Forecasting Financing Taxes And Advanced Topics

Entering dividends and distributions

Dividends (for corporations) or distributions (for LLCs or partnerships) are a way to pass profits to the company's owners or shareholders. Companies can issue dividends at any time but typically do so at the end of the fiscal year. That timing makes sense, given that dividends are based on after-tax profits.

Adding a dividend

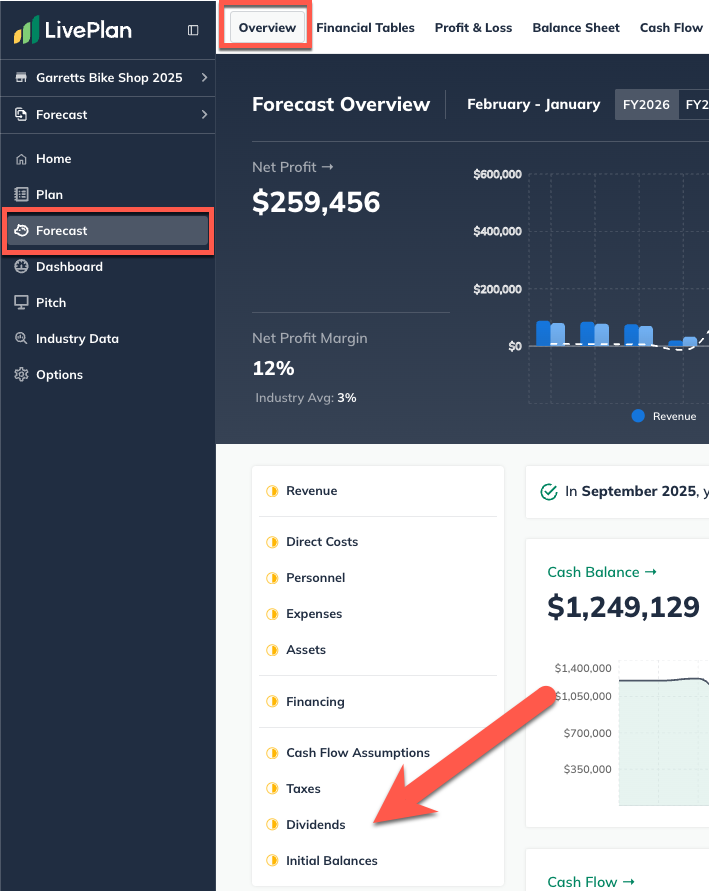

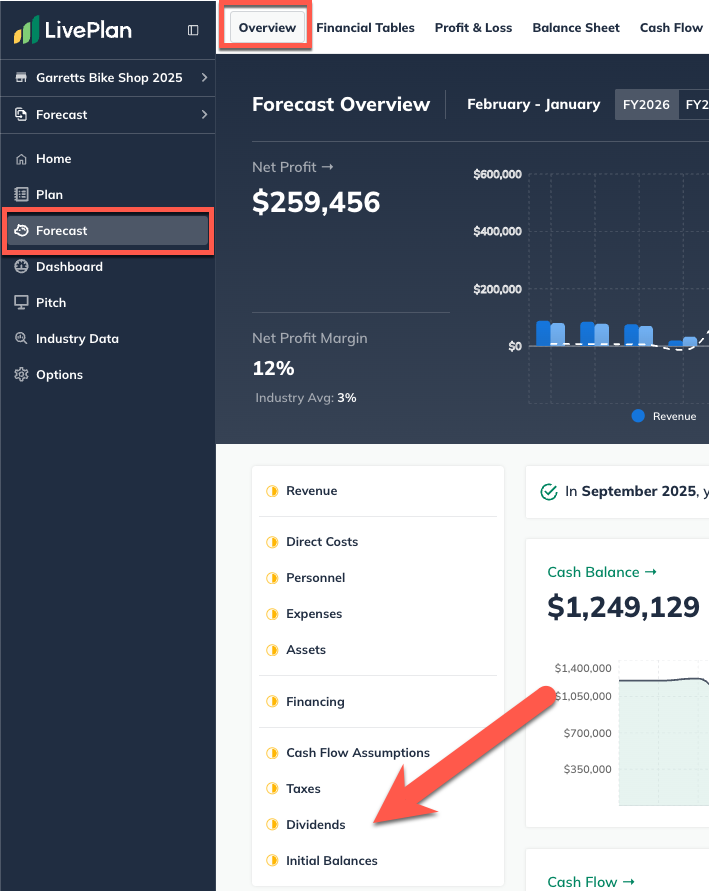

In the forecast overview, select Dividends:

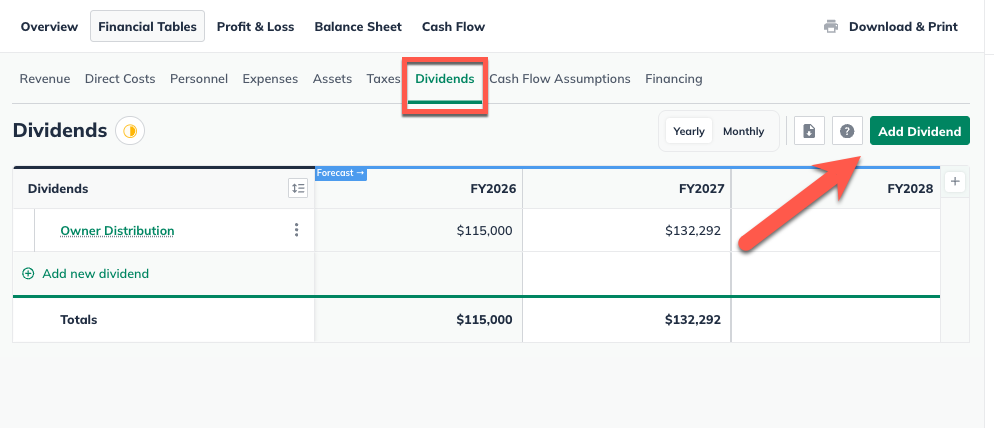

Click the Add Dividend button:

Enter a name or description for the dividend:

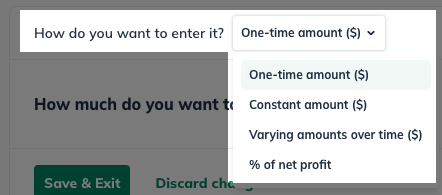

Next, indicate whether this is a one-time distribution, or happens regularly and is the same amount, or varying amounts over time:

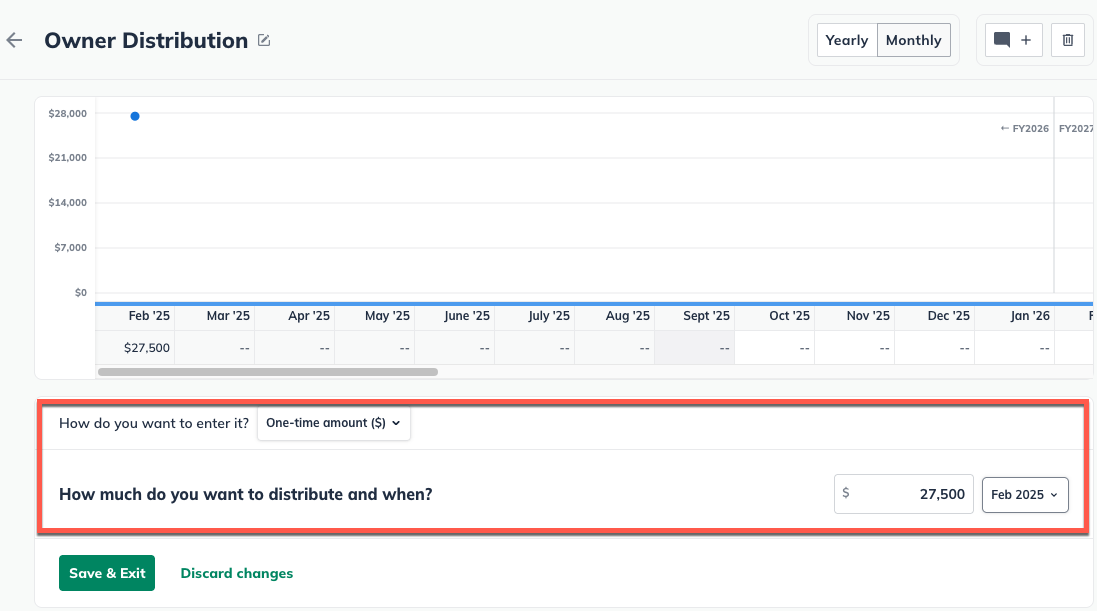

If you chose a One-time amount, indicate the amount of the dividend and select the month/year that it will be issued:

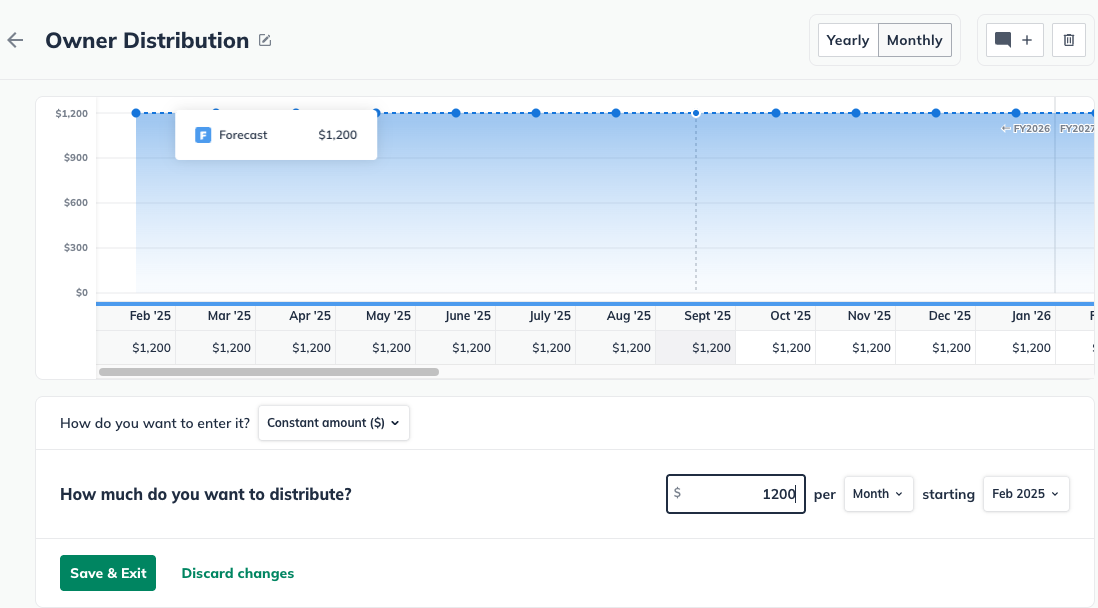

If you chose Constant amount, indicate the amount of the dividend, whether you will issue it monthly or yearly, and when the dividend will start:

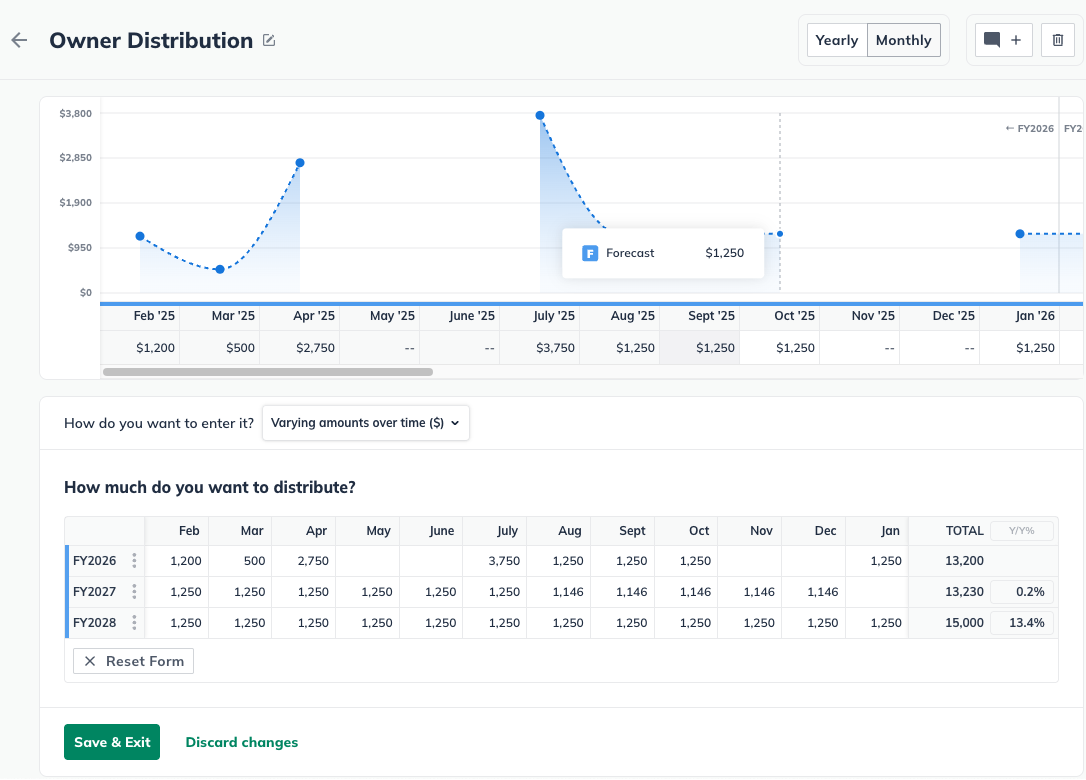

If you chose Varying amounts over time, enter the amounts you want to distribute in the months you'd like to distribute them:

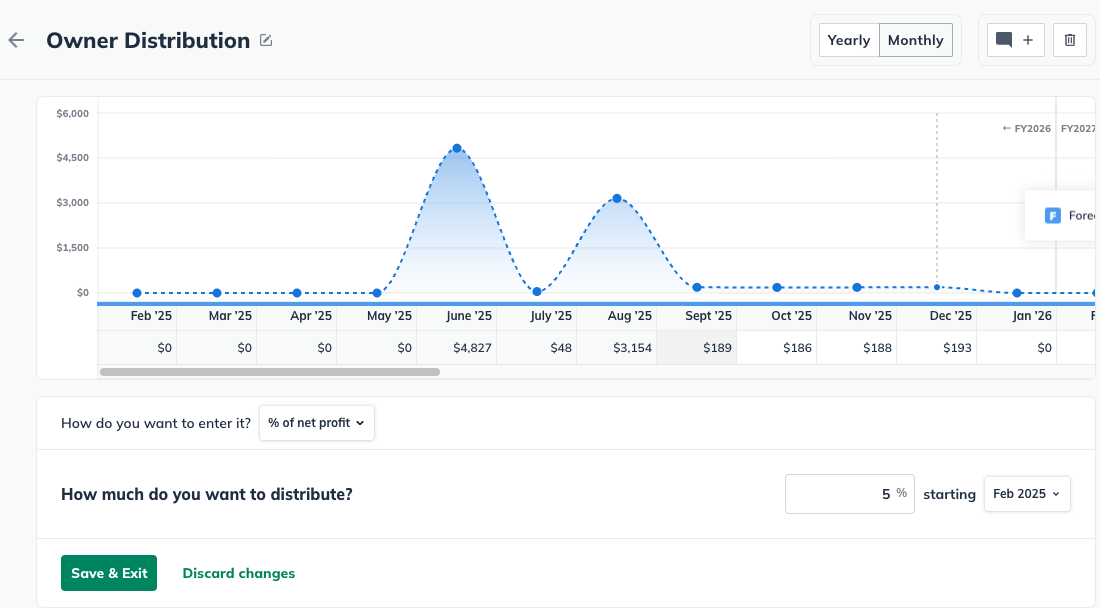

If you choose Percent of net profit, enter the percentage of your net profit that you want to distribute and the month in which those distributions will start.

Click Save & Exit.

Editing a dividend

To edit an item that you have already entered in the forecast (such as a revenue stream, expense, or asset), first navigate to the Forecast Overview. Next, click on the section that contains the entry you wish to edit.

Find the table of your entries at the bottom of the page, then click on the green title of the item you want to update.

You can edit any part of your entry. Click Save & Exit when you're done:

To discard changes, click on the back arrow in the upper-left corner of the editor window:

For more details, see How do I edit or delete forecast entries?

Deleting a Dividend

Forecast items can be deleted from two different places: from the forecast table or list, or from within the editor overlay when viewing a single forecast item.

In the forecast tables:

Click on the action menu (three vertical dots) to the right of the forecast item and select Delete:

In the forecast editors:

Click the More actions dropdown near the top-right of the forecast editor and select Delete:

Where does this entry appear in the financial statements?

Dividends will not appear in the Profit and Loss table.

In the Balance Sheet, a dividend payment is subtracted from Earnings to calculate your Retained Earnings. Notice that this value carries forward from the month when it was paid. This doesn't mean the same dividend is being subtracted each month; it indicates that the deduction is being carried forward in calculating your monthly and annual earnings:

In the Cash Flow table, you'll see a reduction in net cash, as shown below. This reduction is calculated only in the month when the dividend was paid: