Forecasting Setup And Management

Forecast financial statements

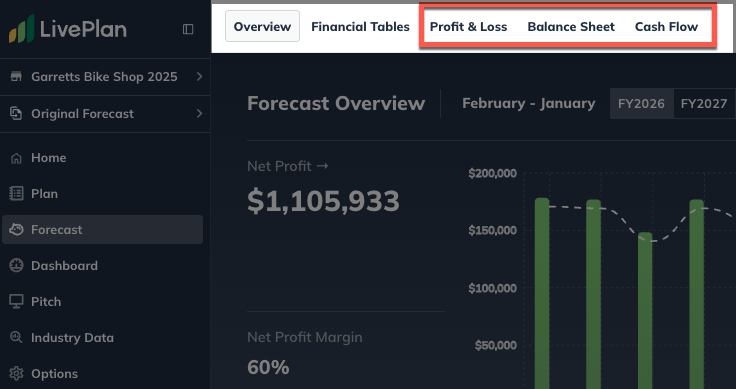

A LivePlan Forecast provides the three standard (or "pro forma") financial statements that accountants and investors generally expect to see. These are found near the top of the Forecast section under Financial Tables.

Note: LivePlan Premium users with past financial data entered can view detailed comparisons of forecasted and actual results in the Dashboard financial statements.

Using the numbers you enter into your forecast, LivePlan builds these financial statements automatically for you:

Profit and Loss (P&L) statement: A Profit and Loss (P&L) statement is a financial report summarizing a company's revenues, costs, and expenses during a specific period (generally annually, quarterly, or monthly.) The difference between the total revenue and total expenses illustrates your company's net profit or loss. It's an essential tool for investors and stakeholders to evaluate a company's financial performance and profitability, providing insight into how efficiently your business runs, how well costs are managed, and revenue-generating capacity.

Balance sheet: Your Balance Sheet provides a snapshot of your company's financial position at a specific point in time. It details the assets (what it owns), liabilities (what it owes), and equity (the net worth or capital provided by the owners). The fundamental accounting equation, "Assets = Liabilities + Equity," ensures the balance sheet is always balanced.

Cash flow statement: The Cash Flow statement tracks the inflow and outflow of cash within a company over a specific period. It's divided into three sections: operations (cash from daily business activities), investing (cash from assets purchased or sold), and financing (cash related to equity and debt transactions). This statement provides an understanding of how a company generates and uses cash. In essence, it helps stakeholders evaluate the company's ability to cover its obligations, reinvest in its business, return money to shareholders, or weather financial hardships.

These three statements work together to create a complete picture of your business and are the foundation of your key financial metrics. Since they can be the sum of many different forecast entries, they can't be edited directly. Instead, you will need to edit the entries in your various forecast fields, at which point these statements will automatically update.