Forecasting Financing Taxes And Advanced Topics

Entering an investment

Equity investments are cash contributions made to your business in exchange for partial ownership or shares in the company. These investments provide essential funding without the burden of debt, meaning there’s no obligation to repay the investor or pay interest. Instead, investors receive a stake in the company, entitling them to a portion of future profits, often distributed as dividends, and a say in business decisions, depending on the ownership structure.

Equity funding can come from a variety of sources:

Friends and Family: Personal connections who are willing to invest in your business based on trust and belief in your vision.

Crowdfunding: Platforms that allow a large number of individuals to invest small amounts in exchange for equity.

Angel Investors and Venture Capital: Professional investors who typically provide larger sums of money in exchange for equity, often in early-stage or high-growth businesses.

In LivePlan, these contributions are recorded as paid-in capital under the equity section of your balance sheet. This ensures your financial statements accurately reflect the ownership structure and capital contributions, helping you and your stakeholders understand the company’s equity position. By documenting equity investments properly, you can clearly differentiate them from loans or other forms of financing, ensuring compliance and clarity in your financial forecasting.

Note: If you have a convertible debt arrangement with an investor, that's entered differently. See Entering convertible debt.

Adding an investment

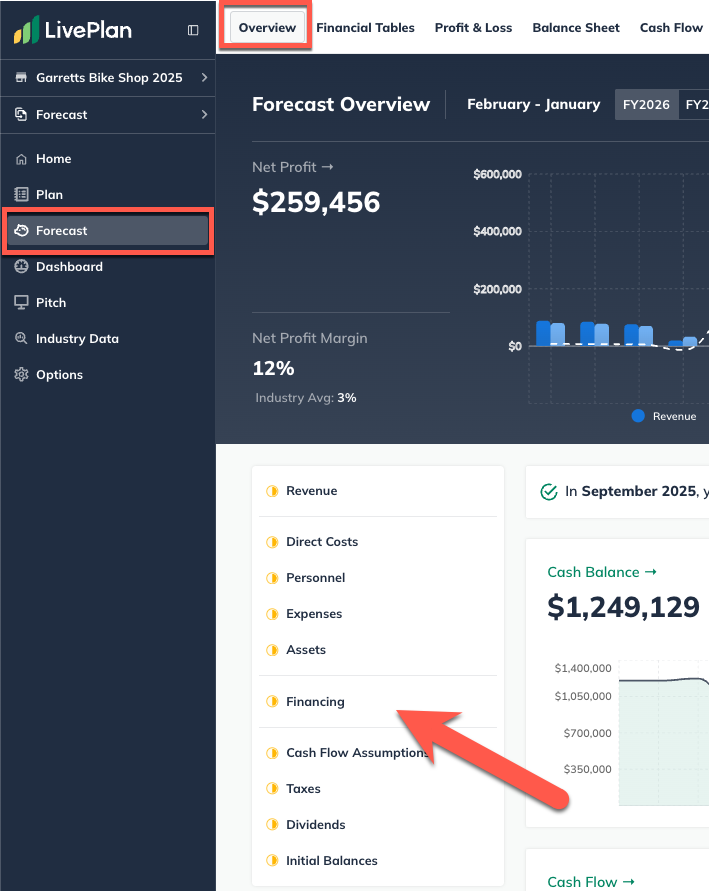

In the Forecast Overview, click Financing:

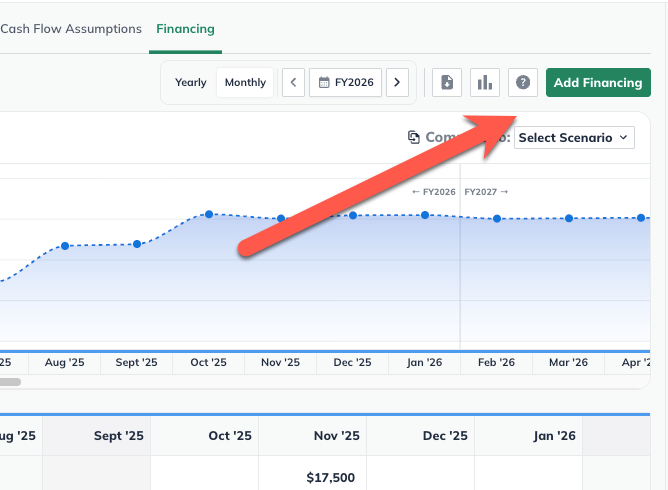

Click Add New:

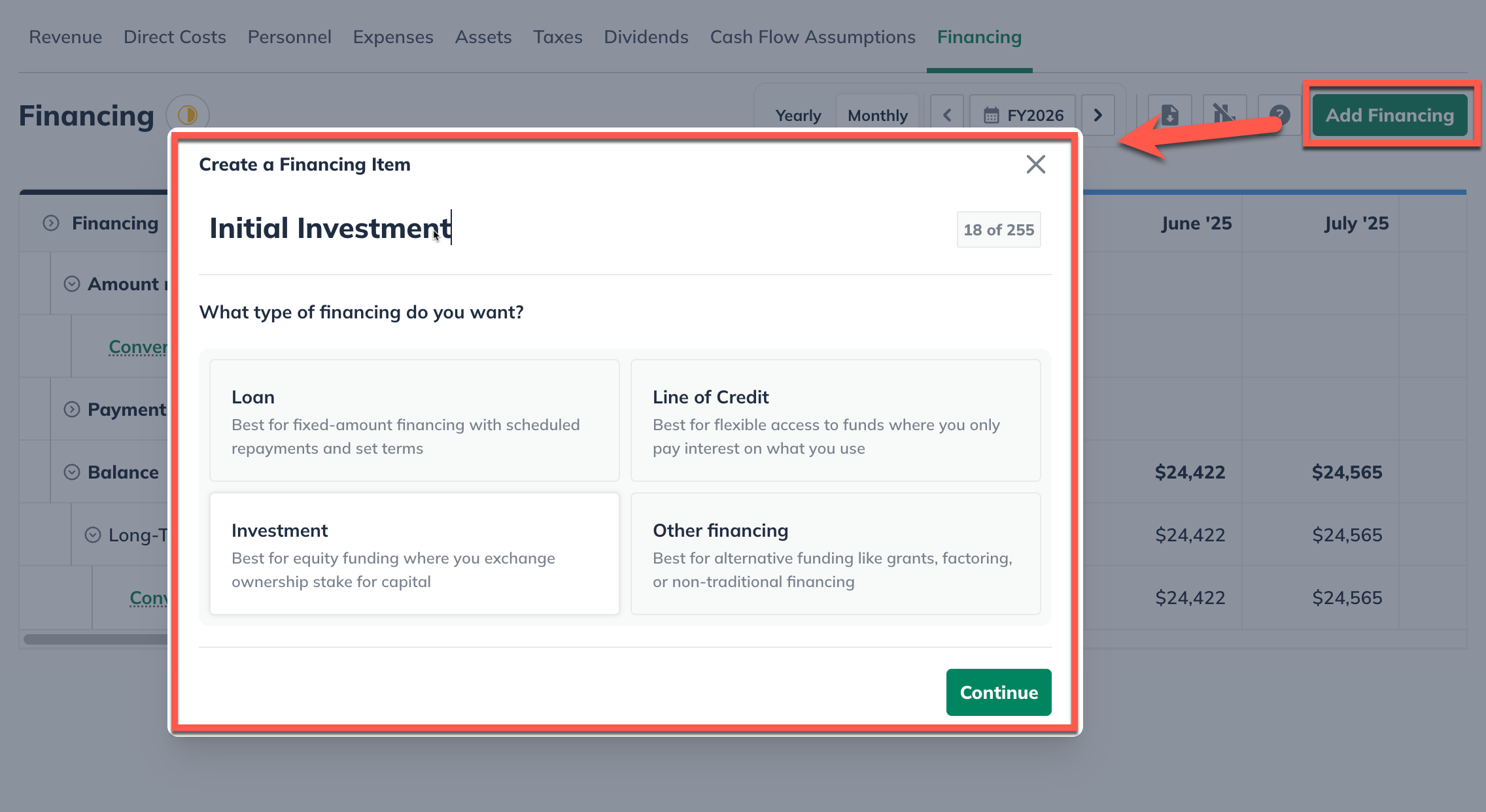

Select Investment:

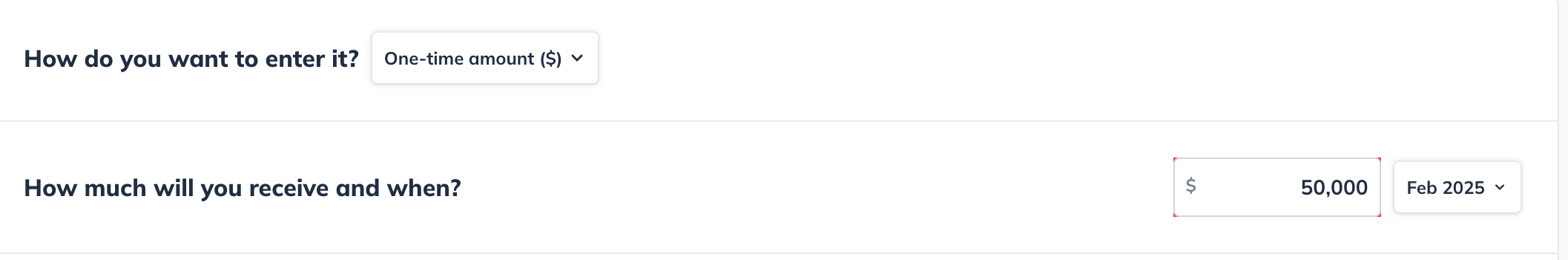

Enter a name for the investment and choose how to enter it. Choose whether this will be a one-time investment, a constant repeating amount, or varying amounts over time. If you choose One-time amount, indicate how much the investment will be and when you'll receive it:

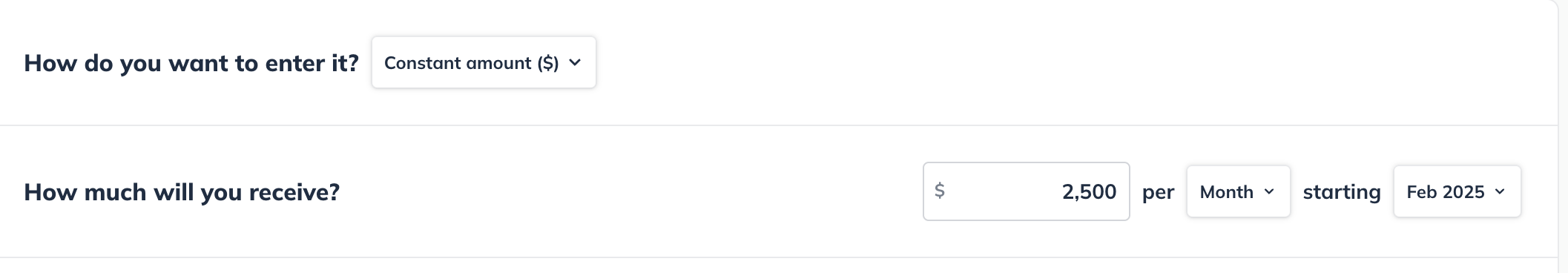

If you choose Constant amount, indicate how much you'll receive per month/year and when the investment will start:

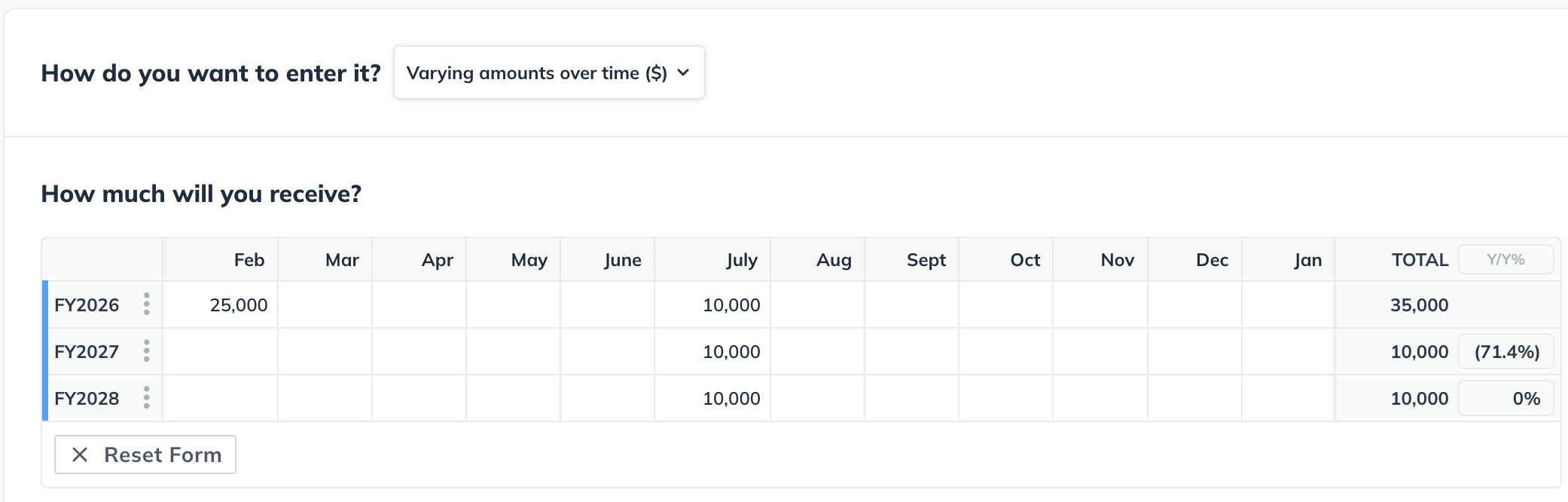

If you choose Varying amounts over time, indicate how much you will receive and in which months/years:

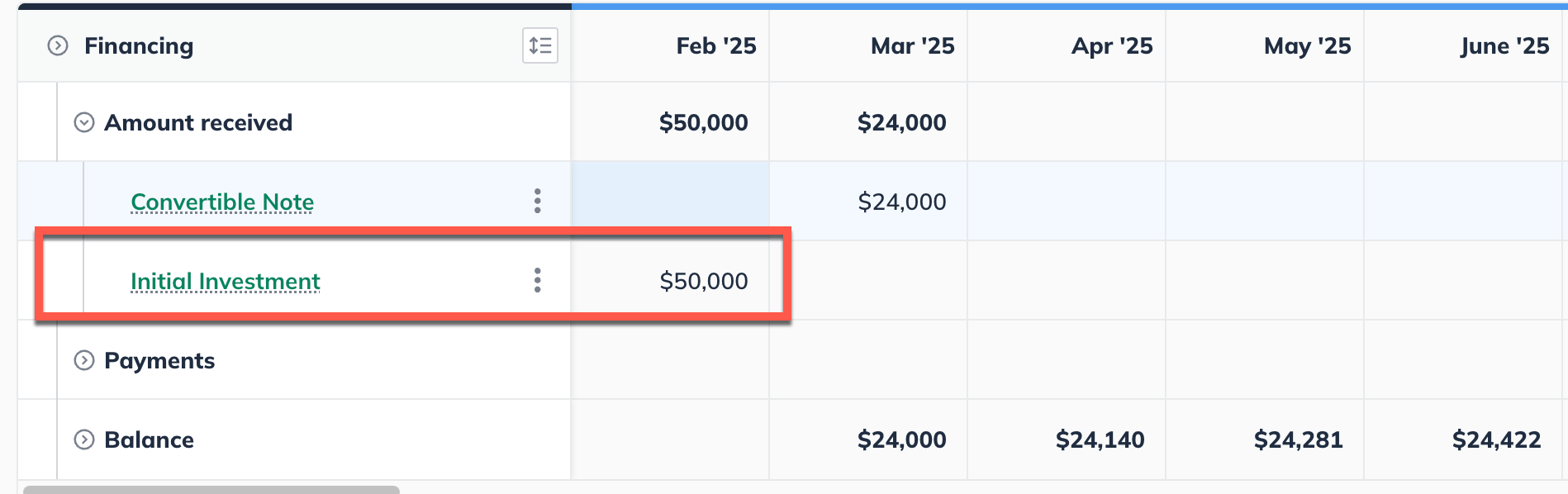

Click Create & Exit. The investment will appear in the Financing table under Amount received:

Where does this entry appear in my financials?

An Investment will not appear in the Profit and Loss statement. In the Balance Sheet, it appears as Paid-In Capital and the value carries forward from the date you receive the investment:

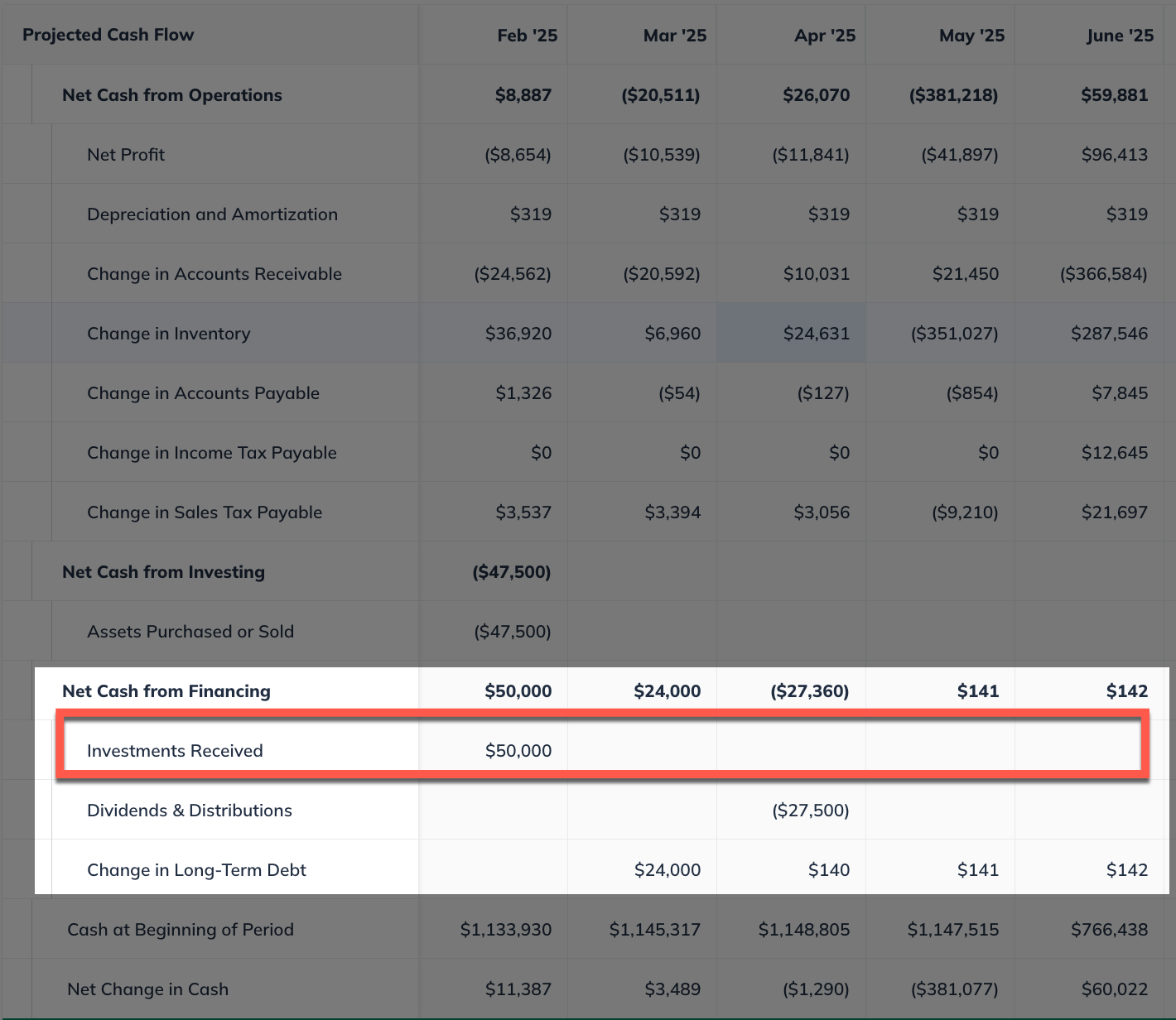

In the Cash Flow, the investment appears as Investments Received, with a positive cash value in any month where you received money: