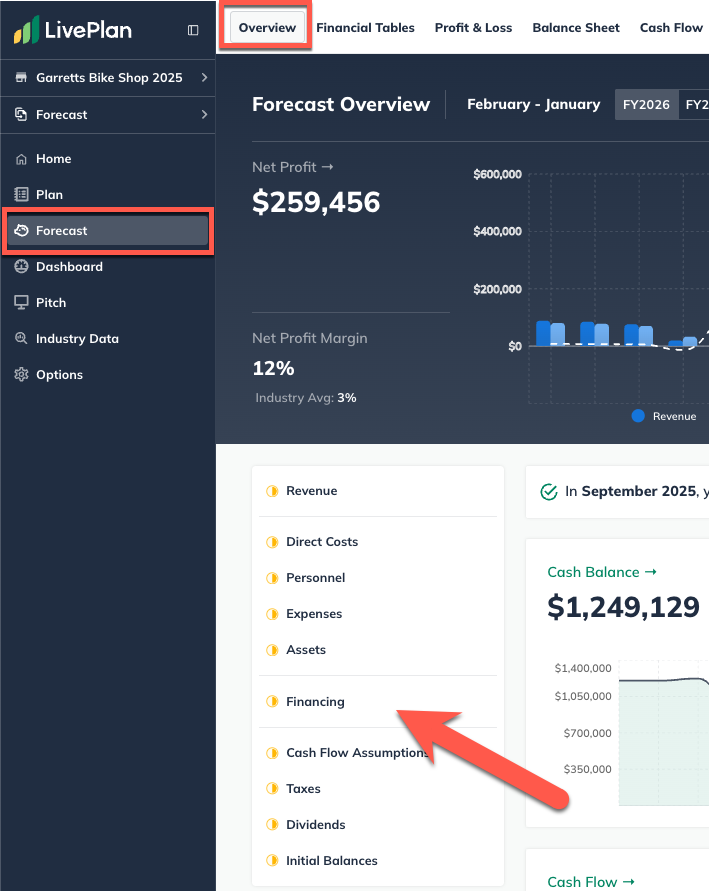

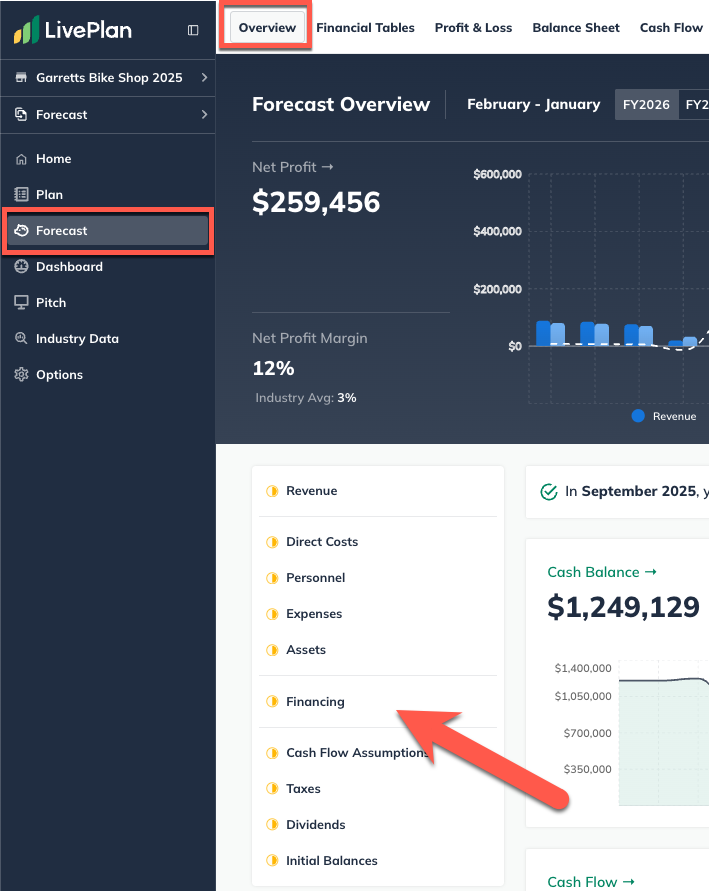

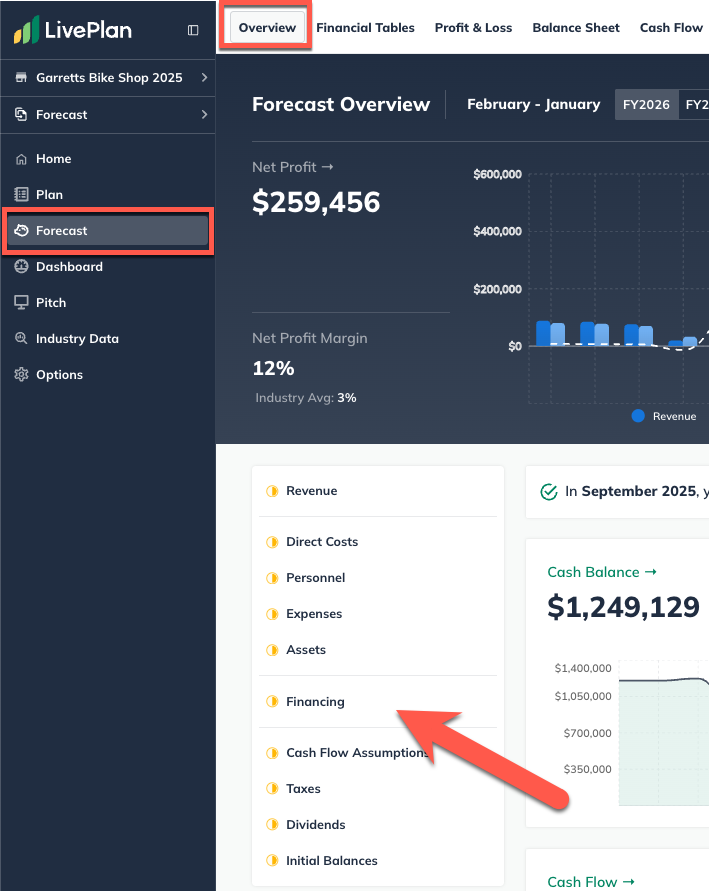

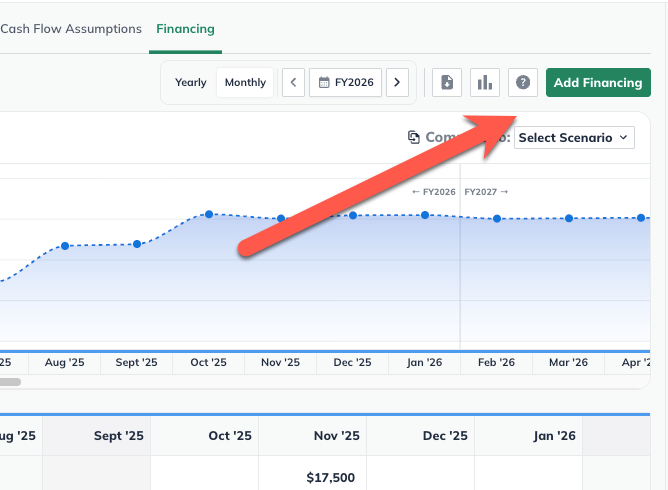

