Forecasting Financing Taxes And Advanced Topics

Entering a line of credit

A line of credit (often called revolving credit) is a flexible financing tool that lets your business borrow, repay, and re-borrow funds within a predetermined credit limit. Unlike a term loan, which delivers one lump-sum disbursement and follows a fixed amortization schedule, a line of credit can be dipped into multiple times to smooth cash-flow gaps, finance a large inventory purchase, or cover seasonal working-capital needs. Common real-world examples are credit cards and bank-issued revolving credit lines. Because you pay interest only on the amount actually drawn (not on the total credit limit), a line of credit can be one of the most cost-effective short-term borrowing options available.

In LivePlan, a line of credit behaves just like its real-world counterpart: you set an overall credit limit, specify any starting balance, and forecast both draws (new borrowing) and repayments for each period of your plan. LivePlan then automatically calculates:

Interest expense—based on either a constant annual rate or a month-by-month variable‐rate table you provide.

Outstanding principal—the running balance after each draw and payment.

Available credit—your remaining borrowing capacity at any point in time.

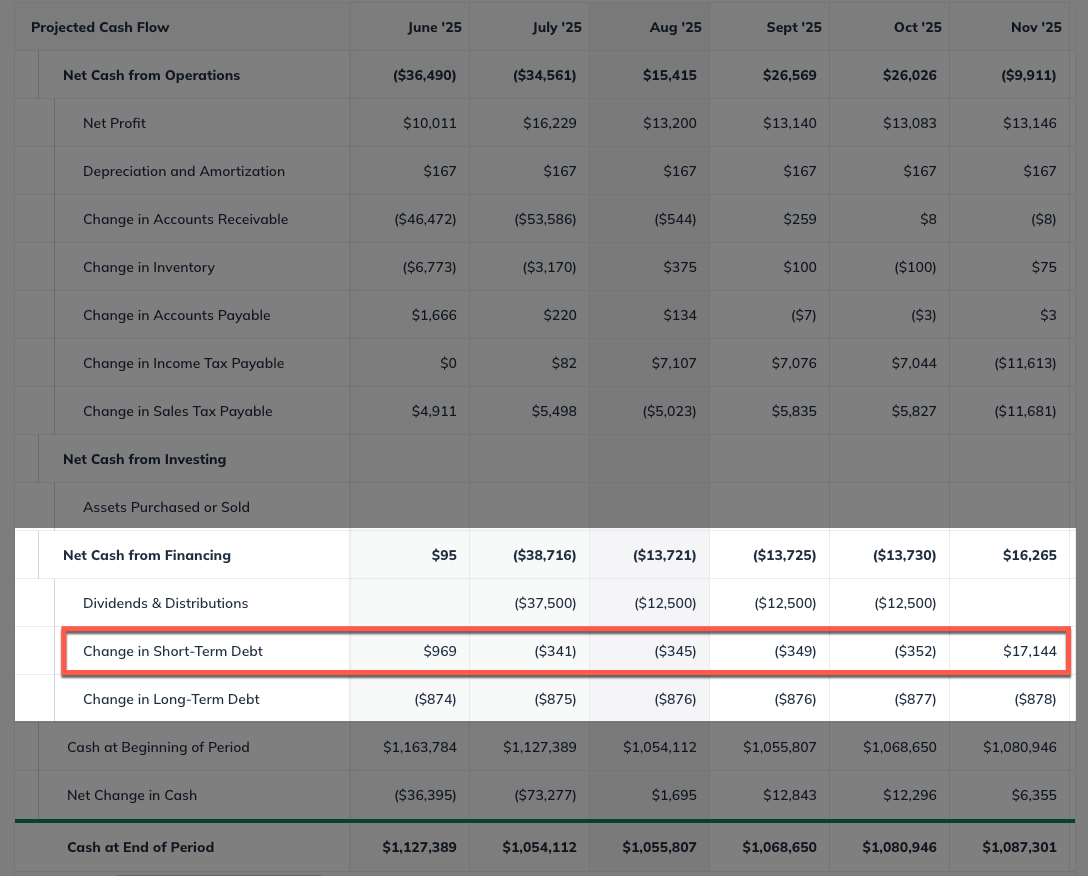

These calculations, in turn, figure into all three core financial statements: the interest shows up on the Profit & Loss as an operating cost; the net principal appears on the Balance Sheet as Short-Term Debt; and the period-by-period changes roll through the Cash-Flow Statement under Change in Short-Term Debt.

Adding a line of credit

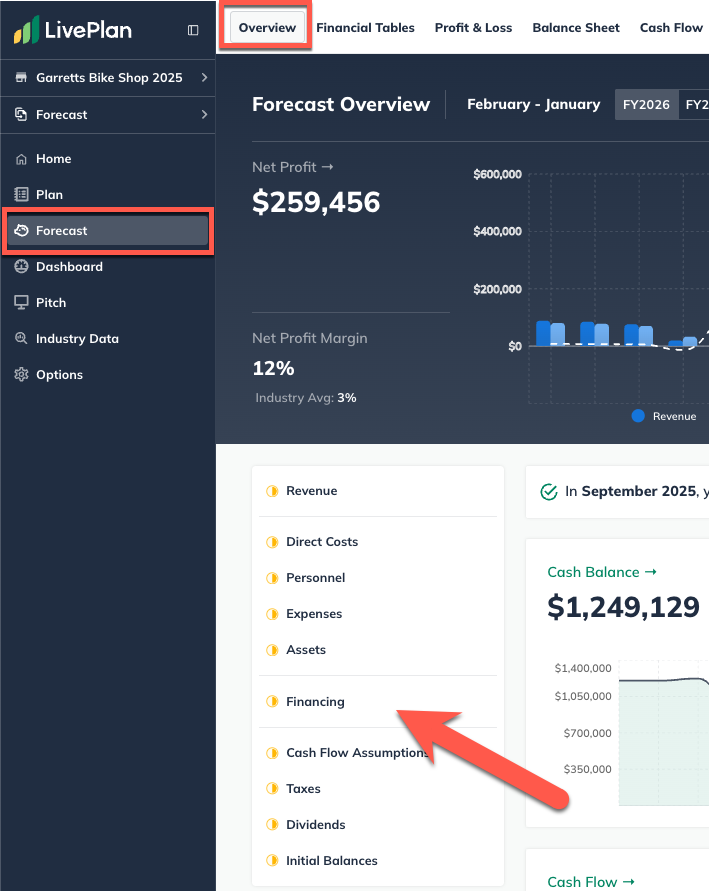

In the Forecast Overview click Financing:

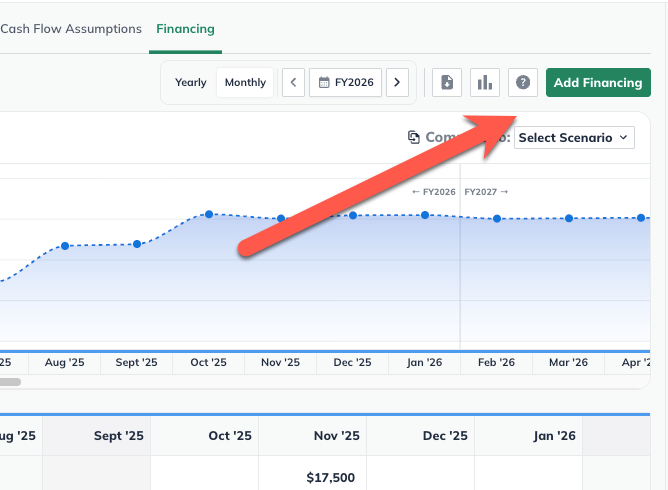

Click the Add New button:

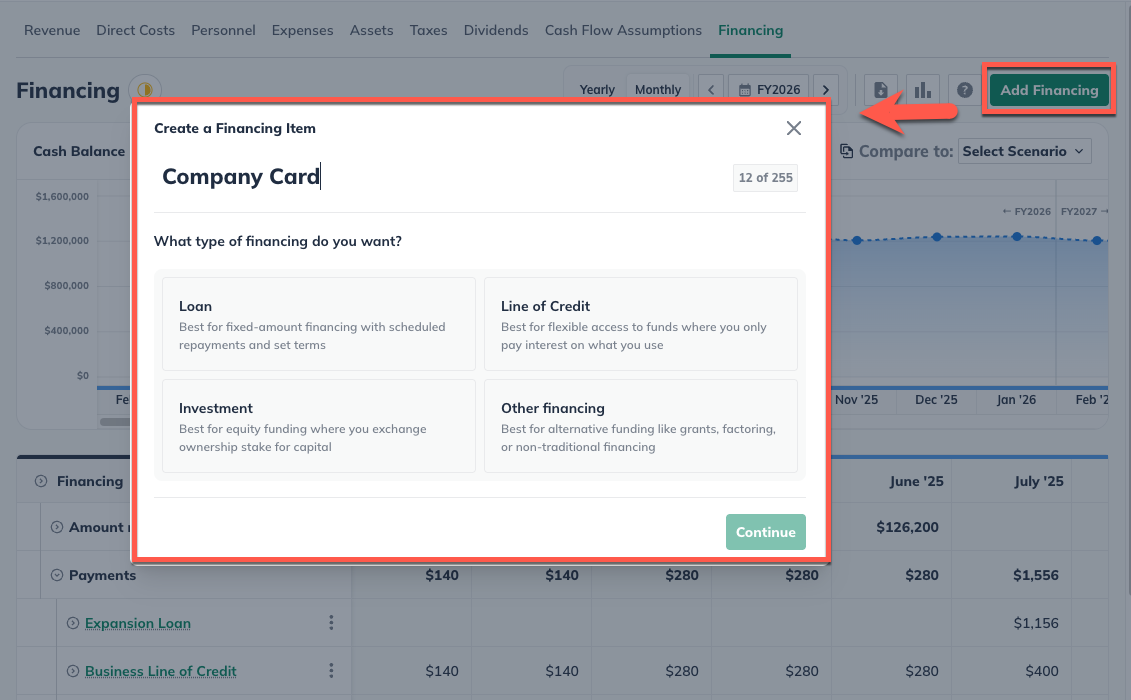

Select Line of Credit:

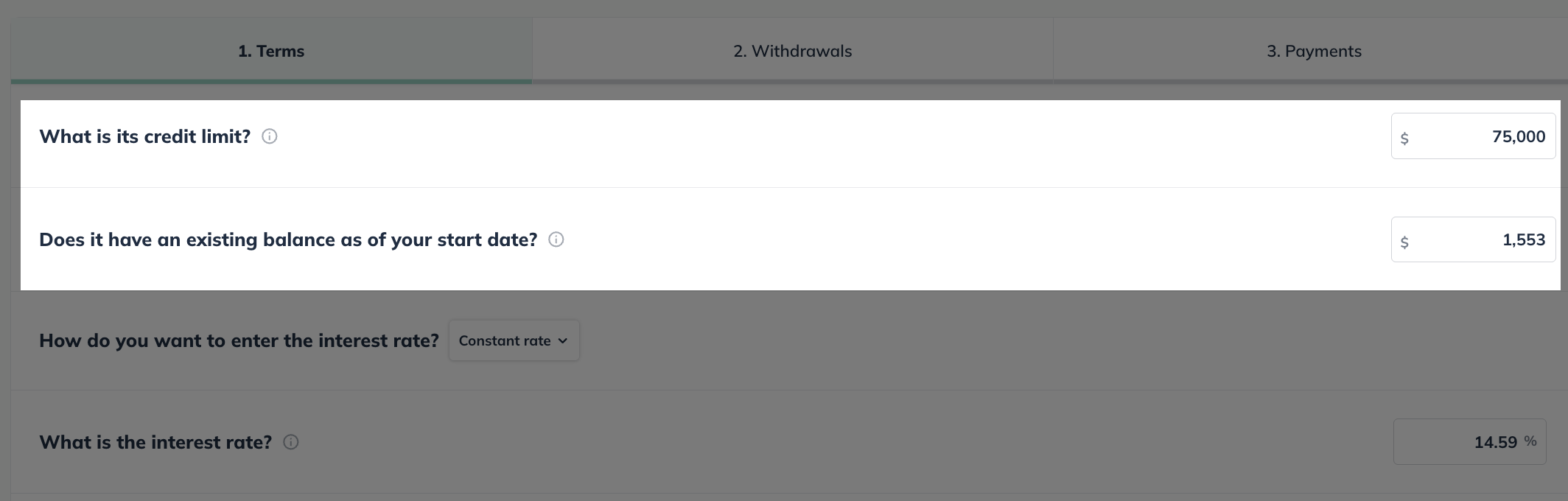

Enter the limit of the line of credit and the starting balance on the line of credit as of the beginning of your forecast (if any):

Note: if you have no starting balance, enter zero.

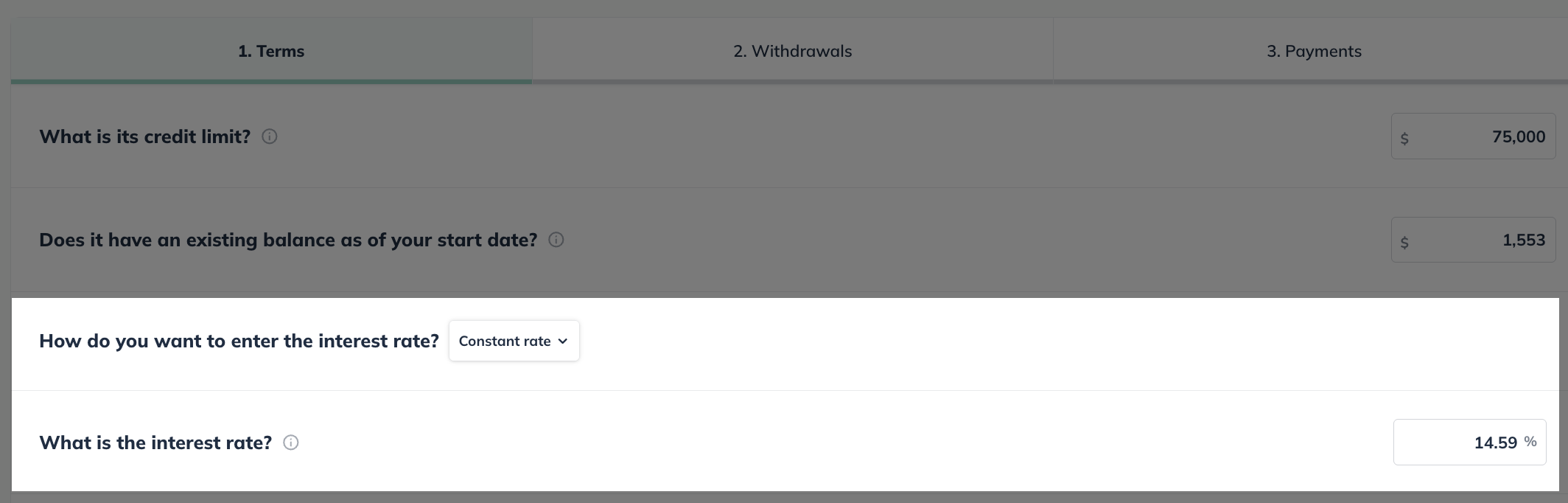

Select whether your line of credit has a constant or variable interest rate. In the field for a constant interest rate or table for the varying interest rate over time, input what that rate will be and then hit next:

If the interest rate is constant, enter the rate in the following box:

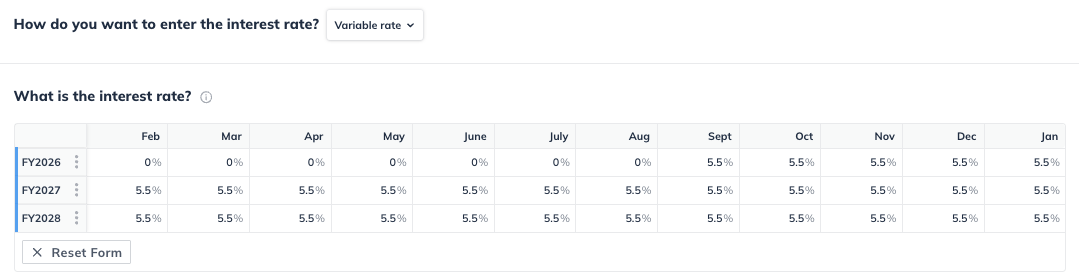

If the interest rate is variable, plot the rate out during your forecast period:

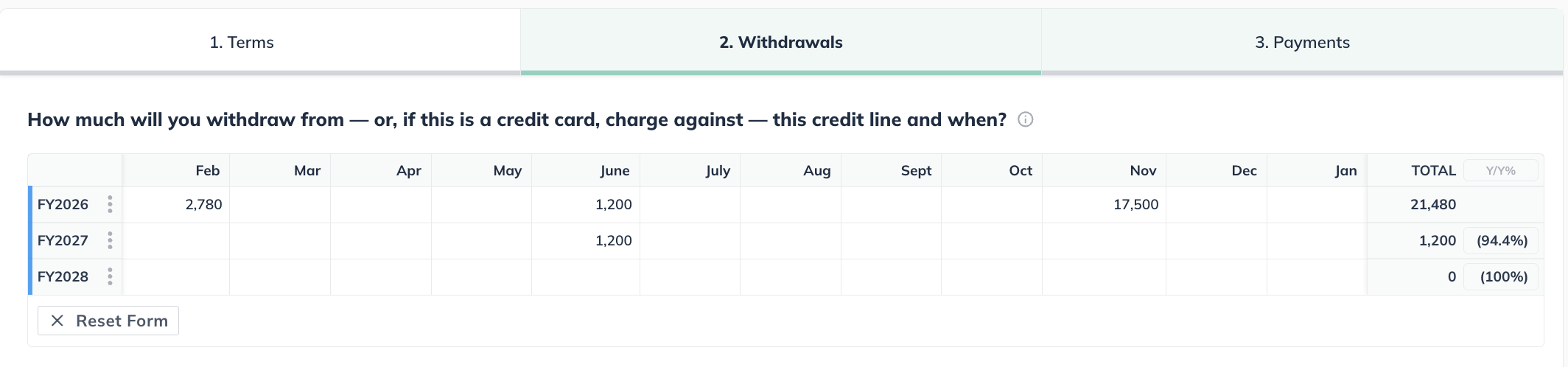

Enter the amount you plan to draw from this line of credit in each period:

Next, enter the amount that you plan to pay back in each period:

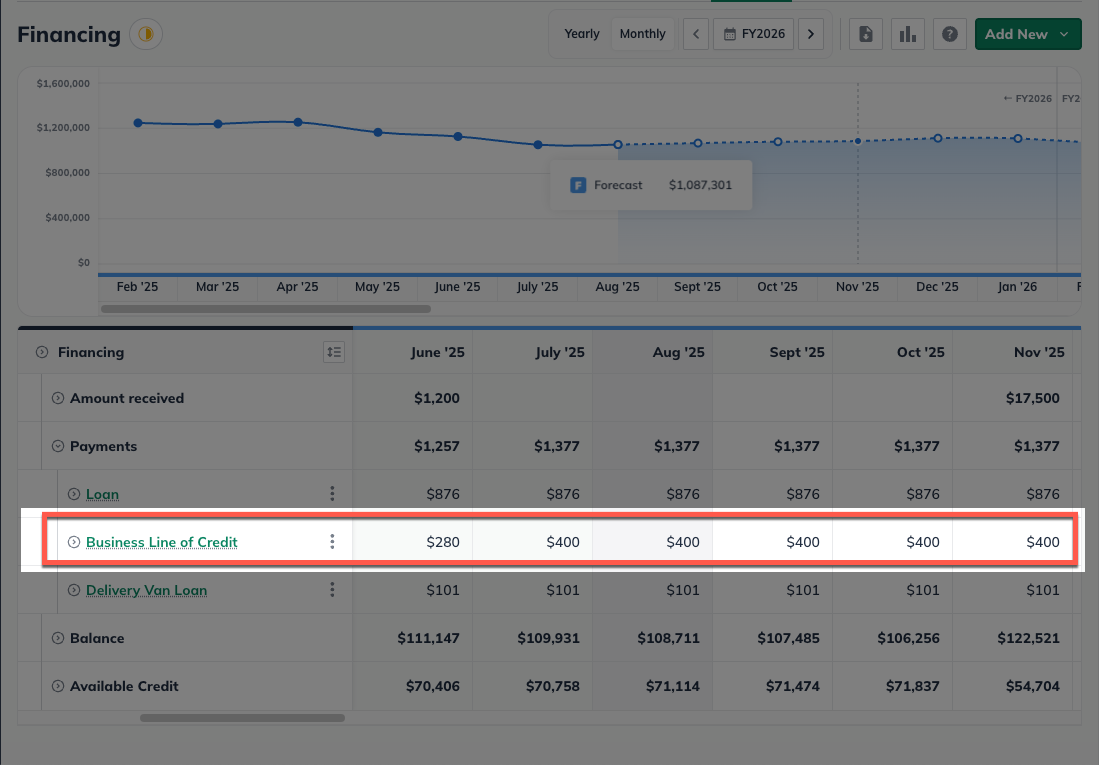

Click Create & Exit. The line of credit, its payments, the balance due, and available credit will be shown in the Financing table:

Where does this entry appear in my financials?

(For more details, read How LivePlan handles loans and other financing.)

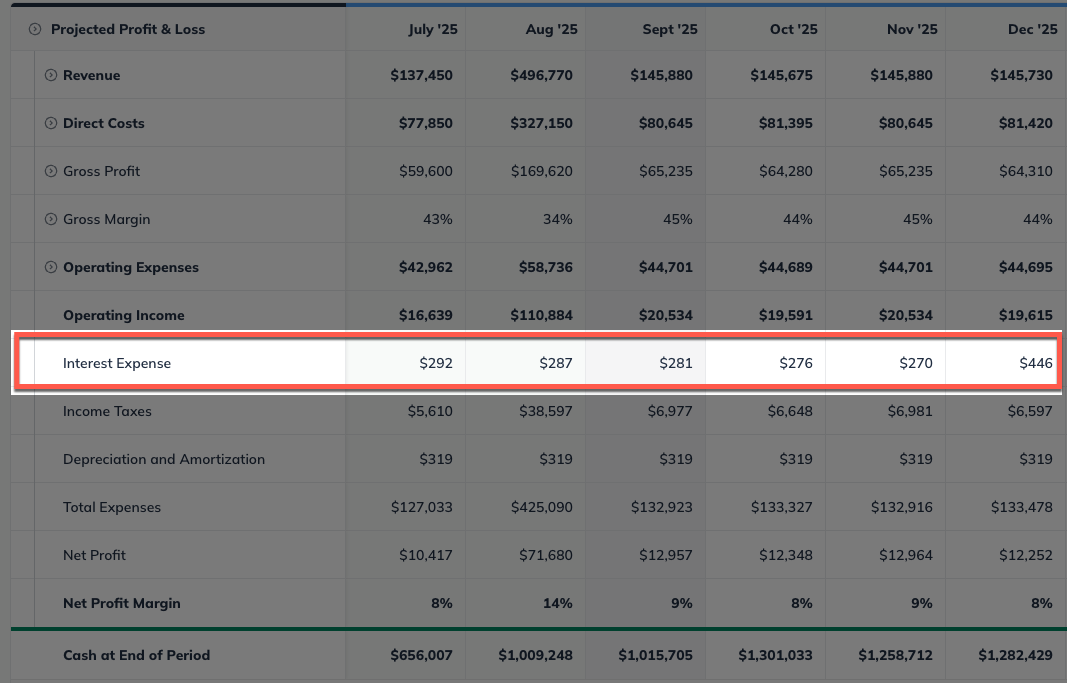

Similarly to a Loan entry, you'll only see the interest portion of your Line of Credit in the Profit & Loss under Operating Expenses, listed as Interest Expense. The interest is the only true cost your business incurs with a line of credit:

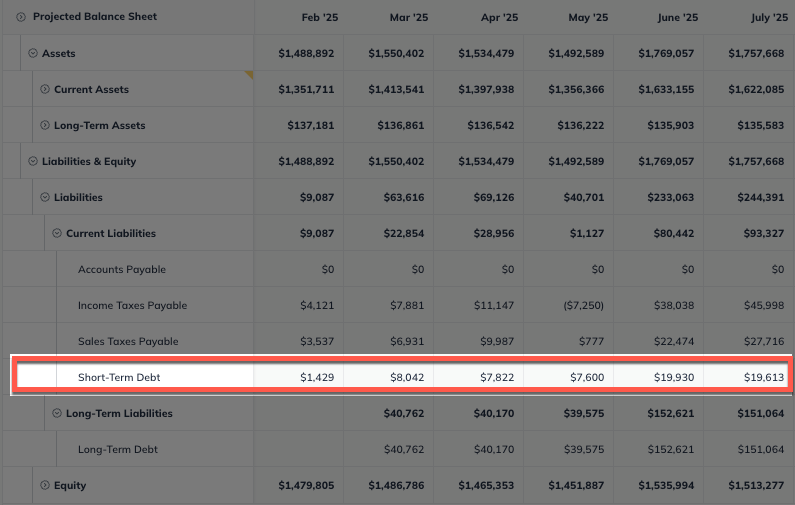

Because you can both use your Line of Credit and make a payment on it in the same month, the Balance Sheet will calculate the net debt that remains in each month. This amount is shown as part of the Current Liabilities, as Short-Term Debt:

In the Cash Flow, the net debt of your line of credit is found under Net Cash from Financing, calculated into the Change in Short-Term Debt: