Forecasting Financing Taxes And Advanced Topics

What is the difference between short-term and long-term debt?

When you enter a long-term loan into your LivePlan forecast, you may notice that it appears on your Balance Sheet and Cash Flow statements in two ways: as both Short-Term and Long-Term Debt.

To explain why a loan is split this way, let's begin with a definition of each type of debt:

What is Short-Term Debt?

Short-Term Debt is any financing that will be paid back within the current 12 months. If you've entered a loan in your forecast that will last for 12 months or less, the entire loan is considered short-term debt. If, on the other hand, you've entered a loan that will be paid back over multiple years, then the part you'll pay back within the current 12 months is short-term debt.

Similarly, if you've entered a line of credit in your forecast, the portion that will be paid back within the current 12 months is also considered short-term debt:

What is Long-Term Debt?

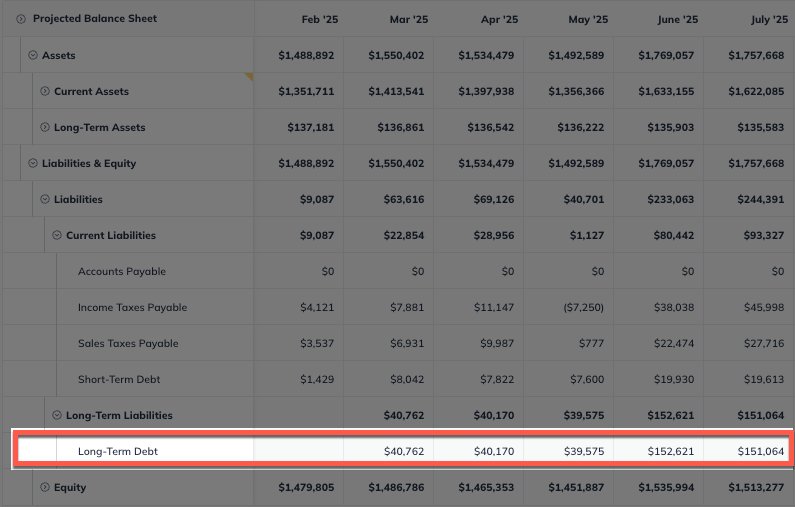

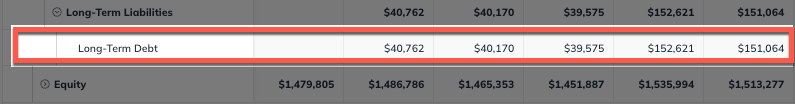

Long-Term Debt is the portion of a loan that will not be paid back within the current 12 months. So, for example, if you enter a 60-month (or 5-year) loan into your forecast, the part you'll pay back in the first year becomes short-term debt, while the amount you'll pay back in Years 2-5 is long-term debt:

Why do we need both?

Breaking a loan into both short-term and long-term segments helps you plan for cash flow and maintain a picture of your business's future health.

Let's take that earlier example of a 5-year loan. Obviously, you don't need to come up with the funds to pay all of that debt back at once. But you will want to ensure you have enough funds to pay back what you owe on that loan this month and this year. This is why keeping track of that amount through the Short-Term Debt line on your balance sheet is helpful.

The Long-Term Debt line on your balance sheet helps you see how much debt your business will carry in future years. This information is valuable if you consider taking out additional loans or lines of credit. The long-term debt amount will also be of interest to potential investors as an indicator of the future solvency of your business.

Why doesn't the short-term debt amount change as I make payments?

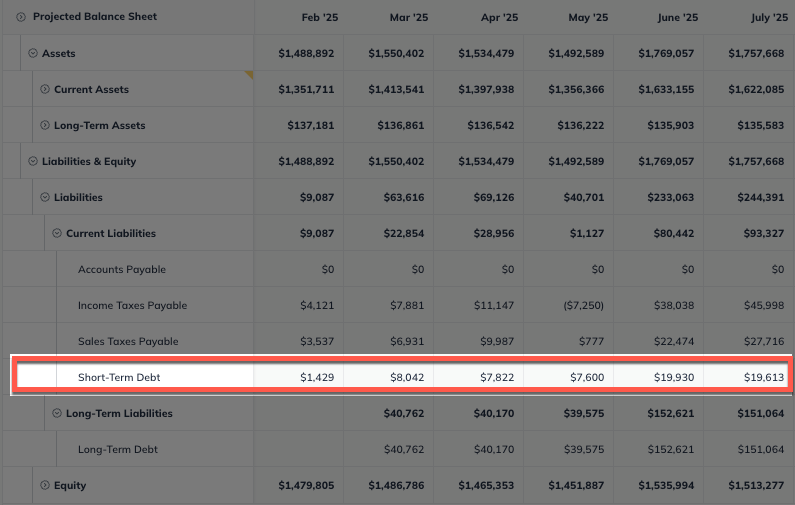

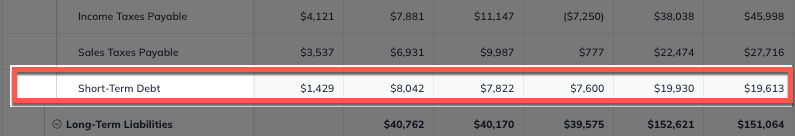

Here's the slightly more complicated part of this concept, and it's well-illustrated by these screenshots:

Short-term debt will always be 12 months' worth of a loan until the loan has less than a year left. So, although your payments are being applied to the short-term debt, another month of short-term debt is added back each month.