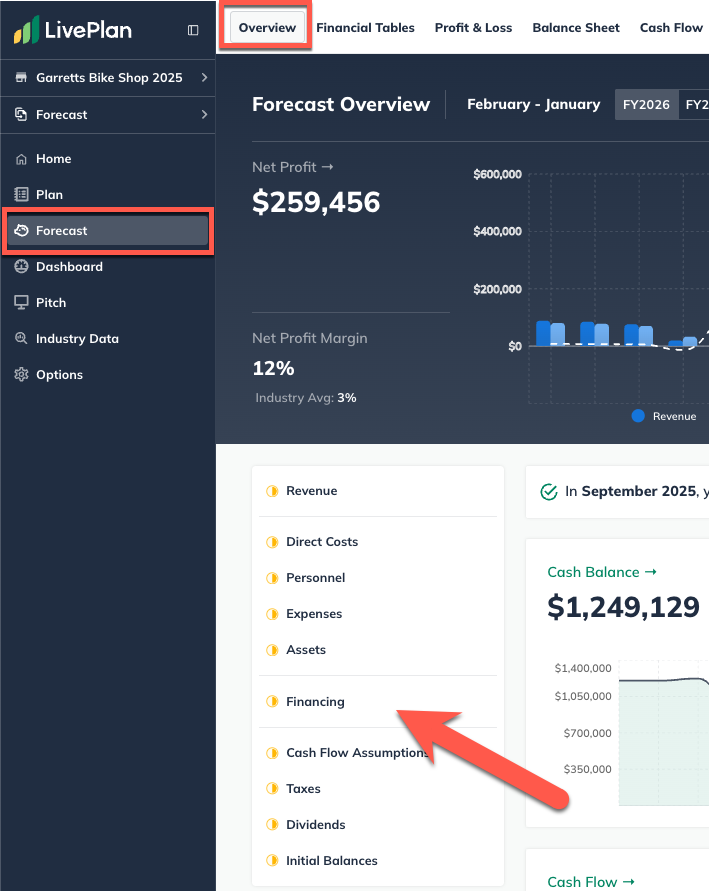

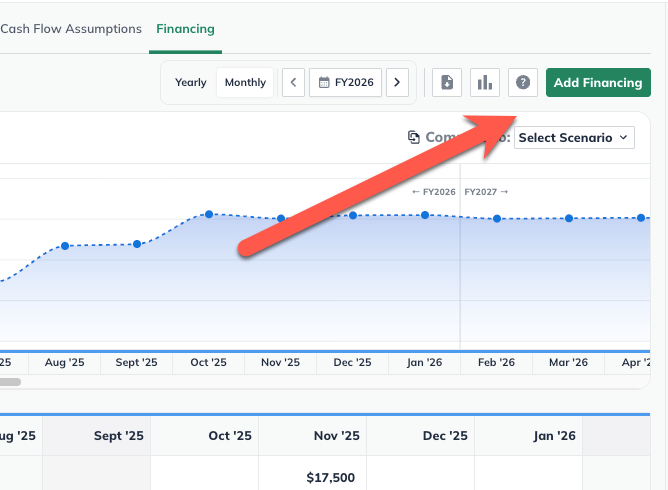

In the Forecast section, click Financing:

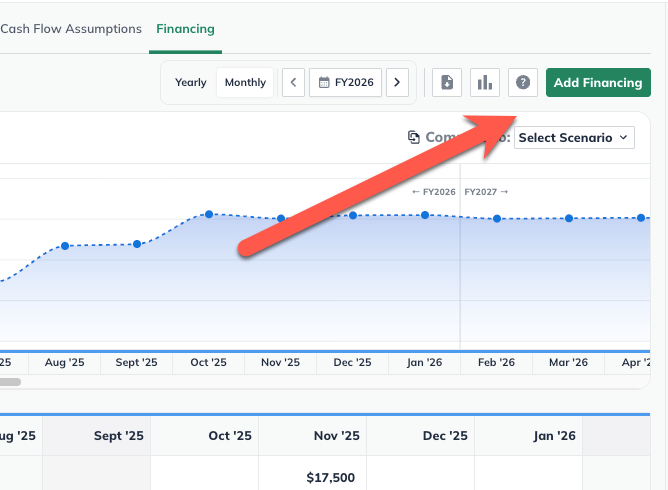

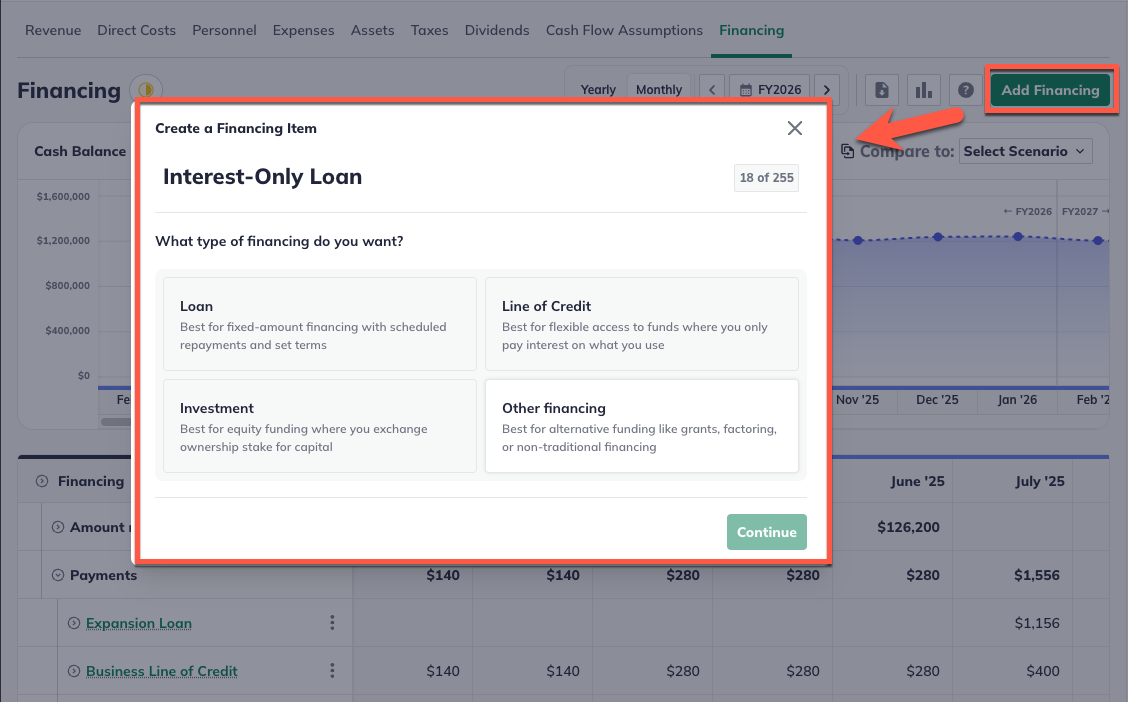

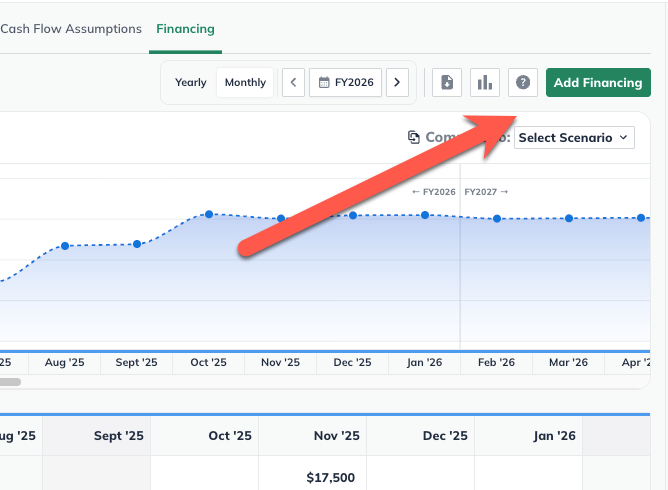

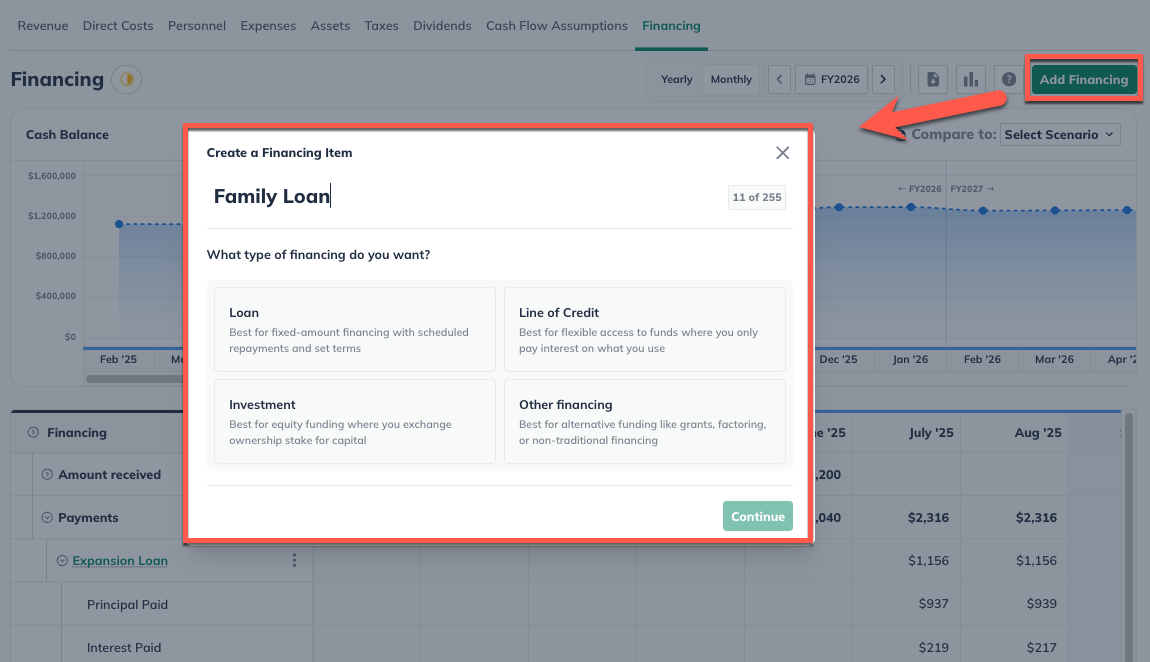

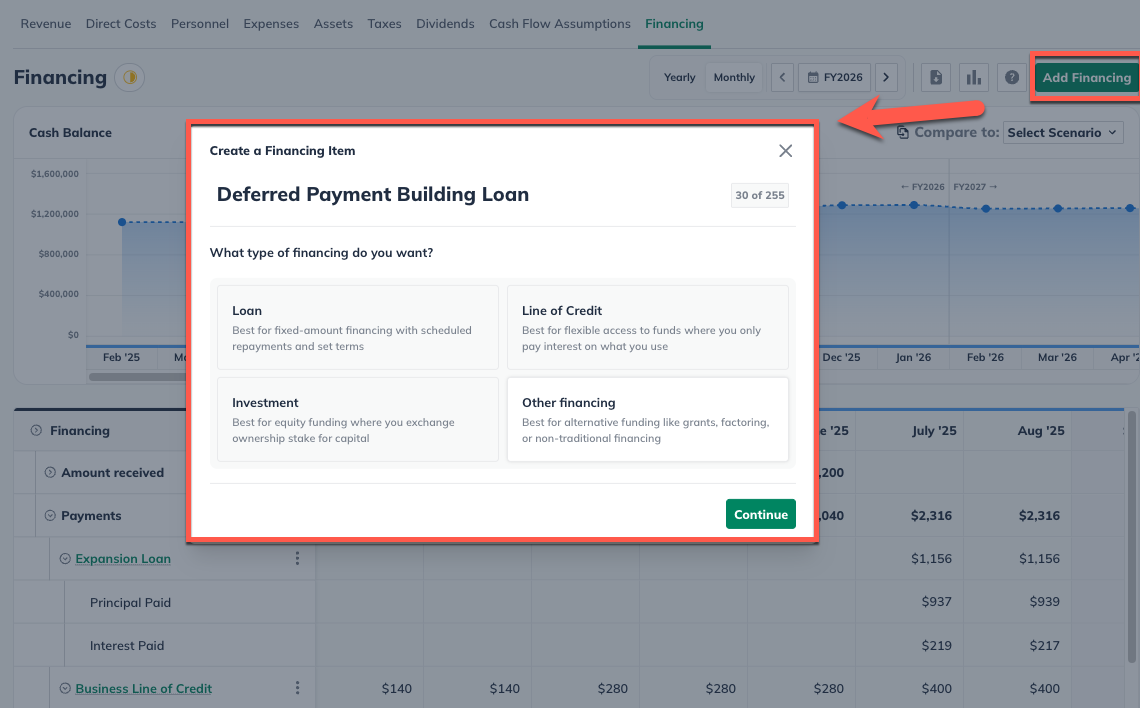

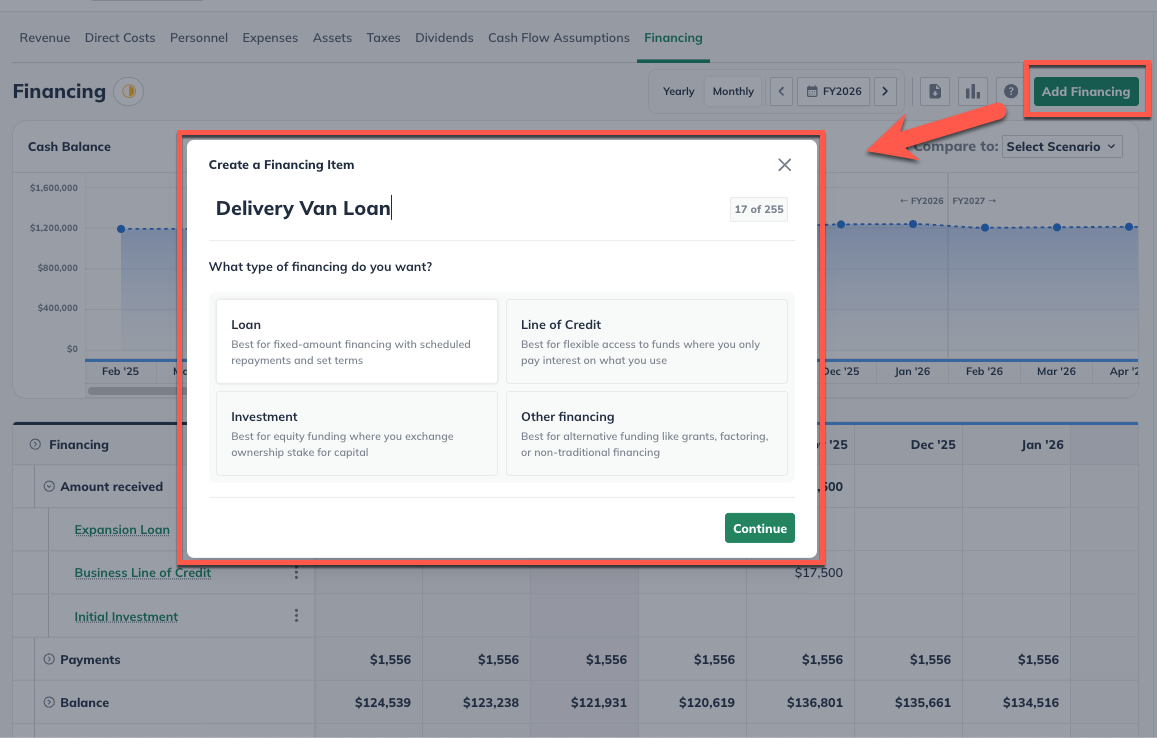

On the Financing page, click the Add New button and select Other:

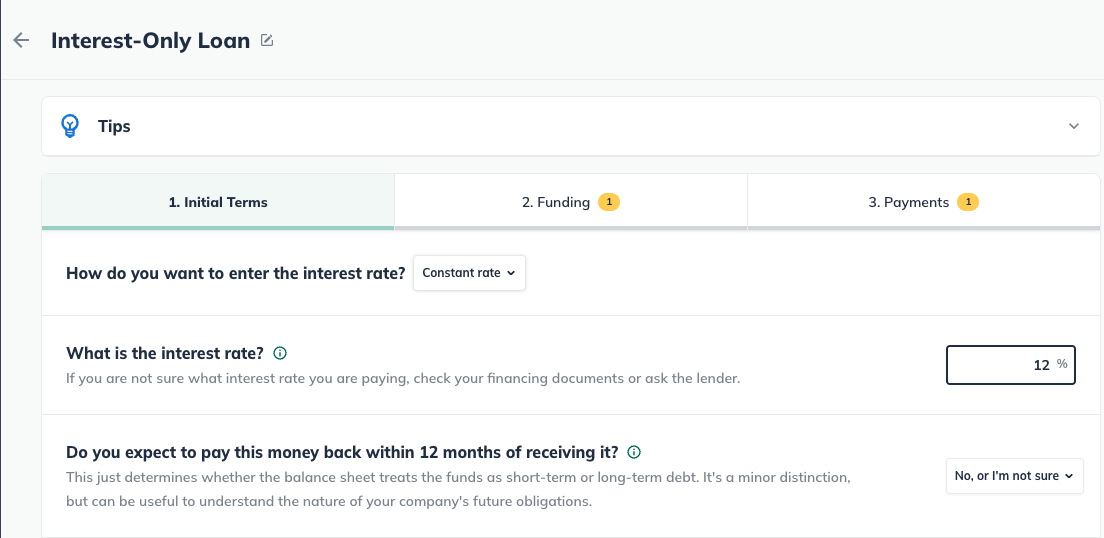

Give this segment of the loan a name and enter the interest rate, then select whether you will pay the loan back within 12 months or not. Since our example is a 36-month loan, we've selected "No" here:

Note: a loan you'll pay back within 12 months is considered short-term debt in your financial statements. Long-term debt is considered a loan you'll pay back in more than 12 months.

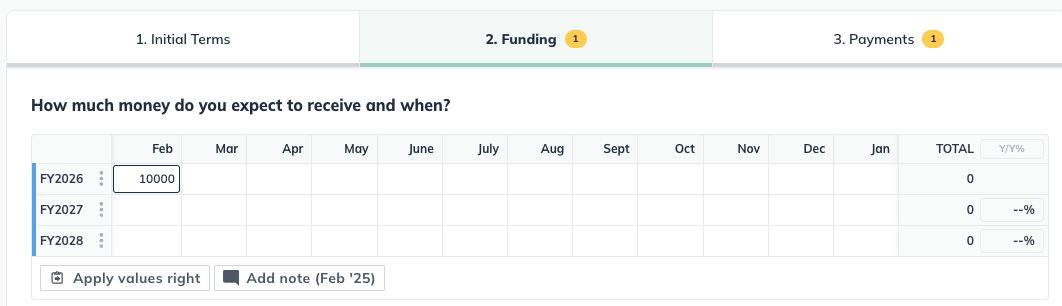

Next, enter the full amount you will receive in the month you'll receive it:

Finally, enter the payments you'll make in the months you'll make them. The example below shows interest-only payments in the first six months and the interest-plus-principal payments in the remaining months:

Note: remember that interest payments typically begin the month after receiving the funds.

Click Create & Exit:

Checking your work

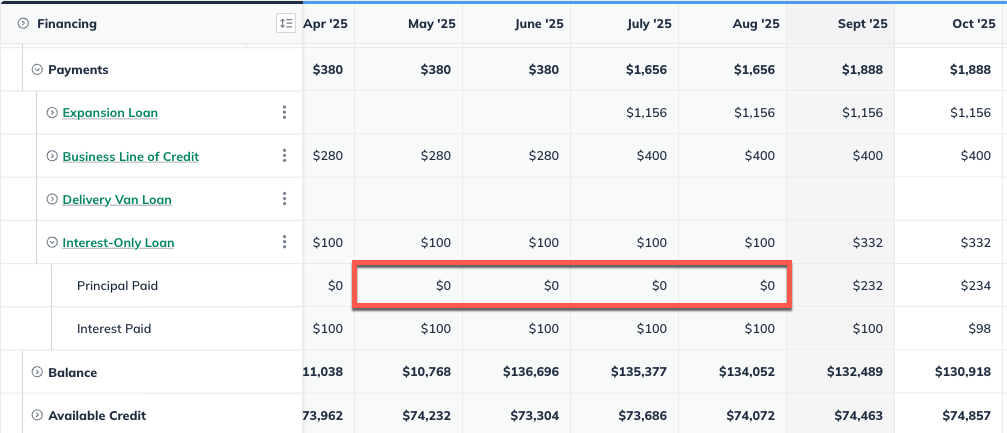

The Financing table shows that the interest payment of $100 is fully paid for each month while interest-only payments are made. However, the principal of the loan is unaffected until the payments increase to start paying down the principal as well.

Note: notice the balance of the loan is unchanged until the payments increase in August to start paying down the principal along with monthly interest.

Entering a loan with a custom disbursement or payment schedule

In the Forecast Overview, click Financing:

Click the Add New button and select Other:

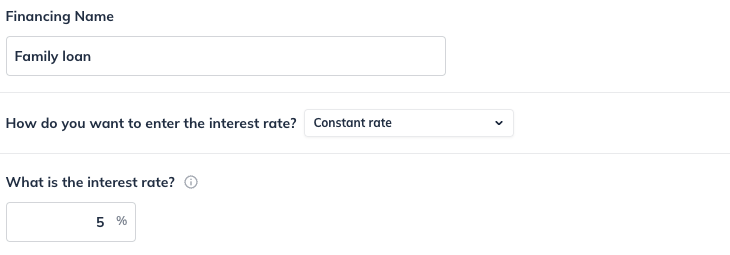

Enter a name for the loan and set the interest terms:

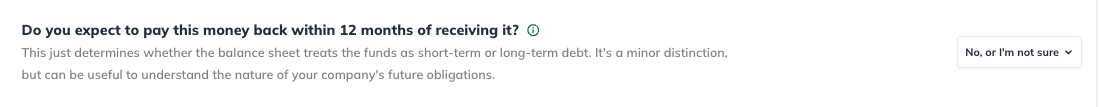

Select whether you'll pay this financing back within 12 months:

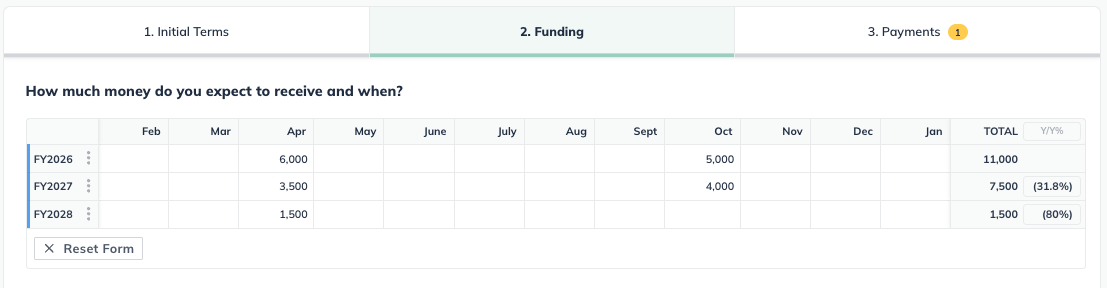

Enter the amount of money you'll receive and when you'll receive it. You can enter a single amount in a single month or amounts in multiple months, depending on how your loan is structured:

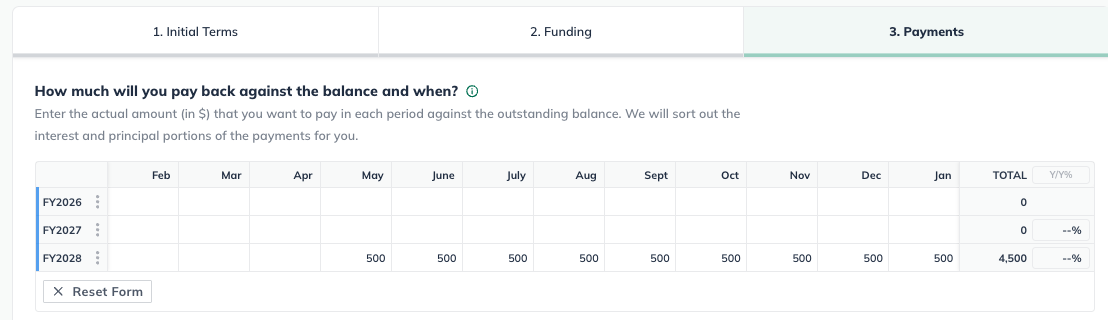

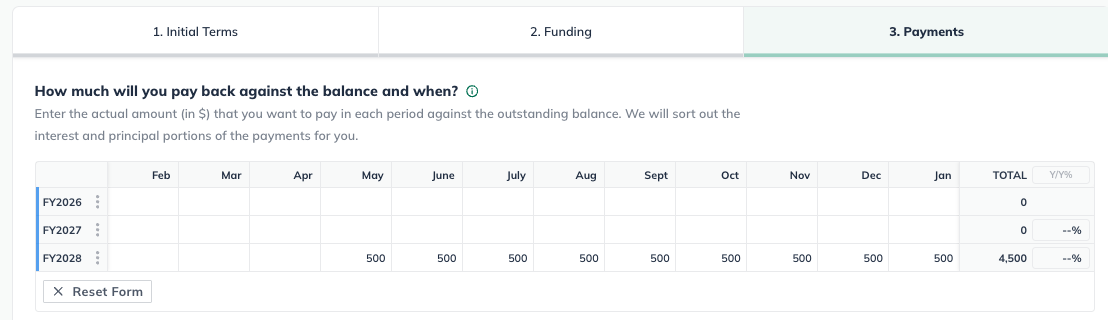

Next, enter the amount you plan to pay back each month or year against the balance:

Note: the default setting in LivePlan is for two years of monthly detail. If you need more years of monthly detail to enter future payments more accurately, you can easily change that setting.

Click Create & Exit. This loan and its payments will be displayed in the Financing table.

Entering a deferred payment loan

In LivePlan, when you enter a standard loan into your forecast, the software automatically applies payments the month after receiving the loan. If you're taking on a loan where you won't make payments right away (also known as "deferred payments"), the Add Other financing entry will allow you to represent that.

In the Forecast section, click Financing:

On the Financing page, click the Add New button and select Other:

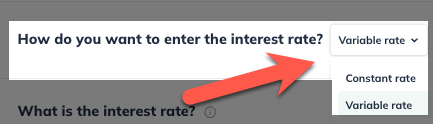

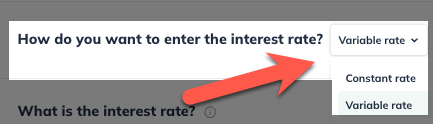

Enter the name of the loan and select whether it has a Constant rate or a Variable rate:

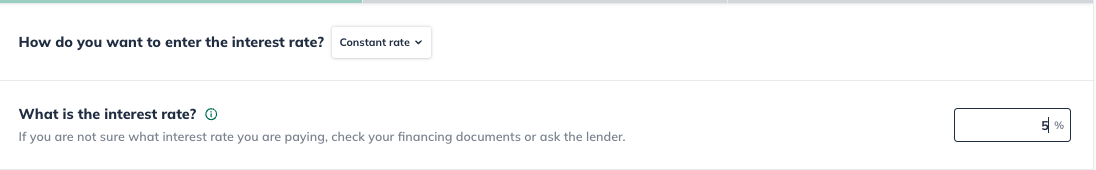

If the interest is a Constant rate, indicate the rate:

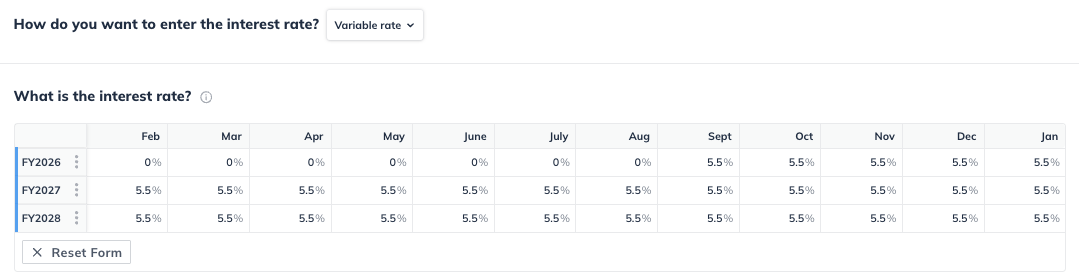

If the loan has a Variable rate, plot the rate over time:

Indicate whether you expect to pay the loan back within 12 months of receiving it:

Note: a loan you'll pay back within 12 months is considered short-term debt in your financial statements. Long-term debt is considered a loan you'll pay back in more than 12 months.

The next overlay represents when you will receive the money. Enter the loan amount you'll receive in the month you'll be receiving it. Click Next to continue:

Finally, enter the payments you'll be making in the months in which you'll make them:

Note: If you aren't sure of your payment amounts, you may want to consult your lender or search online for a loan payment calculator.

Click Create & Exit:

Entering a deferred interest loan

When you enter a loan with a constant interest rate into your LivePlan forecast, the software will automatically begin applying interest the month after you receive the loan. However, some loans have rates that vary over time depending on the terms of the loan. A common version of this is when you're taking on a loan that won't accrue interest immediately (also known as deferred interest).

In the Forecast section, click Financing:

On the Financing page, click the Add New button and select Loan:

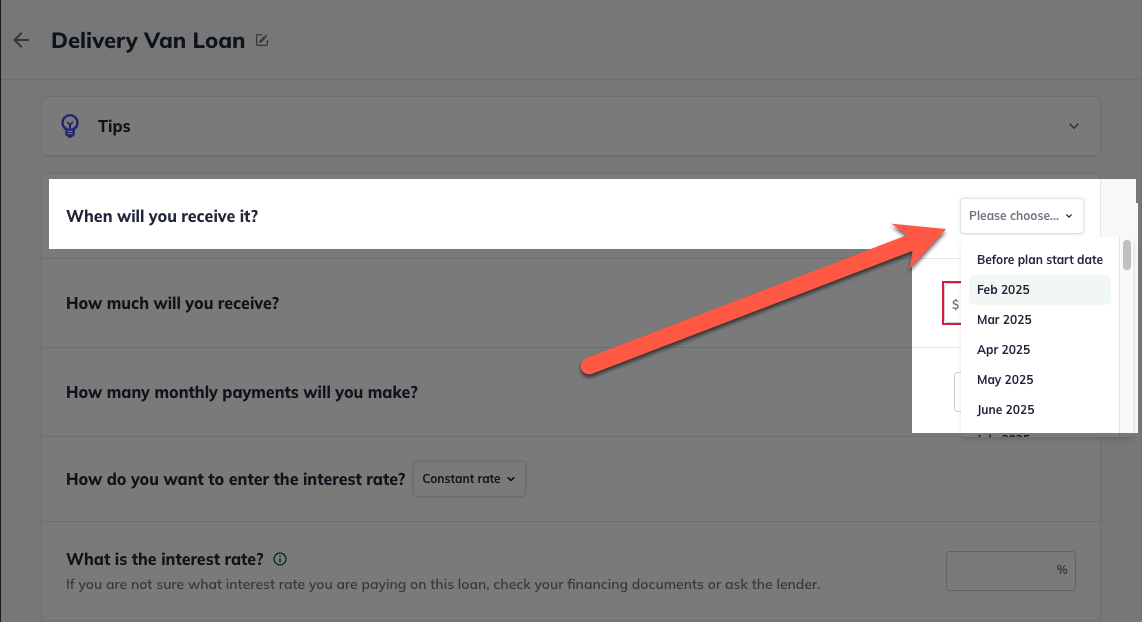

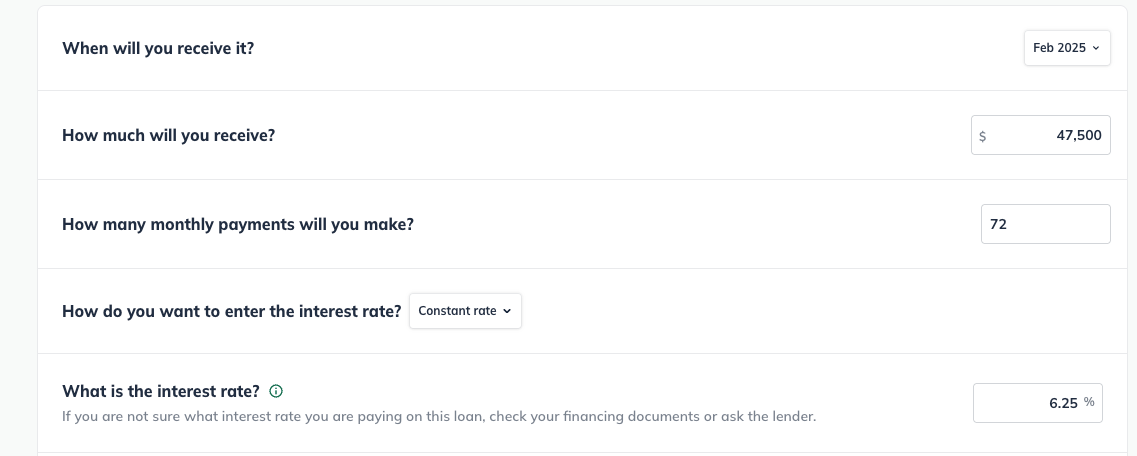

Give this loan a name and select when you will receive it:

Next, enter the amount received and the number of payments you will make. In our example, we're receiving $37,500 and will make 72 monthly payments:

Note: a loan you'll pay back within 12 months is considered short-term debt in your financial statements. Long-term debt is considered a loan you'll pay back in more than 12 months.

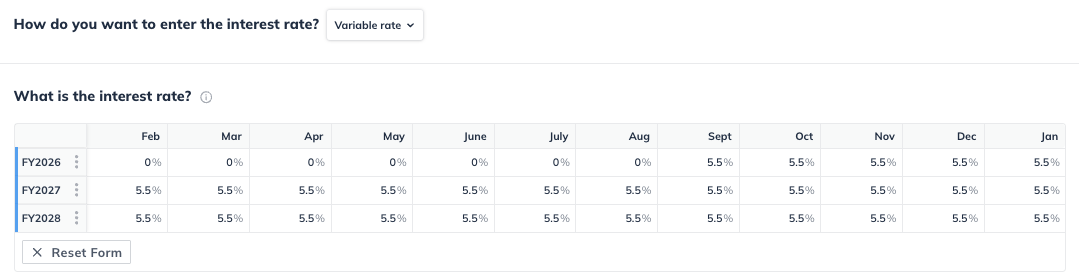

Next, you will select the type of interest rate. Since this loan has zero interest to start and increases to 8% after 6 months, you will select Variable rate from the two options in order to represent this:

In the table, input the interest rates to your loan according to the terms. In this example, we input 0% for the first six months and 8% for the remaining months of the 72 month term of our loan.

Click Create & Exit:

Note: You can also create a deferred interest loan with an Add Other entry. This might be used in scenarios that require you to model a variable interest loan with a custom pay schedule, as an example.

(For more details, read How LivePlan handles loans and other financing.)

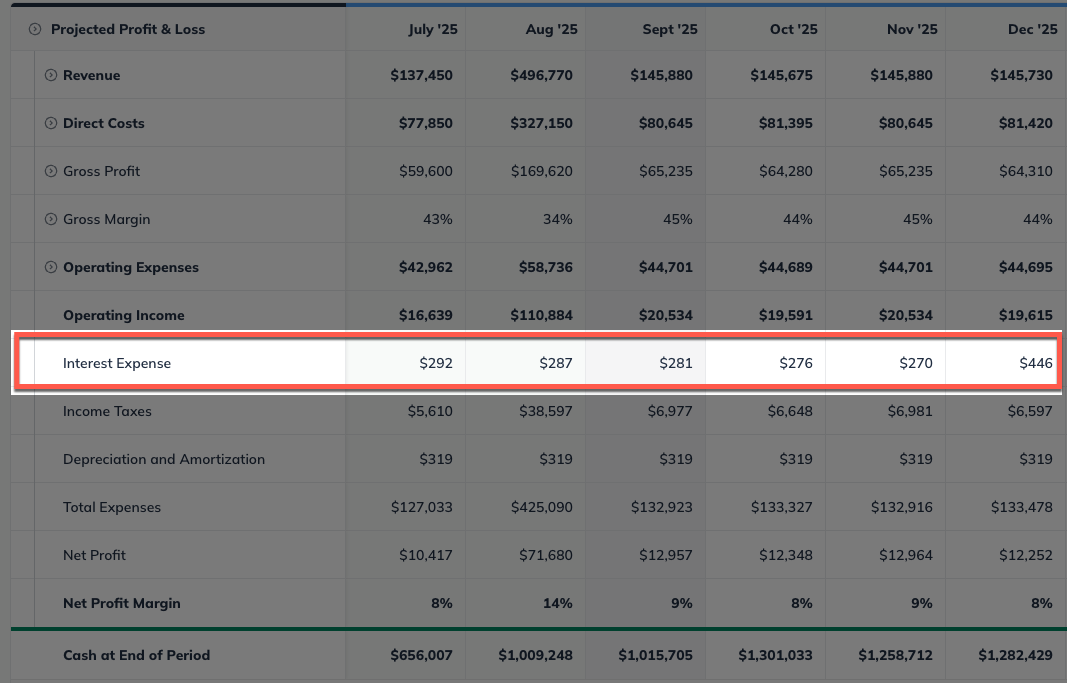

Only the interest portion will appear in your Profit and Loss table when you enter a custom loan, under the Interest Expense line. This is because the interest is the only actual cost your business incurs in the loan:

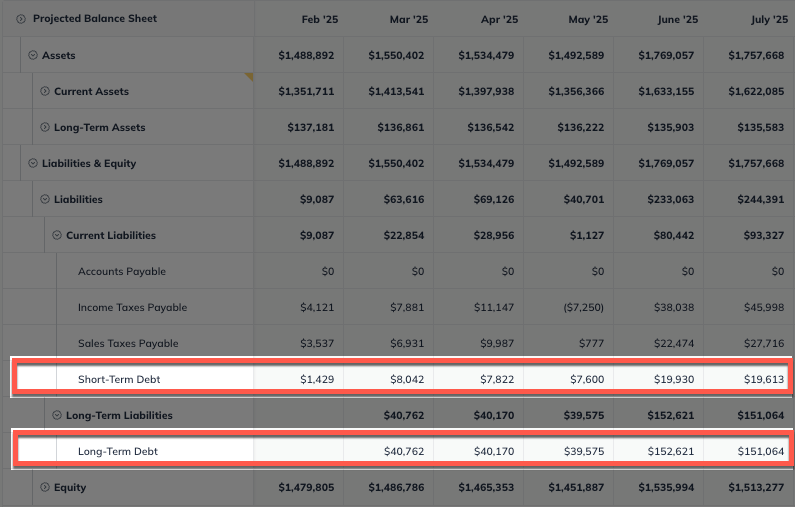

Loans will appear on one or two lines of the Balance Sheet, depending on their length. Short-Term Debt includes loans paid back within 12 months. A loan of over 12 months will be divided into Short-Term Debt and Long-Term Debt.

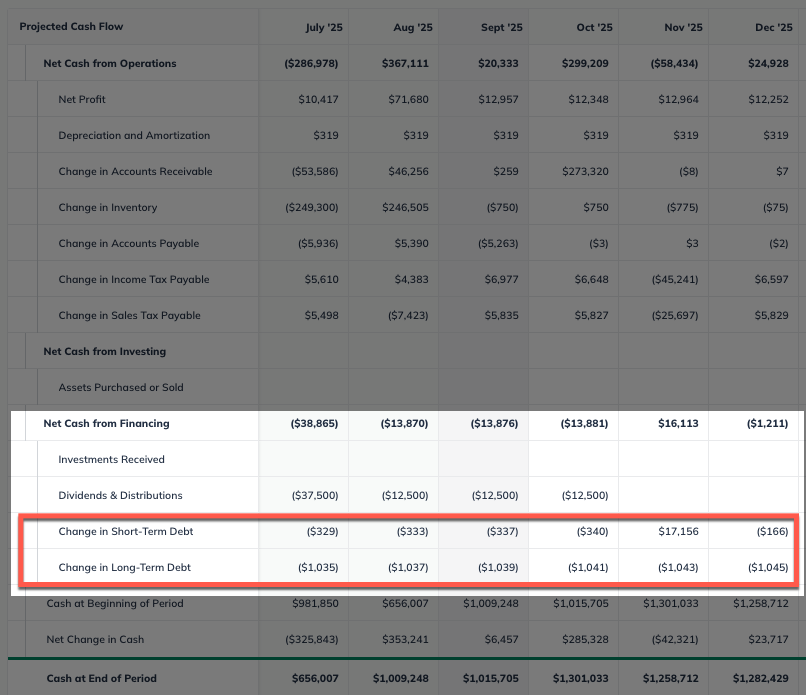

In the Cash Flow, similarly, loans (or portions of loans) may be considered Short-Term Debt or Long-Term Debt: