Forecasting Financing Taxes And Advanced Topics

What is the difference between long-term assets and current assets?

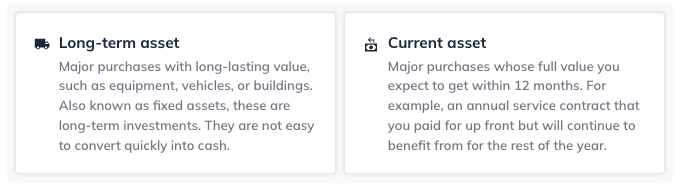

When you enter an asset purchase into your forecast, you can choose between two types: Long-term assets and Current assets. We cover these asset types below.

Long-term assets

Long-term assets, also known as fixed assets or capital assets, are resources intended to be utilized in your business operations for a period extending beyond one year. Examples of long-term assets include items like machinery, office equipment, vehicles, and buildings. Over time, most long-term assets gradually lose value, a process referred to as depreciation. LivePlan simplifies asset management by automatically calculating the depreciation of these long-term assets based on their useful life, which is set on the asset entry page.

Current Assets

Current assets, often referred to as short-term assets, are expected to be consumed, sold, or transformed into cash within one year. This category includes accounts receivable (the funds owed to your business by customers), inventory, and prepaid expenses, such as annual professional licensing or service contracts. The value of these assets is typically realized over the short term through either sales, in the case of inventory, or consumption, as with a service contract or professional license. LivePlan facilitates efficient financial management by automatically calculating the amortization of these current assets, aiding in smoother fiscal operations and planning.